Best Buy shares fell 7% on Tuesday even as the consumer electronics retailer reported strong 3Q results. The company did not issue any specific 4Q outlook but cautioned on its conference call that it does not expect sales trends to remain at the levels experienced in 3Q.

Revenue in 3Q FY21 (ended Oct. 31) grew 21.4% year-over-year to $11.9 billion, with comparable sales rising 23%. Best Buy’s (BBY) top line exceeded analysts’ estimate of $11 billion. The company’s domestic revenue increased 21% to $10.9 billion, driven by strong demand for computing devices, home theater and appliances, partially offset by lower mobile phone sales. Domestic online comparable sales surged about 174%.

Consumers spending more time at home amid the pandemic and the demand for electronics helped boost Best Buy’s sales. Overall, strong revenue and enhanced margins drove an 82% gain in 3Q adjusted EPS to $2.06, surpassing analysts’ estimate of $1.70.

Best Buy suspended share repurchases in March to conserve liquidity during these challenging times. The company now plans to resume share repurchases in the fiscal fourth quarter. Also during 3Q, Best Buy decided to exit its Mexico operations. The company’s Mexico business contributed about $400 million in revenue in the previous fiscal year with a slightly negative operating income. (See BBY stock analysis on TipRanks)

Following the print, Wells Fargo analyst Zachary Fadem reiterated a Hold rating on Best Buy with a price target of $112. In a research note to investors, Fadem stated, “All in, BBY has performed admirably during the pandemic and is innovating at warp speed to reposition its business and stores for rapidly changing consumer preferences.”

“That said, softening demand trends appear inevitable, increasingly difficult compares loom (in CY21), and rising investments (services, health, stores, etc.) likely pressure margins from current peak levels. And with valuation (NTM P/E) +20% vs. 5- yr avg., we see few reasons to step in here,” added Fadem.

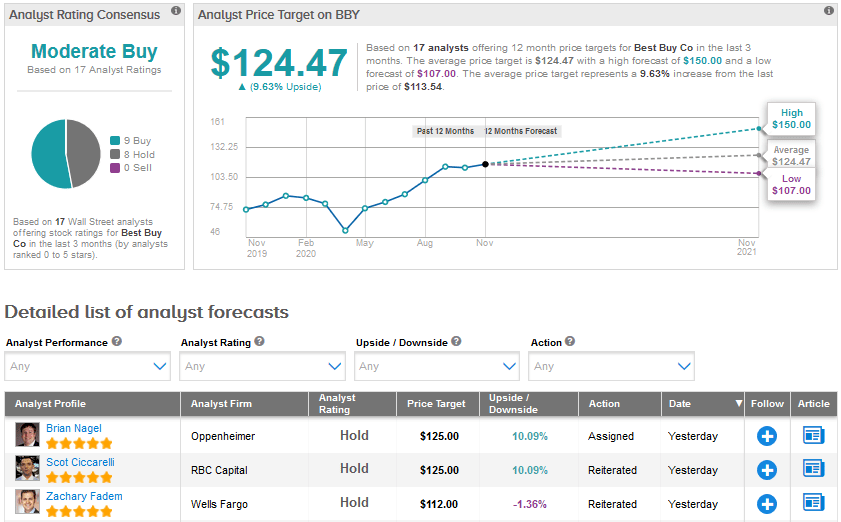

The Street is cautiously optimistic about Best Buy, with a Moderate Buy analyst consensus based on 9 Buys versus 8 Holds. The average price target stands at $124.47, reflecting an upside potential of 9.6% over the coming year. Shares have risen 29.3% year-to-date.

Related News:

Dick’s Sporting’s 3Q Profit Beats Estimates On Robust Online Sales

Tiffany’s Quarterly Revenue Outperforms As China Sales Boom; Street Says Hold

Foot Locker Tops 3Q Estimates; Shares Dip 5% On Covid-19 Woes