Berkshire Hathaway (BRK.B) reported upbeat earnings results on Saturday, with operating earnings up 12.6% year-over-year. On a negative note, however, the company’s stock buying and selling behavior implied decreased faith in the near-term future of the stock market.

As for first quarter operating earnings, they came in at $8.065 billion, and insurance underwriting totaled $911 million. Additionally, Berkshire’s insurance investment rose an incredible 68%, from $1.170 billion to $1.969 billion. Geico, which is owned by Berkshire Hathaway, was one of the big winners in the company’s portfolio, showing an underwriting profit of $703 million.

BRK.B Stock Trading: A Slew of Sells, A Bit of Buys

Saturday’s report also disclosed a disturbing trend: in Q1 2023, Berkshire sold significantly more stocks than it bought. Specifically, it sold $13.3 billion worth of stocks, and bought only $2.9 billion worth of stocks of other companies. Yes, BRK.B did repurchase its own stock to the tune of $4.4 billion, but stock repurchases do not indicate great trust in the stock market at large.

Berkshire’s success, along with its lopsided sells vs. buys, means the company has stockpiled a huge chunk of cash. Specifically, its pile of cash, at $130.6 billion, is $2 billion larger than it was at the start of 2023.

Although Buffett did not sound off any alarms at his shareholder meeting, he did state lowered expectations for the markets. Buffett said that a majority of the businesses held by BRK.B could see reduced year-over-year earnings ahead, in a sign of a slowing economy.

Adding fuel to the fire, Charlie Munger, Buffett’s right-hand man, was quoted last month by the Financial Times as saying, “It’s gotten very tough to have anything like the returns that were obtained in the past.” Munger’s concerns about higher interest rates and overvalued companies are likely reflected in Berkshire’s hesitancy to increase its investment in stocks.

How Is Berkshire Hathaway Stock?

BRK.B stock is up 3.5% year-over-year. Analyst consensus considers it a Moderate Buy, with a 12-month price target of $353.00, implying an upside of 9%.

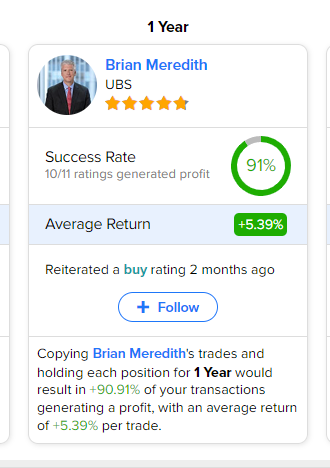

Which analyst is the best to follow, when it comes to BRK.B stock? The most profitable analyst on the stock has been Brian Meredith of UBS. Copying Brian Meredith‘s trades and holding each position for 1 Year would result in +90.91% of your transactions generating a profit, with an average return of +5.39% per trade.