Shares of Bed Bath & Beyond Inc. (NASDAQ: BBBY) rose 6.5% in the extended trading session on Wednesday after three of the company’s insiders bought shares worth $0.33 million on July 6. BBBY stock lost 3.7% in the normal hours on Wednesday, ending the session at $4.47.

Tracking Insiders

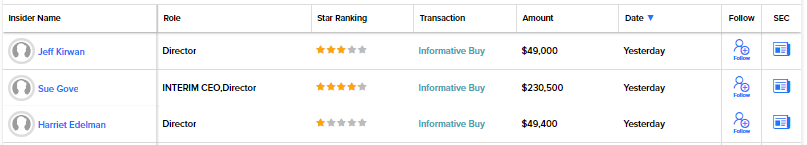

The TipRanks Insiders Trading tool reveals that Jeff Kirwan, a Director in BBBY, purchased 10,000 shares of the company for $4.90 per share. The total value of this transaction was $49 thousand. The Director now holds $201.6 thousand worth of BBBY stock.

Meanwhile, the company’s Interim CEO, Sue Gove, bought 50,000 shares of BBBY for $230.5 thousand at a per-share price of $4.61. Gove now holds BBBY shares worth $489.9 thousand.

Lastly, Harriet Edelman, another Director, lapped up 10,000 shares of the company for $49.4 thousand at a per-share price of $4.94. The corporate insider’s total holding value in the company now stands at $342.4 thousand.

A pictorial snapshot of these insider trading activities is provided below:

After such trading activities, investors are likely to get intrigued about BBBY. Before jumping to any conclusion, it will be wise to gauge other factors of this insider-friendly stock.

Performance on TipRanks

On TipRanks, the company has a Moderate Sell consensus rating based on four Holds and eight Sells. BBBY’s average price forecast of $4.16 reflects 6.94% downside potential from the current level. Also, with shares plunging 84.5% in the past year, the company’s falling stock price is a cause of worry.

On the Slippery Slope

The nervousness about the stock could be due to its dismal performances in the past few quarters. In the first quarter of Fiscal 2022 (ended May 28, 2022), the company reported a loss of $2.83 per share, wider than the consensus estimate of a $1.39 loss per share. Macro-economic woes, supply-chain issues, and cost inflation played spoilsports in the quarter.

Seven days ago, Justin Kleber of Rober W. Baird maintained a Hold rating on BBBY while lowering the price target to $4 from $7. The analyst opined that BBBY’s management “has some time to turn the trajectory of fundamentals, but it will likely be an uphill battle given the macro/sector backdrop and ongoing market share slippage.”

Finally, Insider Transactions Project a Silver Lining

In the face of current macro and micro challenges, the recent trading activities of corporate insiders of Bed Bath & Beyond have come as a surprise. These moves, which lifted the company’s share price on Wednesday, could help infuse new vigor into this otherwise struggling retail company.

Read full Disclosure