Barratt Developments (GB:BDEV) posted record profits in its annual results for 2022, although the company warned of inflation fears, a slowdown in housing demand, and rising costs for 2023.

The company’s revenue grew by 9.5% to £5.26 billion, driven by a 4% increase in total home completions, which have returned to pre-COVID levels.

Adjusted profit before tax increased by almost 15% to £1.05 billion, as forecasted earlier.

Gross margins of 24.8% in the results reflected improved customer demand combined with higher house prices, but the company is expecting the housing prices to soften over the next few months.

Building cost inflation is expected to be around 9%-10%, which will lead gross margins to hover around 23%.

The company announced a final dividend of 25.7p per share, up from 21.9p per share in 2021. Barratt is among the best dividend payers in the market, with a yield of 7.8% when the sector average is at 1.65%.

What do Barratt Developments do?

Barratt Developments is among the largest property builders in the UK market.

The company’s operations involve the acquisition of land, obtaining consent and designing, building houses, and marketing.

Are Barratt shares a good buy?

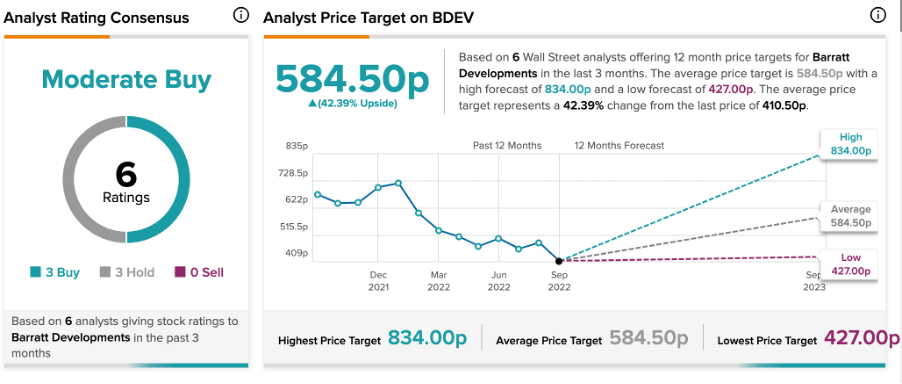

According to TipRanks’ analyst rating consensus, Barratt stock has a Moderate Buy rating based on three Buy and three Hold recommendations.

The BDEV target price is 584.5p, which shows a change of 42.4% on the current price level. The analyst price targets range from a low of 427p to a high of 834p.

Citi analyst Ami Galla reiterated her Buy rating on the stock post-results with a target price of 757p, showing an upside of 84%.

Analysts at Citi said, “The full-year results, as well as Barratt’s forward bookings, increased its confidence in the 2023 outlook despite fears over a potential economic downturn.”

Conclusion

The company is off to a great start for the fiscal year 2023, with strong forward sales of 55%, a healthy balance sheet, and an amazing land portfolio.

It remains on track to achieve its new target of 21,500 completed homes annually after 2023.