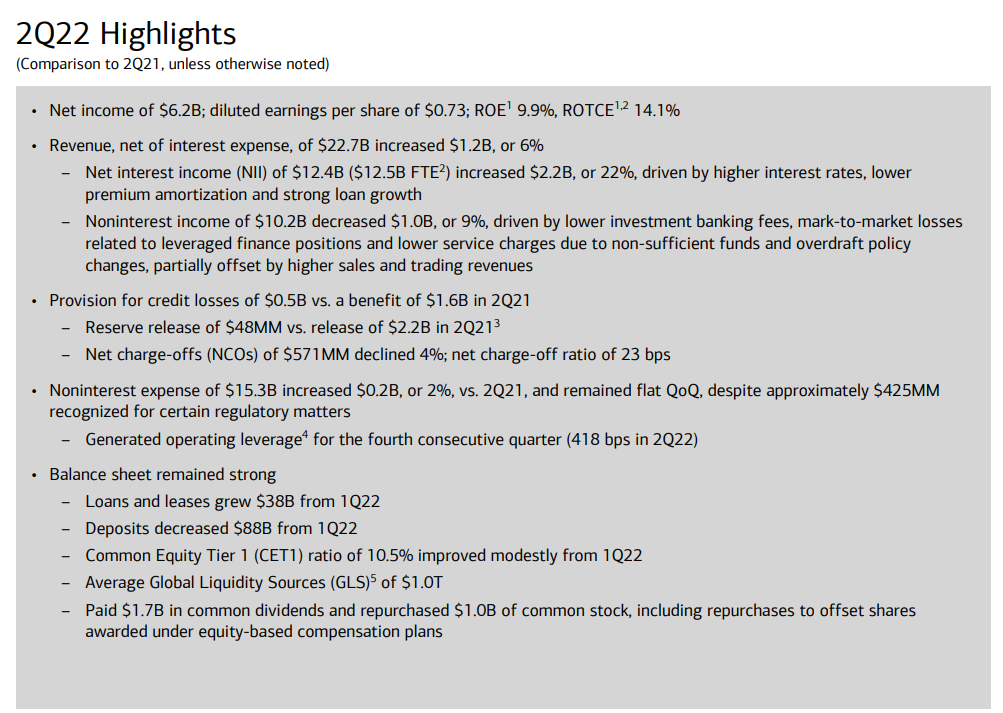

Bank of America (BAC) reported Q2 earnings Monday of $0.73 per diluted share, which represents a decrease from $1.03 a year earlier. It also falls short of the consensus on Tipranks of $0.75.

Revenue for the quarter ended June 30 was $22.7 billion, down from $22.92 billion a year earlier.

Net Interest Income was up 22% to $12.4 Billion

The company’s shares were falling in recent premarket activity on Monday.

“Our strong organic growth engine once again was evident in new account openings for checking, consumer investments, and small businesses, as well as net new Merrill and Private Bank households and new commercial banking customers. This solid client activity across our businesses, coupled with higher interest rates, drove strong net interest income growth and allowed us to perform well in a weakened capital markets environment. We grew revenue 6% and delivered our fourth straight quarter of operating leverage,” Chief Executive Brian Moynihan said in a statement.

CFO Alastair Borthwick said, “Second quarter results once again demonstrate how our Responsible Growth strategy and diversified business model delivers for customers, clients, employees, shareholders and the communities we serve even in changing and challenging markets. Despite expenses recognized for certain regulatory matters in the quarter, we were able to hold expenses flat to the prior quarter, which included seasonally higher compensation expenses.”

This is Bank of America’s fourth consecutive quarter of operating leverage, which is defined as the year-over-year percentage change in revenue, net of interest expense, less the percentage change in noninterest expense.

Goldman Sachs are scheduled to report results later today (Monday).