Bank of America Corp.’s (BAC) Board hiked the final compensation package for its Chairman and CEO Brian T Moynihan to $32 million. The approval comes on the heels of the bank’s robust performance in fiscal 2021.

Shares of the global investment bank and financial services firm closed up 4% at $48.28 on February 4.

CEO Compensation

CEO Moynihan earned a 31% raise in his compensation package, compared to the FY20 pay of $24.5 million. The structure of the package remains similar to the structure over the last nine years, based on a shareholder’s vote through the annual advisory “Say on Pay” process, with an average of 94.5 % support.

The compensation of $32 million includes a $1.5 million base salary, and the remaining $30.5 million includes equity incentive awards, namely time-based restricted stock units (RSUs), and performance RSUs.

Out of the $30.5 million incentives, 30% will be cash-settled RSUs that will vest over the next 12 months, 20% will be stock-settled RSUs that will vest annually over the next four years, and 50% will be performance RSUs that will be re-earned only if Bank of America’s future financial performance meets specific standards.

Recently, other big banks too, increased the FY21 annual compensation of the CEOs on similar lines. JPMorgan Chase & Co. (JPM) raised CEO Jamie Dimon’s pay to $34.5 million, and both Morgan Stanley (MS) and Goldman Sachs (GS) hiked the CEO’s pay to $35 million.

BofA delivered solid Q4FY21 earnings ending the year with a positive outlook. The bank earned net income of $32 billion in FY21 and returned $32 billion to shareholders in the form of dividends and stock repurchases. Moreover, BAC stock has gained 51.2% over the past year.

In FY21, the bank also increased the minimum hourly rate of pay for U.S. employees to $21 and intends to increase the same to $25 per hour by 2025. BofA also continued to support its clients in 2021, raising a record $963 billion on their behalf and increased new commercial commitments to $426 billion. Additionally, the bank continued to advance racial equality and economic opportunity by funding $450 million of its previously announced $1.25 billion commitment.

Wall Streets’ View

The Wall Street community is cautiously optimistic about the BAC stock with a Moderate Buy consensus rating based on 12 Buys, 5 Holds, and 2 Sells. The average Bank of America price target of $51.79 implies 7.3% upside potential to current levels.

Blogger Opinions

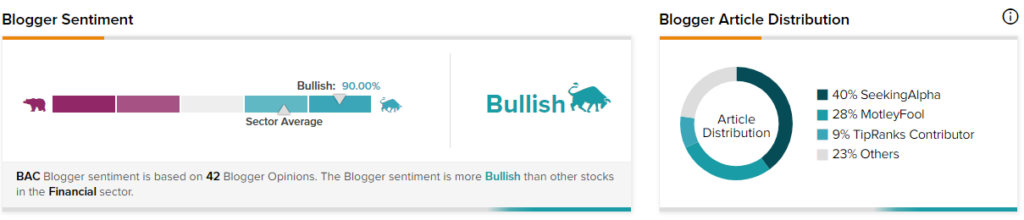

TipRanks data shows that financial blogger opinions are 90% Bullish on BAC, compared to a sector average of 73%.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Snap Delivers Stellar Q4 Results; Shares Skyrocket 59% After Hours

Biogen Delivers Mixed Q4 Results; Shares Hit All-Time Low

Eli Lilly Drops 2.4% Despite Beating Q4 Expectations