Shares of Chinese e-commerce giant Alibaba (NASDAQ:BABA) have been on an upward spike as of late, nearly doubling since the low seen just last October. Is the rally sustainable? Based on the latest word from Robert W. Baird analysts, the answer is that it’s more likely than you might think.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Baird, via analyst Colin Sebastian, noted that Alibaba’s online sales for December look better than those seen previously. Moreover, China ditching its Zero Covid policy for something that won’t turn the economy into a crater should also help improve things. Based on reports from the National Bureau of Statistics, substantial growth has already been seen. Online sales were up 6% when comparing 2022 figures to 2021 in China. December volumes alone were up around 15% year-over-year, although they fell 15% month-over-month thanks to the “double 11” event in November.

Some here would point out that Alibaba stock has already seen a sharp run-up. Sebastian acknowledges said run-up but noted also that China’s conditions are somewhat different. Work-from-home initiatives never really caught on, and Alibaba is still running below “…historical average earnings multiples,” which should still give it room to run. Just to top it off, Alibaba recently got quite an indirect endorsement. A group regarded as China’s internet watchdog, the Cyberspace Administration of China, bought 1% of one of Alibaba’s Guangzhou businesses.

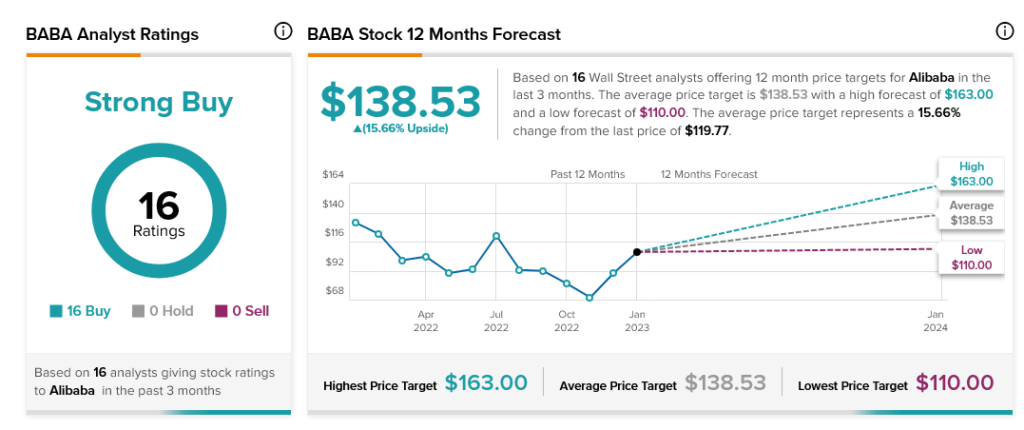

Overall, Wall Street analysts have a consensus price target of $138.53 on BABA stock, implying over 15% upside potential, as indicated by the graphic above.

Join our Webinar to learn how TipRanks promotes Wall Street transparency