Shares of Chinese tech major Baidu (NASDAQ:BIDU) are trending lower today after Jing Kun, the CEO of Baidu’s smart device subsidiary Xiaodu Technology, resigned from all his roles at the company citing “personal reasons.”

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Reportedly, Kun has teamed up with his CTO, Zhu Kaihua, to embark on a new venture. Now, Li Ying, the Vice President and CIO of Baidu, will take over as CEO of Xiaodu and will report to Baidu’s Co-founder, CEO, and Chairman, Robin Li. Baidu is a majority stakeholder in Xiaodu. The smart device unit was last valued at $4.87 billion and was ranked number 1 in smart display and speaker shipments in the country in the first quarter.

Importantly, Kun’s exit comes only days before Baidu’s annual technology event, Baidu World. The company is expected to provide major updates on its artificial intelligence applications at the event, where Kun was also scheduled to speak. Scheduled for October 17, Baidu World is a key event to keep an eye on.

Looking to fortify its supply chain and reduce its technological dependence on the U.S., China is aiming to increase its computing capacity from 197 exaflops at present to over 300 exaflops by 2025. Baidu, along with other tech heavyweights in the country, could be a key beneficiary of the ambitious goal.

What is the Forecast for BIDU Stock?

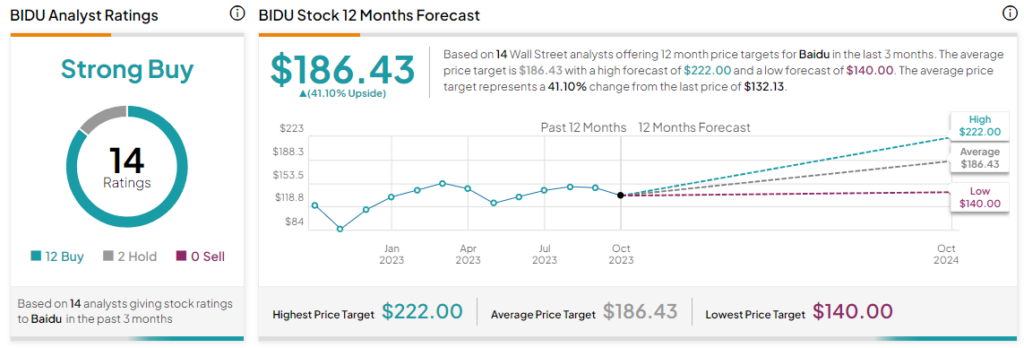

Overall, the Street has a consensus price target of $186.43 for Baidu, along with a Strong Buy consensus rating. This implies a substantial 41% potential upside in the stock.

Read full Disclosure