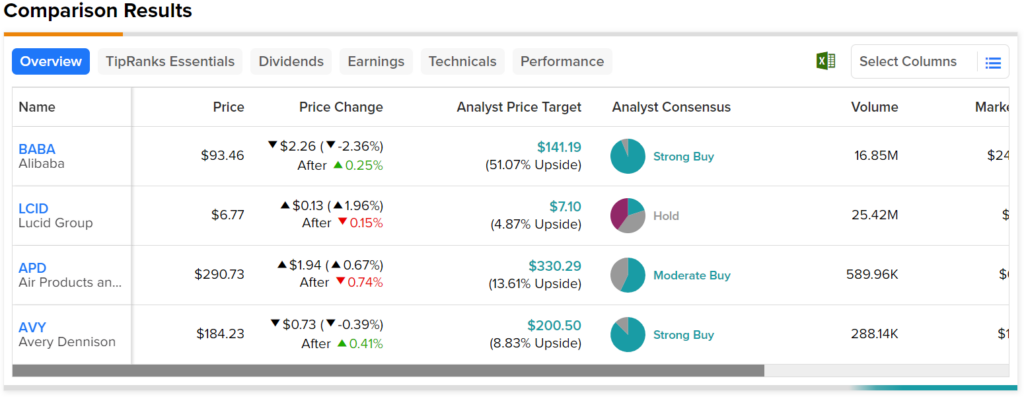

Saudi Arabia’s sovereign wealth juggernaut, the Public Investment Fund (PIF), made some strategic moves in the stock market. Its latest Q2 2023 report showed an increased stake in two heavy hitters – Chinese e-commerce behemoth Alibaba (NYSE:BABA) and electric car maker Lucid Group (NASDAQ:LCID). The Alibaba stake soared to about 1.46M American depositary shares from 1.04M after the company’s impressive 14% quarterly revenue hike. Meanwhile, the Lucid stake had reached 1.37B, a rise from Q1’s 1.11B, marking PIF’s ownership in LCID at a solid 60.49%.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

But it wasn’t all about stock accumulation for the PIF. It trimmed down its stake in label makers Avery Dennison (NYSE:AVY) and completely cut ties with Babylon Holdings after the digital health firm went private. However, they did sprinkle some more funds into industrial gas producer Air Products (NYSE:APD). In the backdrop, stakes in other companies remained undisturbed.

Overall, Wall Street analysts seem to expect the most from BABA stock. Indeed, it is rated a Strong Buy with a $141.19 per share price target, implying over 51% upside potential.