Shares of Arizona-based Axon Enterprise, Inc. (AXON) gained up to 22.5% on Tuesday before closing 6.2% up following the release of excellent results for the third quarter of 2021 after the market closed on Monday.

The company develops technology and weapons products for the military, law enforcement and civilians. Its shares gained nearly 1% in the extended trading session on Tuesday to end the day at $179.39.

Earnings and Revenue

Adjusted earnings came in at $1.17 per share and surpassed the Street’s estimate of $0.26 per share. The company had reported earnings of $0.40 per share in the same quarter last year.

Revenue grew 39% year-over-year to $232 million, exceeding analysts’ expectations of $201.11 million. The growth was driven by global demand for the company’s software suite and TASER 7 devices.

Segment Revenues

TASER segment revenue increased 44% year-over-year to $121 million primarily due to strong demand for the TASER 7 platform across the world.

Axon Cloud revenue rose 39% to $63 million, and Sensors & Other revenue jumped 29% to $47 million.

Other Highlights

Bookings were up 54% year-over-year to $488 million, driven by strength in the software and sensors segment. Further, year-to-date bookings totaled around $1.2 billion, surpassing the bookings of full-year 2020.

Gross margin improved 330 basis points to 62.3%, and adjusted EBITDA surged 50% to $51 million.

Outlook

Axon updated its 2021 outlook following the release of strong third-quarter results. It now expects revenue at the high end of the previously announced guidance range of $840 million to $850 million.

The company also raised the adjusted EBITDA guidance to a range of $163 million to $168 million from the earlier expectation of $155 million to $160 million.

Furthermore, it expects to make capital expenditures of nearly $65 million to $70 million in 2021. (See Insiders’ Hot Stocks on TipRanks)

Wall Street’s Take

After the announcement of the third-quarter results, Craig-Hallum analyst Jeremy Hamblin upgraded the rating on the stock to Buy from Hold with a price target of $232 (30.5% upside potential).

The upgrade was backed by increased federal funding for the company’s non-lethal policing solutions, solid results, international market growth and expanded consumer base.

Meanwhile, Hamblin said, “Demand for Taser weapons has never been higher.”

Moreover, Raymond James (RJF) analyst Brian Gesuale maintained a Buy rating on the stock with a price target of $223 (25.4% upside potential).

In a research note, Gesuale said, “Axon remains uniquely positioned to provide technology that enables more effective policing, reduces lethality, and increases transparency and public trust. The demand for their ecosystem of products is by our measure stronger than ever.”

Analyst Recommendation

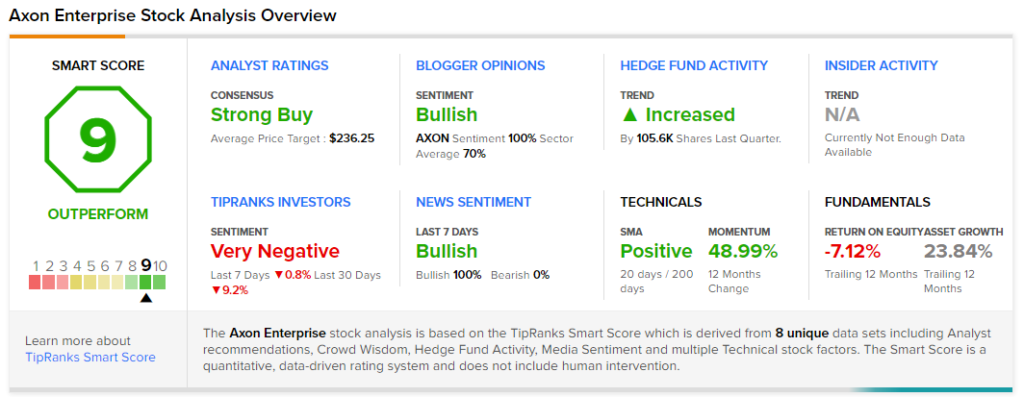

Overall, the stock has a Strong Buy consensus rating based on 4 unanimous Buys. The average Axon Enterprise price target of $236.25 implies nearly 33% upside potential. Shares have gained 52.2% year-to-date.

Smart Score

According to the TipRanks’ Smart Score rating system, Axon scores a 9 out of 10, suggesting that the stock is likely to outperform market averages.

Related News:

Boeing Expansion Continues with New Orders

Biogen Gets EU Marketing Approval for MS Treatment Vumerity

Gevo Adds Two New Risk Factors