Aircraft lessor Avolon announced that it cancelled commitments to acquire an additional 27 of Boeing Co.’s (BA) 737 MAX aircraft after already cancelling 75 of the planes in the first quarter of the year.

In addition, Avolon scrapped the commitment to acquire one of Airbus Group’s (EADSF) A330 neo aircraft due to be delivered in 2022 and deferred the delivery of 3 A320 neo family aircraft from 2020/21 to 2022.

Boeing’s 737 MAX aircraft have been grounded since March 2019 following a second deadly crash. The plane maker has recently started flight tests of the 737 MAX to try and receive regulatory approval for it to return to fly.

The announcement is another setback for Boeing, which has seen its shares plunge 45% this year, after Norwegian Air at the end of June cancelled orders for 97 of the 737 MAX aircraft order and filed compensation claims.

The coronavirus travel restrictions have resulted in a deep cut in the number of commercial jets and services Boeing customers need over the next few years. As such, global airlines suffering billions of dollars in losses have been seeking to cancel or delay some of the orders they have with the planemaker.

Boeing shares dropped 4.8% to $178.88 at the close on Tuesday.

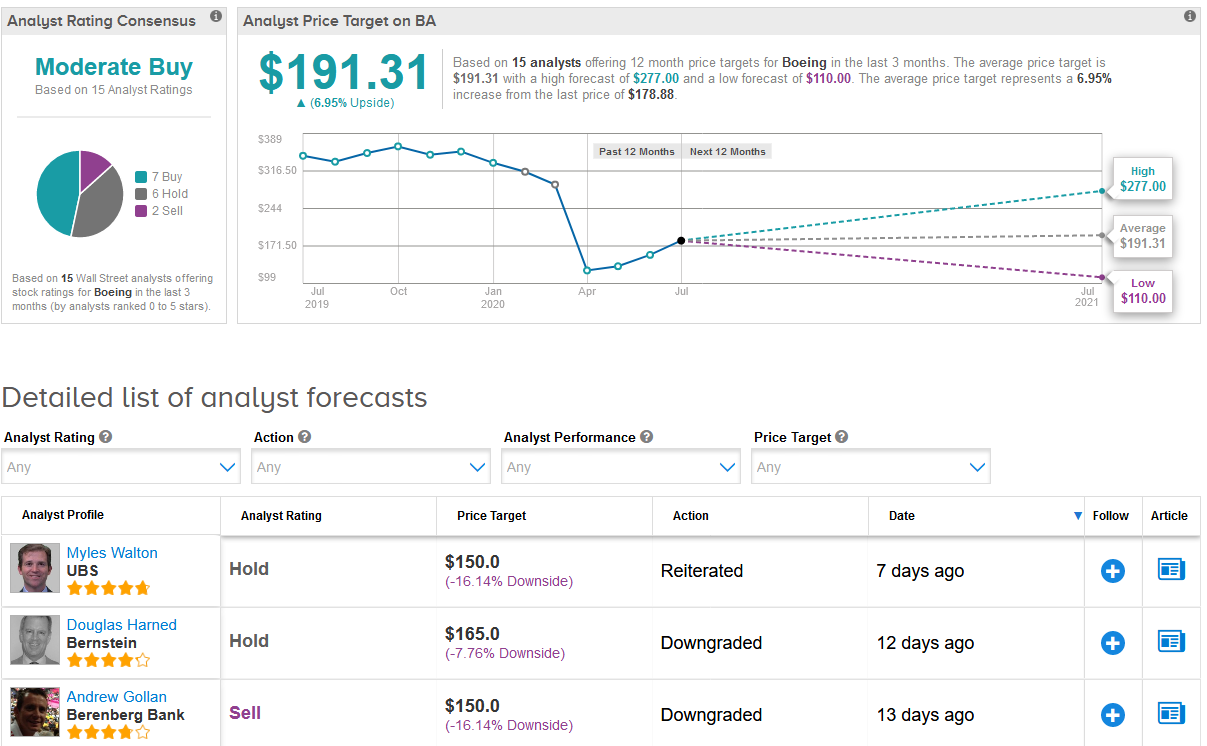

Five-star analyst Myles Walton at UBS this month reiterated a Hold rating on the stock with a $150 price target, saying that investors “have to take the good with the bad with Boeing”.

Commenting on the recent 737 MAX flight tests he said: “After the days of certification flights, there will be extensive post-flight analysis,” adding that, “along with the convening of [regulators] to validate the training protocols being proposed by the FAA,” he now estimates the plane will be back in commercial service by October.

Overall though Wall Street analysts are cautiously optimistic on the stock. Seven Buys, 6 Holds, and 2 Sell ratings give Boeing a Moderate Buy analyst consensus. Meanwhile the $191.31 average analyst price target implies 7% upside potential in the shares over the coming year. (See Boeing stock analysis on TipRanks).

Related News:

Norwegian Air Cancels 97 Boeing Aircraft, Seeks Compensation

Global Airlines Are Set To Lose $84.3 Billion In 2020, IATA Says

United Airlines Secures $5 Billion Loan To Shore Up $17 Billion Liquidity Chest