Car dealership operator AutoCanada Inc. (TSE: ACQ) recently reported impressive results for the second quarter of 2022. The company recorded the highest second-quarter revenues in its history. The strength in the earnings results should positively support the company’s share price, which was up 1.6% on August 10.

With a market cap of C$570.70 million and 81 franchised dealerships in Canada, AutoCanada is a leading North American multi-location automobile dealership group. The company offers new and used vehicles, spare parts, maintenance services, and customer financing.

AutoCanada’s Q2 Earnings in Detail

The company’s earnings rose to C$1.33 per share in the second quarter from C$1.23 per share in the year-ago period. The metric surpassed analysts’ estimates of C$1.29 per share.

AutoCanada’s revenues for the reported quarter came in at C$1,686.0 million, up 31.6% from the year-ago period. The upside came on the back of strength in all its business areas, particularly finance and insurance (F&I), and parts, service, and collision repair (PS&CR) business operations. The company also witnessed persistent improvements in its U.S. Operations along with synergies from acquisitions.

Notably, the company’s adjusted EBITDA came in at C$75.6 million in the reported quarter, rising around 7.2% from the year-ago quarter.

Segment-wise, the company saw a 32% year-over-year rise to C$1,437.9 million in revenues from Canadian operations. Notably, strength in the F&I and PS&CR segments largely drove the upside in the reported quarter. Moreover, there was a 6.4% jump over the prior year to C$65.4 million in the adjusted EBITDA for Canadian operations.

On improvements across all its business areas, the U.S. operations witnessed the fifth straight quarter of year-over-year growth in adjusted EBITDA. The segment’s revenues came in at C$248.1 million, jumping 29.5% year-over-year. Also, the adjusted EBITDA totaled C$10.1 million in comparison to C$9 million in the prior year.

Due to the rising interest rates and the company expanding its used vehicle inventories, there was a 70% year-over-year rise in floorplan financing costs to C$5.9 million.

The company’s new vehicle inventory is shrinking due to the shortage of chips. In order to compensate for the shortage in new vehicles, AutoCanada significantly increased its used vehicle inventory position to C$699 million at the end of the second quarter, in comparison to C$309.8 million in the year-ago period.

During the quarter, AutoCanada concluded acquisitions worth around $78.8 million.

Should Investors Buy or Sell AutoCanada Stock Right Now?

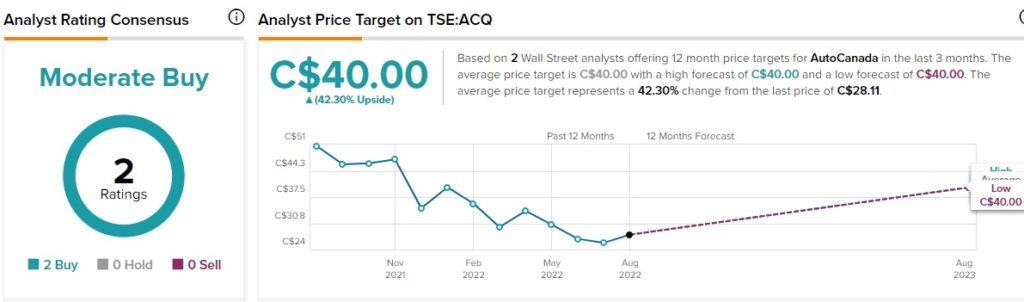

Turning to Wall Street, analysts seem to be cautiously optimistic about ACQ, which has a Moderate Buy rating based on two Buys. Shares of the company have lost 31.5% so far this year.

Similarly, retail investors are Neutral on the stock. In the last seven days, the number of portfolios holding AutoCanada stock rose by 1.1%.

Interestingly, financial bloggers are 100% Bullish on ACQ, compared to the sector average of 65%.

AutoCanada’s Future Prospects Look Promising

The car dealership operator seems to be at the top of its game right now. The company has witnessed the highest second-quarter revenues on persistent strength in all its business operations. Also, its efforts to grow inorganically look impressive. However, the company remains exposed to OEM production disturbances and new vehicle inventory constraints.

Read full Disclosure.