Aurora Cannabis (ACB) total revenue declined in the first quarter of 2022 due to lower recreational cannabis sales. Aurora Cannabis is one of the world’s largest cannabis companies, serving both the recreational and the medicinal cannabis market.

Total net revenue for Q1 2022 came in at C$60.1 million, down 11% year-over-year. Aurora’s medical cannabis revenue increased 23% to C$41 million. Consumer cannabis net revenue amounted to C$19.1 million, down 44% from the same period a year ago.

The average net selling price of cannabis rose to C$4.67 per gram in the first quarter, up 21% from C$3.86 in the prior-year quarter. (See Insiders’ Hot Stocks on TipRanks)

Aurora reported an adjusted EBITDA loss of C$12.1 million in Q1 2022, an improvement compared to an adjusted EBITDA loss of C$58.1 million in Q1 2021.

The company’s balance sheet remains solid, with a cash balance of C$424.3 million as of September 30, 2021. Working capital improved by C$362.3 million from the previous year.

Transformation Plan Is on Track

Aurora Cannabis CEO Miguel Martin said, “On a run-rate basis to date, we have executed over C$33 million in annualized cost savings and are positioned to deliver approximately C$60 to C$80 million in aggregate across selling, general and administrative (“SG&A”), production, facility and logistic expenses upon the completion of our business transformation. Our strong Adjusted gross margins and narrowing Adjusted EBITDA loss are also providing us with a clear path to profitability by the first half of fiscal 2023 as we position ourselves for long-term success.

“Importantly, our robust balance sheet and working capital support our organic growth plans, and provide us with the financial flexibility to evaluate accretive M&A opportunities.”

Martin added that the company’s regulatory and compliance expertise in the medical field also allows it to expand into the global adult recreational market, as evidenced by Aurora’s recent entry into the Dutch recreational market through an investment in Growery B.V. Based on the current global regulatory framework, Aurora expects this market to become the largest regulated recreational market outside of Canada.

Wall Street’s Take

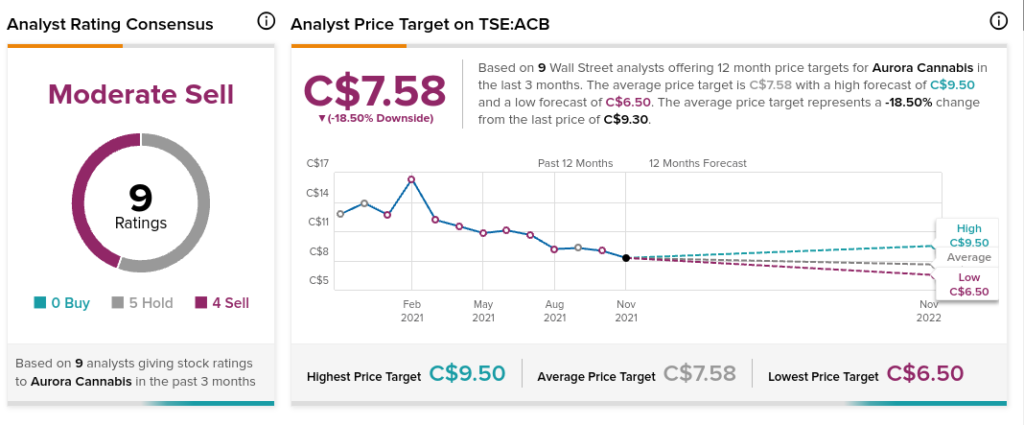

Last month, Cantor Fitzgerald analyst Pablo Zuanic maintained a Hold rating on the stock but raised its price target to C$9.50 (from C$8.30). This implies 2.2% upside potential.

The rest of the Street is quite pessimistic on ACB with a Moderate Sell consensus rating based on five Holds and four Sells. The average Aurora Cannabis price target of C$7.58 implies 18.5% downside potential to current levels.

Related News:

Aurora Cannabis Buys Stake in Growery; Shares Pop

Curaleaf Q3 Sales Rise 74%, Loss Widens

Canopy Growth Posts Narrower Q2 Loss; Shares Plunge