Shares of aTyr Pharma (LIFE) rose almost 4% in Thursday’s extended trading session after receiving a patent from the U.S. Patent and Trademark Office (USPTO).

aTyr Pharma is a biotherapeutics company focused on the research and development of innovative medicines based on novel biological pathways

The patent covers the company’s processes for the use of histidyl-tRNA synthetase Fc fusion proteins in reducing inflammatory responses in the lung. Notably, the patent covers the use of the company’s lead therapeutic product, ATYR1923.

ATYR1923 is an Fc fusion protein based on the N terminal fragment of histidyl-tRNA synthetase. It is currently undergoing clinical trials for the treatment of pulmonary sarcoidosis and is being evaluated in other inflammatory lung diseases, the company said.

Reacting positively to the news, aTyr CEO Sanjay S. Shukla said, “We are pleased with the USPTO grant of this patent covering the use of ATYR1923 to treat inflammatory response in the lung, which builds upon our growing intellectual property estate on this lead molecule series.” (See aTyr stock charts on TipRanks)

Last month, Laidlaw analyst Yale Jen hosted a KOL call with the Pulmonary Medicine Chairperson from the Cleveland Clinic. During the call, the need for the treatment of pulmonary sarcoidosis (PS) and how the disease progresses, were highlighted. According to the expert, the cumulative risk of metabolic complications due to the long-term use of glucocorticosteroids stands as the major unmet need. Therefore, the analyst stated that “aTyr has a therapy, ATYR1923, in PS with Phase II trial data on-track for 3Q21.”

According to Jen, besides an accurate safety profile, if ATYR1923 is successful in reducing steroid usage versus the placebo group, along with managing symptoms, including shortness of breath or coughing, it would be a catalyst for aTyr.

The analyst maintained a Buy rating and a price target of $18 (293% upside potential) on the stock “to reflect the potential success of the two first-in-class novel cancer therapeutics.”

“With multiple major catalysts within the next 12 months,” he believes “LIFE shares remain undervalued.”

Consensus among analysts is a Strong Buy based on 4 unanimous Buys. The average aTyr price target stands at $14 and implies upside potential of 205.7% to current levels. Shares have gained 12.8% over the past year.

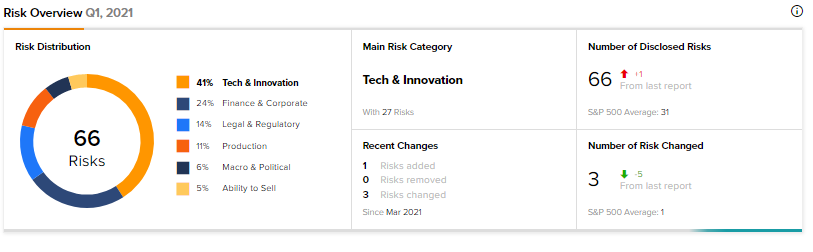

Investors should always be aware of the risks involved in any stock. According to the new TipRanks’ Risk Factors tool, LIFE stock is at risk mainly from two factors: Tech & Innovation, and Finance and Corporate, which contribute 41% and 24%, respectively to the total risk for the stock. Within the Tech & Innovation risk category, aTyr has identified 27 individual risks.

Related News:

Tonix Inks Acquisition Deal; Shares Gain

Xerox Pops 5% After Blowout Quarter

Apple Records Quarterly Beat; Shares Down After-Hours