General Motors (GM) and AT&T (T) are working towards connecting millions of to-be-produced GM vehicles in the U.S. with 5G network over the next 10 years. The 5G cellular network architecture is expected to meet the future needs of all-electric and autonomous vehicles.

While Michigan-based General Motors designs, produces and sells trucks, cars and automobile parts, AT&T provides telecommunications, media and technology services. (See General Motors stock chart on TipRanks)

The 5G connectivity is also expected to enhance a vehicle’s roadway-centric coverage; provide faster voice, mapping and navigation services; offer secure over-the-air software updates; and provide higher quality and faster video and music downloads.

General Motors first plans to make 5G connectivity available in select vehicles of model year 2024. The 5G network will help current 4G LTE-equipped vehicles of model year 2019 and later experience faster connectivity speeds. The current owners of Cadillac, GMC, Buick and Chevrolet 4G LTE-capable vehicles of model year 2019 and later can also easily migrate to 5G network infrastructure.

The rollout forms a part of the companies’ two-year collaboration, including test-driving of connected vehicles at GM’s 5G proving grounds in Milford, Michigan. (See AT&T stock chart on TipRanks)

The Senior Vice-President of Global Business, Industry Solutions at AT&T, said, “By connecting millions of GM vehicles to our nationwide 5G network, we will improve the customer experience for existing services while laying the groundwork for the next wave of innovation including autonomous driving.”

Shares of General Motors and AT&T declined 3.5% and 1.1%, respectively, on Thursday.

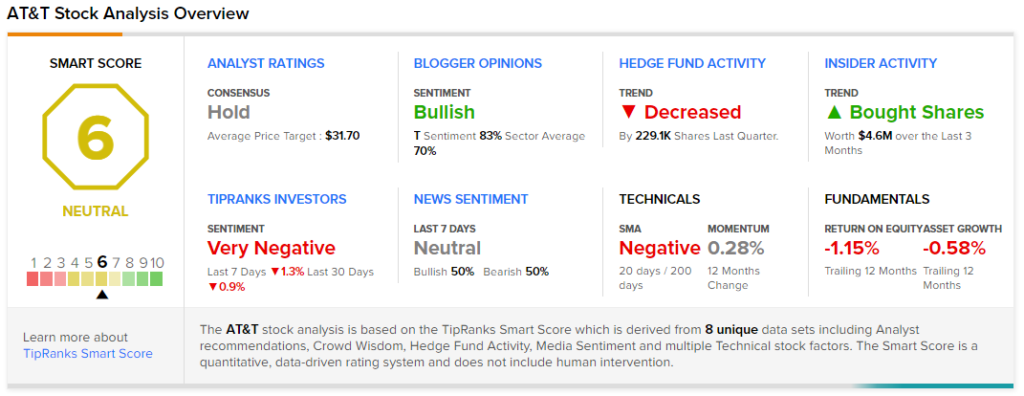

Last month, Deutsche Bank analyst Bryan Kraft reiterated a Buy rating on AT&T and raised the price target to $37 from $34 (34.4% upside potential). In a research note to investors, the analyst said, “The company’s Q2 results demonstrated solid execution against its key strategic opportunities.”

Overall, the stock has a Hold consensus rating based on 5 Buys, 5 Holds and 2 Sells. The average AT&T price target of $31.70 implies 15.2% upside potential. The company’s shares have lost 7.2% over the past year.

According to TipRanks’ Smart Score rating system, AT&T scores a 6 out of 10, suggesting that the stock is likely to perform in line with market averages.

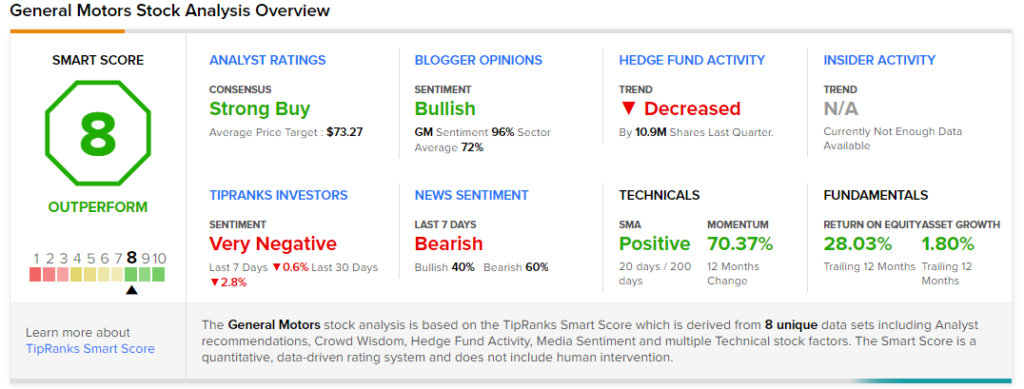

On August 10, Nomura analyst Anindya Das maintained a Buy rating on General Motors with a price target of $70 (42.6% upside potential). The analyst expects the company to report earnings per share (EPS) of $1.92 in the third quarter.

Overall, the stock has a Strong Buy consensus rating based on 14 Buys and 1 Hold. The average General Motors price target of $73.27 implies 49.3% upside potential. Shares of the company have gained 70.2% over the past year.

According to TipRanks’ Smart Score rating system, General Motors scores an 8 out of 10, suggesting that the stock is likely to outperform market averages.

Related News:

Applied Materials’ Q3 Results Surpass Estimates; Shares Fall 1.1%

SpartanNash Beats Q2 Expectations, Updates Q3 Guidance

Bilibili Slips 3.6% Despite Lower-Than-Expected Q2 Loss