The temporary closure of physical stores due to Covid-19 significantly impacted the sales of retailers. Retailers who had strong e-commerce channels gained from the spike in online sales. With the gradual reopening of stores amid easing lockdown restrictions, retailers are now seeing a recovery in their physical store sales.

In these challenging times, consumers prefer retailers who can offer value deals. Five Below and At Home are two such companies.

Using the TipRanks’ Stock Comparison tool, we will place Five Below and At Home alongside each other to see which stock offers the most compelling investment opportunity.

At Home (HOME)

After reporting a 38% drop in its first-quarter sales, At Home bounced back with a strong performance in the second quarter as the economy reopened. At Home stock has skyrocketed since its preliminary results for the fiscal 2021’s second quarter, which ended on July 25. All of the company’s 219 stores reopened as of June 19.

The home goods retailer’s preliminary second-quarter sales grew 51% Y/Y to $515 million with comparable sales growth of 42%. The company estimates second-quarter adjusted EBITDA of at least $150 million.

At Home stated that its sales increased faster than the industry and that its market share was considerably up in the quarter. Despite the disruption caused by COVID-19, total sales surged 9% in the first half of fiscal 2020.

Stay-at-home orders led to people spending more on home decoration, organizing their kitchens and creating a workspace. The pandemic-led demand drove higher traffic, increased average basket size and added new customers in the second quarter. Stimulus checks and the delay in the opening of stores by rival retailers also boosted the top line.

To address increased consumer demand, At Home expanded its buy online and pick up in-store facility at almost all its locations and also offered curbside pickup. Moreover, it partnered with logistics service provider PICKUP to offer contactless, next-day local delivery starting at $10.

At Home’s store growth plans came to a standstill due to the virus outbreak. The company opened seven stores in this fiscal year and intends to restart expansion next year by opening 7 to 10 stores. At Home believes that it can expand to 600 stores over the long term. (See At Home stock analysis on TipRanks)

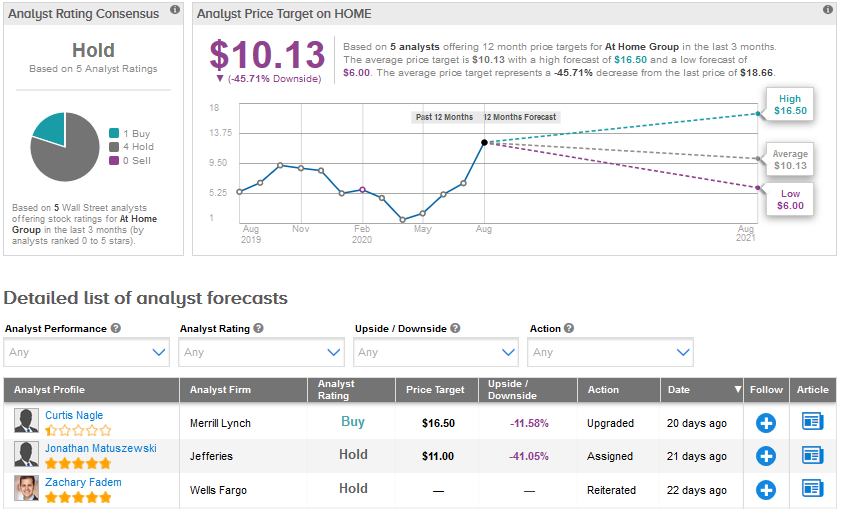

Following the preliminary results, Merrill Lynch analyst Curtis Nagle double-upgraded At Home stock to Buy from Sell and increased the price target to $16.50 from $5.

The analyst stated, “We believe a higher multiple is warranted on higher confidence on sales/ EPS growth through the next 2-3yrs,” Nagle also highlighted that leverage will be much lower after the second quarter.

With 1 Buy and 4 Holds, the Street has a Hold consensus for At Home stock. An average price target of $10.13 implies a possible downside of 45.71%. The stock has risen 239% year-to-date.

Five Below (FIVE)

Five Below is a value retailer, which offers attractive merchandise mostly priced below $5 with a focus on teens and tweens. The company also sells some items up to $10.

The temporary closure of stores dragged down Five Below’s sales by 44.9% to $200.9 million in the first quarter of fiscal 2020, which ended on May 2. Fiscal first-quarter comparable sales fell 51.8% as the company shut down all its stores from March 20 and gradually reopened in late April.

Lower sales led to a loss per share of $0.91 compared to EPS of $0.46 in the first quarter of fiscal 2019.

As of June 9, the company reopened 90% of its 920 store network and the comparable sales at the reopened stores, including e-commerce, were up 8% quarter-to-date for the fiscal second quarter. Management was encouraged by the strong recovery but pointed out that stimulus dollars and pent-up demand also played a role in the improvement.

Five Below has started focusing on its e-commerce business, which was not significant before the pandemic. To enhance its digital capabilities, it acquired the e-commerce platform, fulfillment operation and certain other assets of Hollar.com earlier this year. Five Below’s e-commerce business grew over 4 times Y/Y in the fiscal first quarter.

However, the increase has moderated with the reopening of its physical stores. The company expects e-commerce penetration in the low-single-digit range in fiscal 2020.

The discount retailer delayed its capital projects amid the pandemic and now aims to build its Midwest distribution center in 2021 with plans to open it in 2022.

Five Below has also trimmed down its fiscal 2020 store expansion plans from 180 new stores to an estimated 100 to 120 net new stores. It continues to see the potential to operate over 2,500 stores in the long-term.

Meanwhile, the pandemic also caused the company to enhance its merchandise offerings in the essentials goods and consumables categories, including healthcare, personal care, kitchen and bath products. It also added new tech items amid the rise in the work-from-home trend.

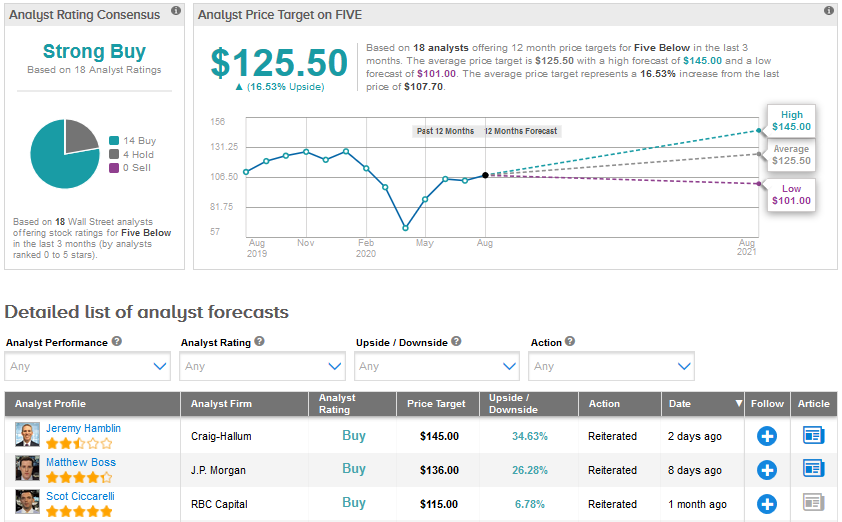

On August 18, Craig-Hallum analyst Jeremy Hamblin upped the price target for Five Below stock to $145 from $133 while maintaining a Buy rating. The analyst feels that though Five Below has generally not been considered as a “COVID Winner”, his store checks indicate that the retailer’s business has had a dramatic recovery while the stock is trading at discount levels.

As per Hamblin’s research, Five Below’s comparable sales growth at reopened stores continued to be robust in the second quarter and is off to a positive start in the third quarter. (See Five Below stock analysis on TipRanks)

Five Below stock scores a Strong Buy Street consensus that breaks down into 14 Buys and 4 Holds. The stock has fallen 16% so far in 2020. An average price target of $125.50 suggests an upside potential of 16.53% over the next 12-months.

Conclusion

While the exposure to the home category is favorable amid the pandemic, At Home’s performance might moderate compared to the fiscal second quarter as competitors’ stores have reopened now. Also, the fear is that some of the tailwinds in Q2, like stimulus checks and pent-up demand, may prove to be temporary.

Five Below’s improving business, zero debt, upside potential in its stock and the Street’s bullish consensus make it more attractive currently.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment