UK-based pharmaceutical company AstraZeneca Plc (AZN) is reportedly interested in a potential merger with rival drugmaker Gilead Sciences Inc. (GILD) in what would be the biggest health-care deal on record.

Bloomberg reported on Sunday that AstraZeneca informally contacted Gilead last month to show its interest in a possible deal. The pharmaceutical company didn’t specify terms for any transaction, which if successful would tie together two companies advancing the development of a vaccine against COVID-19.

According to the report, Gilead has discussed a potential deal with advisers, but no decisions have been made on how to proceed and the companies aren’t in formal talks.

AstraZeneca, valued at $140 billion, is the U.K.’s biggest drugmaker by market capitalization and has developed treatments from cancer to cardiovascular disease. On Thursday, the drugmaker said that it signed supply chain deals for the capacity to produce 2 billion doses of its potential coronavirus vaccine, which it is developing with Oxford University.

Gilead is not currently interested in selling to or merging with another big pharmaceutical company and prefers instead to focus its deal strategy on partnerships and smaller acquisitions, the report said. The company, worth $96 billion at Friday’s close, is the creator of the investigational antiviral remdesivir, which has received U.S. approval for use with hospitalized patients with severe COVID-19, but this authorization is only temporary.

Shares in Gilead have this year advanced 18% as investors have been closely following developments of its antiviral drug for Covid-19 through clinical trials. The stock, which fell 1% to trade at $76.75 on Friday, is still far off its highs seen in 2015.

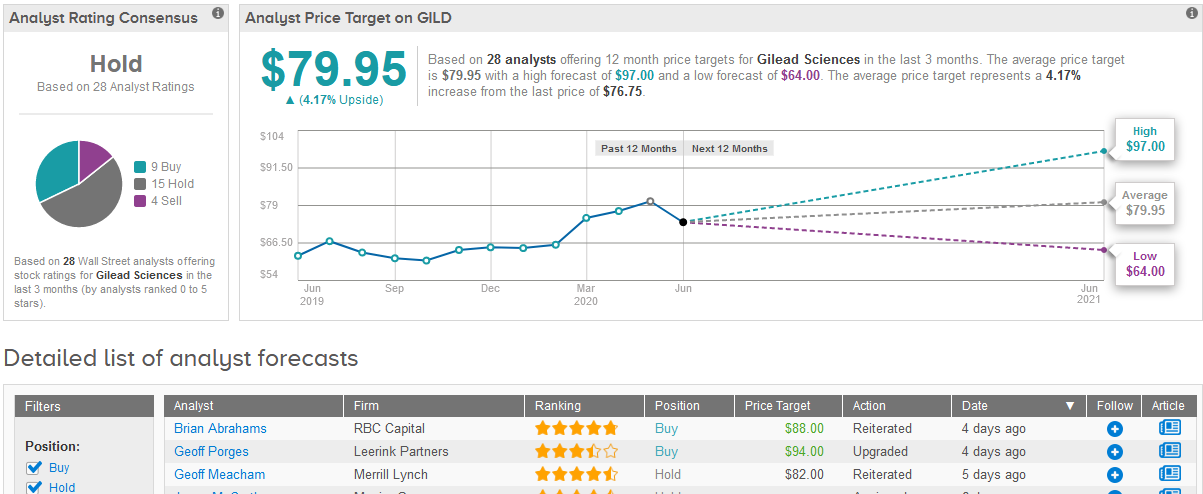

Leerink Partners analyst Geoff Porges last week upgraded the company’s stock to Buy from Hold with a $94 price target (22% upside potential), saying that he forecasts remdesivir sales may reach $7.7 billion in 2022.

Porges is also upbeat about Gilead’s recent investment in Arcus Biosciences Inc., which he believes gives the drugmaker “critical mass in oncology”.

“With these additional opportunities we believe a valuation of $94+ is realistic, perhaps as soon as the company declares its price for commercial sale of remdesivir,” Porges wrote in a note to investors.

Porges expects Gilead to price remdesivir at around $5,000 for a course of treatment, at the list price in the U.S.

Overall, the stock has a Hold analyst consensus based on 15 recent Hold ratings, vs 9 Buy ratings and 4 Sell ratings. Meanwhile, the $79.95 average price target is less optimistic than Porges’ as it indicates a mere 4.2% upside potential in the shares in the coming 12 months. (See Gilead stock analysis on TipRanks)

Related News:

Emergent Bio Plunges 14% Post-Market After Directors Divest Shares

Teva Wins Court Ruling Against Opiant, Emergent Bio On Narcan Nasal Spray

5 Promising Covid-19 Vaccines Picked For Trump’s Operation Warp Speed