Shares of AST SpaceMobile (NASDAQ:ASTS) are gaining some serious eyeballs from different quarters of the Street ahead of its quarterly numbers next week.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

AST, which is setting up the first and only cellular broadband network in space, recently announced preliminary third-quarter numbers. It ended the quarter with a cash pile of $199.5 million and anticipates incurring operating expenses between $41 million and $43 million for the period.

As of September 30, it had incurred about $92 million of capitalized costs primarily associated with its BlueWalker 3 test satellite (BW3) which it launched into orbit in September.

AST has noted that the satellite is functioning normally and expects to complete the deployment of the phased array antenna by November 10, which remains a key event to keep an eye on.

A Roller Coaster Ride

AST shares have been on a rollercoaster ride of their own so far this year, rising to a 52-week high of $14.32 in August but have corrected to the present $7.4 levels since then. In September, the stock had lost big after a short seller report from Kerrisdale Capital, which felt shares of the company were overvalued and was critical of its satellite design.

Despite this near 50% correction since the August highs, short interest in AST is running sky-high at ~29% and ‘diamond hand’ traders could possibly see a short squeeze in the making already.

In the meantime, AST which is yet to turn a profit has seen its top line expand from $1.41 million in 2019 to $12.41 million in 2021. Analysts further expect the figure to rise to $13.6 million in 2022.

Amid all this noise, AST’s third-quarter numbers on November 14 will be keenly watched along with its latest business update.

The Street is Eyeing Serious gains in ASTS Stock

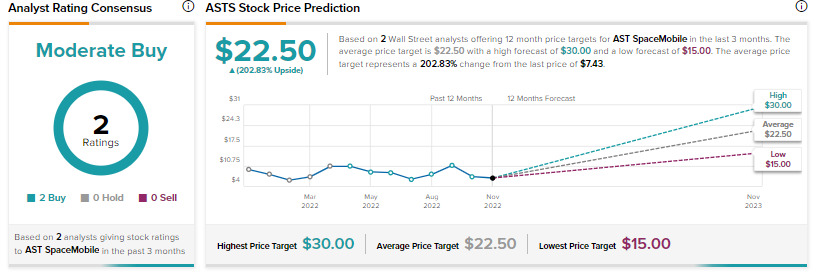

The Street, in the meantime, has a Moderate Buy consensus rating on the stock based on two unanimous Buys.

Further, the average AST price target of $22.50 points to a massive 202.83% potential upside in the stock.

The stock currently has a TipRanks Smart Score of 7, indicating it could move largely in line with the broader markets.

Its daily volume at 1.8+ million is inching upwards of the three-month average volume of 1.69 million and a beta of 1.76 implies the stock can be highly volatile.

Where the stock goes next depends on how markets react to the company’s November 14 showing.

Read full Disclosure