Zscaler, Inc (ZS) operates as a software-as-a-service (SaaS) cloud security company worldwide.

ZS went public in March 2018. I am neutral on ZS stock.

See today’s analyst top recommended stocks >>

Macro Conditions Favorable

Cybersecurity is one of the most critical initiatives of our time. It affects every enterprise, large and small.

It costs businesses and other entities billions each year, due to the need to protect themselves from malware, data breaches, and ransomware.

Most companies are now looking to do business in the cloud using SaaS solutions, rather than house cumbersome hardware onsite. Zscaler’s business is providing zero-trust solutions through the cloud.

Impressive Results

For fiscal year 2021 (the year ended July 31, 2021) Zscaler reached $673 million in revenue. This is a tremendous 56% increase over FY 2020, as well as an acceleration of revenue growth. The growth from FY 2019 to FY 2020 was 42%. Zscaler estimates its serviceable market to be $72 billion, so there are no market constraints on growth in the near future.

Zscaler also has very impressive gross margins (81% for FY 2021). This is critically important to profitability, once the company scales. The company has a long-term target of an operating margin of 20-22%.

The costs that are subtracted to reach gross margins are entirely variable costs. The selling, general, and administrative (SG&A) expenses that follow are a mix of fixed and semi-fixed costs. As companies achieve scale, the fixed and semi-fixed costs decrease as a percentage of revenues, and this is how businesses achieve profitability.

Valuation Concerns

The field of young SaaS cybersecurity companies is becoming increasingly crowded. Zscaler will need to distinguish itself in order to outperform over the long term.

On a trailing 12-month basis, Zscaler trades at a price-to-sales ratio of 52.1x. The company will need to significantly outperform in order to grow into this valuation.

Looking to the future, it currently trades at a 37.4x price-to-sales ratio. This is similar to CrowdStrike’s (CRWD) 39.76 ratio; however CrowdStrike is growing at a faster rate, and the current forecasts call for this to continue.

Wall Street’s Take

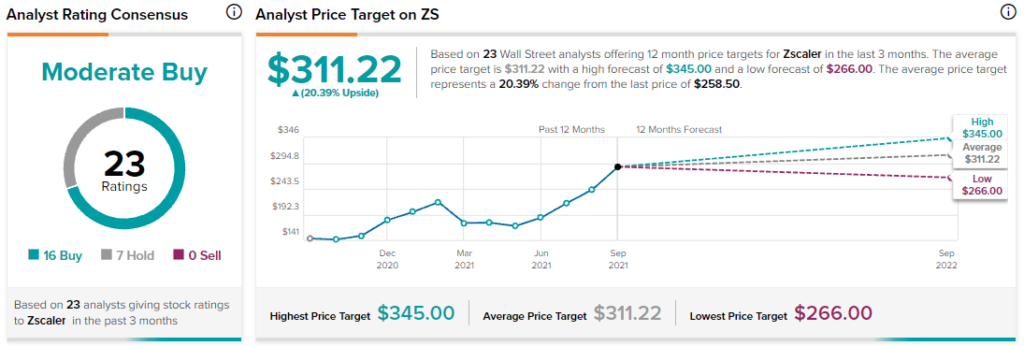

Wall Street analysts are somewhat bullish on ZS stock, with a Moderate Buy consensus rating, based on 16 Buy, seven Hold, and no Sell recommendations.

The average Zscaler price target of $311.22 implies 20.4% upside potential.

Summary on Zscaler

Zscaler is posting impressive results, and it operates in a desirable sector with long-term tailwinds. The sector is becoming quite crowded, however, and ZS must distinguish itself in order to beat the market.

It currently trades at a lofty valuation compared to peers. This indicates that there may be more attractive plays in the sector.

Disclosure: At the time of publication, Bradley Guichard had a position in securities mentioned in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates, and should be considered for informational purposes only. TipRanks makes no warranties about the completeness, accuracy or reliability of such information. Nothing in this article should be taken as a recommendation or solicitation to purchase or sell securities. Nothing in the article constitutes legal, professional, investment and/or financial advice and/or takes into account the specific needs and/or requirements of an individual, nor does any information in the article constitute a comprehensive or complete statement of the matters or subject discussed therein. TipRanks and its affiliates disclaim all liability or responsibility with respect to the content of the article, and any action taken upon the information in the article is at your own and sole risk. The link to this article does not constitute an endorsement or recommendation by TipRanks or its affiliates. Past performance is not indicative of future results, prices or performance.