The restaurant/dining industry is churning out some mixed numbers that may cause confusion. On the one hand, chain restaurants reported growing third-quarter sales. On the other hand, foot traffic has tumbled in recent months as consumers cut back on dining out due to soaring inflation.

Those who don’t take a deep dive into the numbers may miss the reality that most restaurants are only seeing growing sales because they raised their prices — even though the number of customer visits dropped. In this piece, to shed light on the potential pitfalls in the restaurant industry, I evaluated two dining stocks — YUM and BLMN — to see which is better. Upon closer analysis, I am bullish on BLMN and neutral on YUM.

Yum! Brands (NYSE:YUM) owns the fast-food brands KFC, Taco Bell, Pizza Hut, and one fast-casual chain — The Habit Burger Grill. Meanwhile, Bloomin’ Brands (NASDAQ:BLMN) operates sit-down dining options Outback Steakhouse, Carrabba’s Italian Grill, Bonefish Grill, Fleming’s Prime Steakhouse & Wine Bar, and the fast-casual chain Aussie Grill, which was inspired by Outback.

Yum! Brands (NYSE:YUM)

There’s much to like about Yum! Brands, especially in the event of a recession. Based on the company’s trailing price/sales (P/S) and price/earnings (P/E) multiples, it looks like much of the potential upside could be priced in. However, if a recession hits, a reevaluation may be in order. Thus, a neutral view looks appropriate for now. Yum! shares are up 1.6% year-to-date and 4.9% over the last 12 months.

The restaurant industry, in general, looks overpriced, based on its P/E ratio of 42.3 times versus its three-year average of 20.6. The industry is trading around its three-year average P/S multiple of 2.1. Yum! looks overvalued based on its P/S of 5.4 times, although it’s trading at a P/E of 29.4.

Of note, the company came through the brunt of 2022’s soaring inflation intact, generating $6.7 billion in revenue and $1.28 billion in net income for the last 12 months. Data from Placer.ai from August 2022 showed that foot traffic at fast-food restaurants declined 1.2% in the month, while it fell 1.7% for fast-casual eateries and 4.7% for full-service restaurants. In September and October, fast-food traffic bounced back slightly, but fast-casual and dine-in traffic remained in the red.

Despite its strength, Yum! has missed earnings estimates for the last four consecutive quarters, although its same-store sales rose 5% in its most recently reported quarter. Nonetheless, the company has a dividend yield of 1.78%, making it potentially a good income holding.

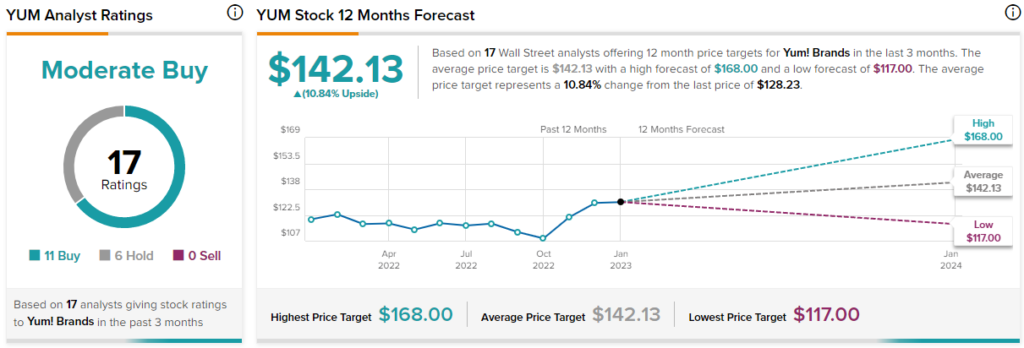

What is the Price Target for YUM Stock?

Yum! Brands has a Moderate Buy consensus rating based on 11 Buys, six Holds, and zero Sell ratings assigned over the last three months. At $142.13, the average price target for Yum! Brands stock implies upside potential of 9.66%.

Bloomin’ Brands (NASDAQ:BLMN)

Shares of Bloomin’ Brands are up 58% since bottoming out over the summer, which may give some investors pause. However, the company looks undervalued based on its multiples, making a bullish view look appropriate, at least for now. A recession could negatively impact Bloomin’ Brands’ sales, which would necessitate a reevaluation.

With a trailing P/S ratio of 0.5 times and a P/E ratio of 24.3, Bloomin’ Brands looks undervalued, especially considering the signs of fundamental strength. For the third quarter, the company reported a 1.4% year-over-year increase in comparable restaurant sales for the U.S. and a 30% increase for its international operations, which consist of Outback Steakhouse in Brazil.

To quantify the growth it’s enjoyed since before the pandemic, Bloomin’ reported an 11% increase in U.S. comparable restaurant sales and a 25% increase in international comparable sales versus its Q3-2019 results. Importantly, Bloomin’ Brands bounced back in the third quarter despite the reported declines in foot traffic for sit-down restaurants.

The company lost money during Q2 2022 but recorded a 4.5% increase in revenue and a more than 800% increase in net income during Q3. Unlike Yum!, Bloomin’ beat the consensus estimates for earnings and revenue in the last four consecutive quarters.

The stock offers a dividend yield of 2.37%, making it a solid addition to an income portfolio as well.

What is the Price Target for BLMN Stock?

Bloomin’ Brands has a Moderate Buy consensus rating based on two Buys, four Holds, and zero Sell ratings assigned over the last three months. At $26.33, the average price target for Bloomin’ Brands stock implies upside potential of 6.2%.

Conclusion: Neutral on YUM, Bullish on BLMN

Whether there’s a recession and its severity will impact both companies, so both require close monitoring in the near term, especially considering that the soaring inflation might be the only reason their sales rose in 2022.

Foot traffic may be a critical differentiator for Yum! in a recession, but for now, Bloomin’ looks better based on valuation. Time will tell whether this thesis remains intact.