Television streaming player Roku, Inc. (NASDAQ: ROKU) is benefiting from improved user engagement and growing average revenue per user (ARPU). In the last quarter of 2021, users streamed 19.5 billion hours on Roku, up 15% year-over-year.

However, there is a common concern among investors about the cost escalations hurting margins. As Needham & Co. analyst Laura Martin explained, “Roku’s business model is not demonstrating upside operating leverage with scale.”

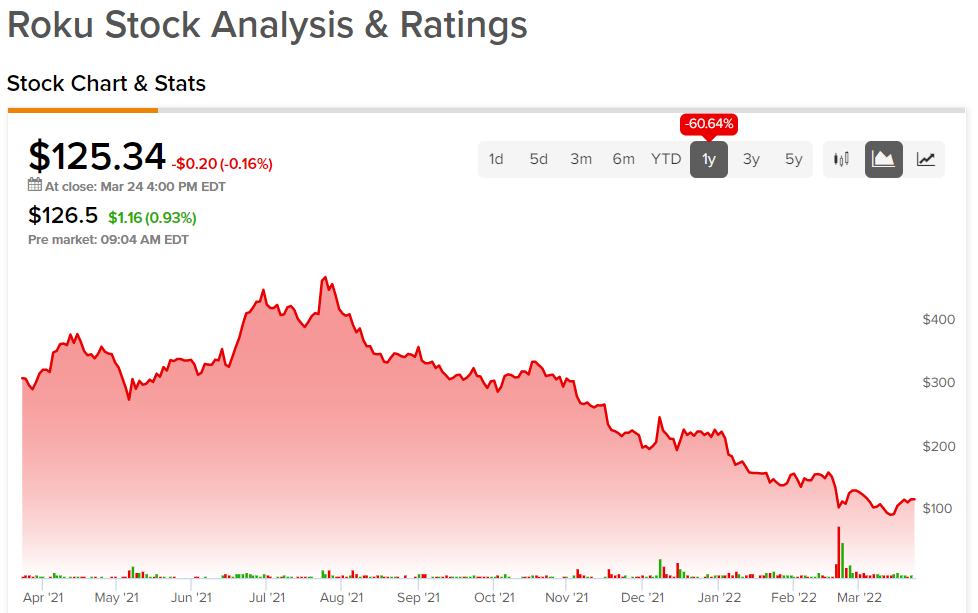

Another concern is its falling share prices. Shares of Roku have shed 60.64% of their value in the past twelve months, and 46.25% so far this year.

Nonetheless, Martin believes that the low prices are the perfect opportunity for buying the dip. She saw several upsides to the stock’s performance, based on which she reiterated a Buy rating with a price target of $205.

Positive Developments and Upsides

Martin pointed out that Roku has overestimated its cost growth a few times in the past. For instance, in 2021, the company had only delivered 42% year-over-year growth of operating expenses against its projection of 62%. So there is a chance that the company misses its own estimates again for this year’s expenses.

Additionally, the analyst is particularly impressed with traction seen in The Roku Channel (TRC). With around 80 million users worldwide, TRC’s total viewing hours doubled in 2021. TRC is possibly the 4th most viewed video app on Roku’s platform currently.

Recently, news and live TV were added to TRC, which is gaining more viewership because of the Russian war on Ukraine.

Martin also highlights the width of Roku’s total advertising addressable market, which gives the company plenty of room for growth. “We believe that Roku’s advertising addressable market (TAM) in the US is the $60B of US traditional linear TV advertising revenue reported in 2021 (source: eMarketer) plus TAMs it adds over time,” said the analyst.

There are also other growth opportunities ahead for Roku, especially in CTV ad revenues. Now that Roku is the “largest premium long-form film and TV content platform for CTV ads,” Roku stands to benefit most from long-term secular growth trends like accelerated cord-cutting, more demand for streaming devices, and demographic changes influencing faster CTV adoption among advertisers.

Martin also believes that since Roku has the advantage of having both AVOD (advertising video-on-demand) and SVOD (subscription video-on-demand) revenue channels, Roku’s financials will not be significantly impacted by the ‘streaming wars,’ regardless of which company wins it.

“Roku is a pure-play way to invest in growth of the US over-the-top (OTT) and connected-TV (CTV) ecosystems,” said Martin, summing up her observations.

Wall Street’s Take

Wall Street holds a cautiously optimistic stance on Roku, with a Moderate Buy rating based on 14 Buys, one Hold, and three Sells. The ROKU stock projection indicates an average price target of $184.50.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure.