For investors in the social media space, Snap Inc. (SNAP) is one of the oft-overlooked players. Indeed, Facebook (FB) continues to garner most of the attention in this area, and Facebook’s market capitalization is roughly 10 times that of Snap. Accordingly, capital inflows into mega-cap names like Facebook can take away some of the luster from competitors such as Snap.

That said, SNAP stock continues to search for new all-time highs in recent months. Surges of upside momentum have been quashed repeatedly, with SNAP stock trading in a relatively consistent range of $50 – $65 per share in recent months. (See Snap stock analysis on TipRanks)

SNAP stock did hit an all-time high of $73.59 earlier this year on the growth stock melt-up that played out in January/February. Since then, shares have settled down to the $61 level, at the time of writing.

What’s in store for Snap from here? Let’s discuss one key catalyst investors and analysts have their eye on right now.

AR Is the Wave of the Future for SNAP Stock

A recent announcement on May 20, that Snap was releasing its new augmented reality Spectacles product at the company’s Partner Summit, stoked yet another rally in SNAP stock. Since that announcement, shares have climbed more than 13% higher on anticipation of impressive growth in the AR segment.

Indeed, augmented reality is a key growth segment for a number of players in the social tech space. Facebook has announced its intent to create its own AR glasses. These glasses are being developed by the team in charge of bringing the company’s successful Oculus virtual reality headsets to market.

Indeed, developing wearable tech, and bringing it to market faster than the competition, is a key focal point for companies like Snap. For Snap, the hope is that the company’s AR offering will be enticing for its core user base, and potentially drive more eyeballs to its existing social media platform, creating positive network effects for the stock.

In addition to this announcement, the company also noted it is pursuing “various tie-ups and developer products across its Snap Kit, Games, Minis, and Bitmoji platforms.” Among those discussed are a couple of intriguing deals with Disney and other vendors looking to cash in on the “map layers” feature. This feature allows vendors to prompt the purchase of tickets or other items when the wearer of the AR glasses looks at a particular venue or landmark.

Various analysts have grown more bullish on SNAP stock as a result of this AR announcement. Indeed, this move into AR is being viewed positively by analysts as a sign of Snap’s innovative and creative upside in the consumer technology space. A number of analysts have placed price targets in excess of $80 on SNAP stock, following the Spectacles announcement.

That’s not bad.

Indeed, the ability for Snap to monetize its impressive AR offering remains to be seen. However, the potential for such monetization is what has analysts and investors so excited about SNAP stock right now.

What Analysts Are Saying About SNAP Stock

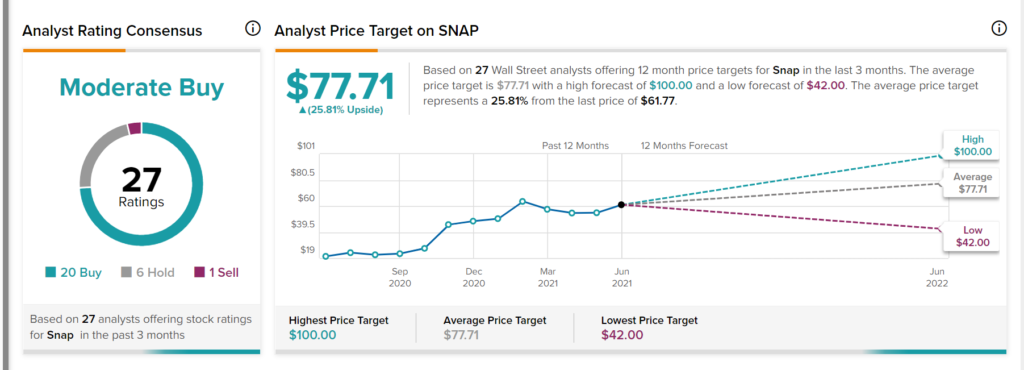

According to TipRanks’ analyst rating consensus, SNAP stock comes in as a Moderate Buy. Out of 27 analyst ratings, there are 20 Buy recommendations, 6 Hold recommendations, and 1 Sell recommendation.

As for price targets, the average analyst Snap price target is $77.71. Analyst price targets range from a low of $42.00 per share to a high of $100.00 per share.

Bottom Line

Snap is a long-term growth play that investors with a sufficiently reasonable investment time horizon ought to consider today. While not yet profitable, Snap’s long-term growth potential indicates this is a stock that could, one day, grow into its valuation.

Indeed, many view this stock as an earlier-stage Facebook, in many regards. Snap is a smaller, but perhaps more nimble (and certainly creative and innovative) competitor to the social tech behemoth.

Those who believe there’s more than enough room for multiple social tech behemoths in the future may want to consider Snap today. Certainly, the company’s AR offering is compelling, and provides such an outlook right now.

Disclosure: Chris MacDonald held no position in any of the stocks mentioned in this article at the time of publication.

Disclaimer: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities.