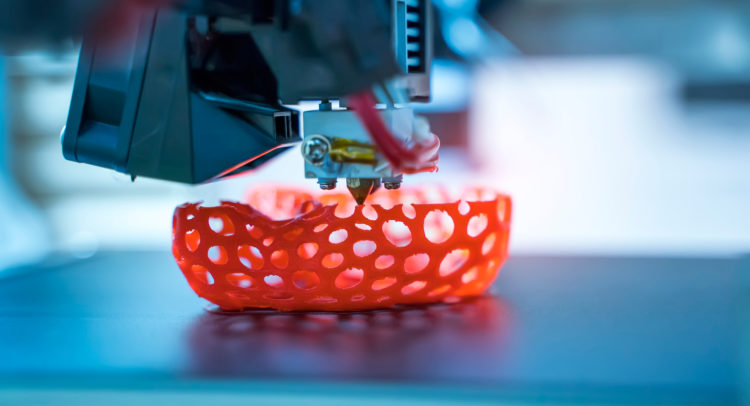

Based in Massachusetts, Desktop Metal (DM) specializes in additive manufacturing technologies and 3D printing technologies. I am bullish on the stock.

Make no mistake about it: Desktop Metal is a company on a mission. Specifically, it seeks to achieve a double-digit share of the $100+ billion additive manufacturing market by the end of this decade.

It’s amazing to consider that this niche market is set to grow by more than 11x to over $100 billion by 2030, yet many people aren’t even aware of this growth-investment opportunity. We’re talking about a compound annual growth rate (CAGR) of around 25% for this industry, which is really still in its infancy.

Yet, the number of established, investable businesses in this niche on major stock exchanges is quite limited. Among the few options is Desktop Metal, a premier additive manufacturing specialist with over 650 patents issues, or patent applications pending – up 5x from 2020.

Someday, Desktop Metal could be a household name and DM stock may be back above its penny stock status. If ever there was a ground-floor opportunity – and one with government backing, as we’ll discover – Desktop Metal is it.

Technology of the Future

Of all the allies a business can have, the government is certainly among the best. After all, when your industry has government backing, it’s much easier to secure funding for infrastructure, research and development, and so on.

Hence, it’s definitely good news for DM stockholders that the current presidential administration launched the Additive Manufacturing Forward (AM Forward) initiative. As Desktop Metal explained, AM Forward supports additive manufacturing/industrial 3D printing adoption in the U.S., particularly among small- and medium-sized manufacturers.

This seems to be a response from the American government to widespread supply-chain issues. As you might expect, Desktop Metal co-founder and CEO Ric Fulop expressed his support for AM Forward, stating that additive manufacturing “has long held the potential to de-risk supply chains and enable new innovations.”

Fulop presented a convincing argument in favor of additive manufacturing generally, and AM Forward in particular. It makes sense that, since 3D printing tends to support localized manufacturing, its adoption could help to reduce the nation’s reliance on global supply chains.

Naturally, the launch of AM Forward is bullish for Desktop Metal. Even beyond that, Fulop seemed to suggest that the expansion of Desktop Metal’s niche industry will have broader and deeper implications.

“Additive manufacturing is the modern manufacturing technology of the future, and it’s the right time for American industry to support this transition to the next era of production,” the Desktop Metal CEO declared.

Off to a Great Start

Already, you might be convinced that this is the right time to invest in the emerging additive manufacturing industry. The 25% CAGR and the U.S. government’s backing certainly make it tempting to start a long position now.

However, informed investors must carefully vet any company before committing capital to it. That’s why quarterly financial reports are so crucial to the decision-making process. They’re even more critical when you’re considering buying a falling stock – and in the case of DM stock, it has declined from $15 to $2 during the past year.

What do Desktop Metal’s first-quarter 2022 fiscal results tell us, then? All in all, they tend to suggest that DM stock has strong recovery potential, and perhaps an intrinsic value far greater than $2 per share.

Fulop boldly assured that his company is “off to a great start to 2022,” but do the numbers spell this out? Desktop Metal’s top-line result is quite compelling, as the company generated $43.7 million in Q1 2022, representing eye-opening growth of 286% from 2021’s first quarter.

Furthermore, Desktop Metal reported having $206.5 million worth of cash, cash equivalents, and short-term investments of as of March 31, 2022. In other words, the company is in a reasonably solid capital position to continue its operations.

Looking toward the future, Desktop Metal anticipates generating revenue of roughly $260 million in full-year 2022, which would represent 131% growth compared to 2021’s result. These figures do, indeed, support Fulop’s “great start” assertion.

Let’s not present a one-sided fiscal picture here, though. On the negative side, we must consider that Desktop Metal sustained a Q1 2022 per-share earnings loss of 14 cents. Admittedly, that’s worse than the analysts’ consensus estimate of a 12-cent per-share loss.

What this means for current and prospective investors is that they should continue to monitor Desktop Metal’s bottom-line results. If the company can steer itself toward profitability, that would be a great sign.

Wall Street’s Take

According to TipRanks’ analyst rating consensus, DM is a Moderate Buy, based on one Buy and one Hold rating. The average Desktop Metal price target is $5.25, implying a 179.26% upside potential.

The Takeaway

Are you ready to participate in, and possibly profit from, a fast-growing industry? Additive manufacturing in the U.S. can help alleviate persistent supply-chain issues, and it’s an industry with support from the government.

Going forward, keep an eye out for Desktop Metal to hopefully improve its bottom-line results. Still, Desktop Metal’s revenue growth, along with the additive manufacturing industry’s rapid expansion, bolster the bullish thesis for DM stock today.

Discover new investment ideas with data you can trust

Read full Disclaimer & Disclosure