The global community has been grappling with supply chain challenges ever since the beginning of the pandemic, shaking businesses across sectors, industries, and countries.

The pandemic may have waned, but the supply issues surely haven’t and are worsening every single day.

Exacerbating the already disrupted international logistics services and supply chains are the recent Shanghai export issues.

To curb the coronavirus outbreak, Shanghai continued its lockdown for the fourth week. Shanghai is one of China’s biggest manufacturing and export hubs. Its exports have taken a massive hit as logistics services have been severely impacted by the lockdown.

Though Chinese ports are still functioning, the lockdown situation in China has led to a shortage of trucks. Cargo is unable to reach the port, leading to containers and shipping carriers remaining idle. As a result, there is a massive dip in freight volumes and exports.

Likewise, there’s a huge gap between supply and demand facing the shipping industry worldwide, driving the steep rise in prices.

Once the lockdown eases, factories will make up for the lost production, further increasing demand and catapulting prices even higher.

Conclusively, this means that international logistics may not return to normal anytime soon, creating an interest in the high-in-demand shipping stocks.

Let’s take a look at the top shipping stocks offering the fastest growth potential.

Using the TipRanks stock comparison tool, we can stack NMM up against AMKBY, and discuss what Wall Street analysts think about the prospects of these two shipping stocks.

Both stocks have gained massively, beating the benchmark during the pandemic years. Over the past two years, NMM rose 161% and AMKBY gained 133%.

Navios Maritime Partners L.P. (NYSE: NMM)

Headquartered in Greece and listed on the NYSE, Navios Maritime Partners L.P. is an international owner and operator of dry cargo and tanker vessels. Navios Partners owns and operates its fleet of dry bulk and container vessels with a diversified customer base worldwide.

Navios Partners operates through three segments: containerships, dry-bulk, and tankers, across 15 vessel types servicing over 10 end markets. Shares of the company, with a current market capitalization of $1 billion, have gained over 20% in the past six months.

On February 17, the company reported results for the fourth quarter ended December 31, 2021. Revenues almost quadrupled year-over-year to $268.1 million, while adjusted net income increased almost ten times to $121.8 million.

However, the quarterly results failed to meet analyst expectations on both the revenues ($276.14 million) and earnings per share (EPS) fronts ($4.03 per share versus consensus of $4.35 per share).

Full-year results also delivered record growth. FY2021 revenues grew 214.5% to $713.2 million, while adjusted net income almost quadrupled to $364.15 million.

The outstanding performance was driven primarily by substantial increases in the size of the fleet as well as an increase in the Time Charter Equivalent (“TCE”) rate.

Preparing for the ongoing upsurge in demand, Navios Partners made an investment worth $1.0 billion in 18 newbuilding vessels delivered through 2024 with the acquisition of four 5,300 TEU Newbuilding Containerships in the fourth quarter.

Navios Partners CEO, Angeliki Frangou, commented, “In 2021, we reimagined the public shipping company… Each segment works independently to mitigate volatility from the other. While we do not expect this to work perfectly, we believe the diversity will sufficiently reduce volatility and create flexibility in our operational and financial decision-making process as we charter, purchase, and sell vessels and finance our activities.”

TipRanks’ Stock Investors tool shows that investors currently have a Very Positive stance on Navios Maritime Partners, with 4.6% of investors increasing their exposure to NMM stock over the past 30 days.

AP Moller Maersk (LSE: GB:0O77) (OTC: AMKBY)

Based in Denmark, A.P. Moller-Maersk A/S popularly known as Maersk, is a shipping company that is active in ocean and inland freight transportation and associated services, such as supply chain management and port operations.

It engages in transport and logistics activities under four main divisions: Maersk Line (container shipping), APM Terminals (ports), Damco (freight forwarder) and Svitzer (tug boats and support vessels in ports).

In fact, Maersk Line is the world’s largest container shipping company, with a market share of around 20%. Shares of the shipping giant have gained 17.75% over the past year, outperforming benchmarks.

Now, let us see what the Wall Street analysts are saying about the stock.

Yesterday, Berenberg analyst William Fitzalan Howard decreased the price target on AP Moller Maersk to DKK20,500.00 (from DKK22,000.00), and reiterated a Hold rating.

On March 22, Deutsche Bank analyst Andy Chu downgraded AP Moller Maersk to Hold from Buy and also reduced the price target to DKK22,500 (from DKK26,400).

Notably, Chu moved from a Buy stance on overall container shipping and logistics space to a Hold view based on his concerns about a weaker GDP outlook, reduced consumer spending power, and increased wage and fuel prices.

Specifically, Chu downgraded the recommendation on AP Moller Maersk based on a limited upside. He arrived at his price target based on a sum-of-the-parts valuation based on EV/IC and EV/EBITDA multiples for each division.

For the Ocean division, the analyst used 1.0x EV/IC (the historical average multiple for the container shipping sector). For the Logistics & Services division, he assigned a 12x EV/EBITDA multiple (in line with peer group valuations for logistics companies).

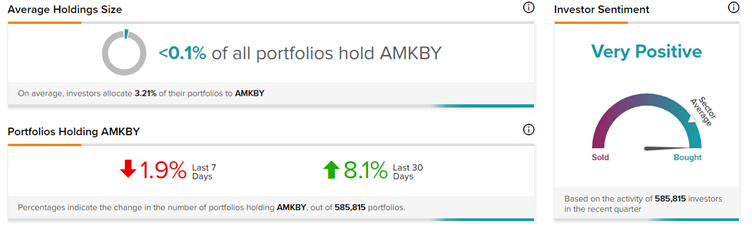

However, investors completely disagree with Chu. TipRanks’ Stock Investors tool shows that investors currently have a Very Positive stance on AP Moller Maersk, with 8.1% of investors increasing their exposure to AMBKY stock over the past 30 days.

Conclusion

Shipping stocks have thrived during the pandemic and should continue to do so despite a growing number of risks from the Russia-Ukraine conflict, inflationary pressures, and macro-economic uncertainty.

With a diversified fleet, both NMM and AMKBY remain well-positioned to capture the growth potential once the above-mentioned uncertainties fade.

Let us look at the two stocks, using the TipRanks Smart Score tool. The Smart Score is an efficient way to predict stock movement, with a score of 10 assigned to the best performing stocks.

NMM scores a 5 out of 10 on TipRanks’ Smart Score rating system, indicating that the stock is likely to perform in line with market expectations.

On the other hand, AMKBY scores an 8 out of 10 on TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Based on the smart score, it seems likely that AMKBY will beat market expectations versus NMM in the coming months.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure