2021 was a fantastic year for banking stocks, but the momentum did not carry over into 2022. Due to a number of issues, this year got off to a shaky start. Recessionary fears were stoked by growing inflation, supply-chain imbalances, the ongoing Russia-Ukraine conflict, and the Federal Reserve’s tightening of monetary policy.

Market sentiment has been impaired by these fears, which have touched practically all sectors, including the financial industry.

Despite signs of rising interest rates, banking stocks have lost steam this year. In the first quarter, the benchmark KBW Nasdaq Bank Index, which covers 24 of the major U.S. lenders, fell more than 11%.

Q1 Could Be a Big Blow

Banks could produce weaker-than-expected results in the first quarter. It is most likely that Q1 earnings from some of the largest U.S. banks may show that rising cost pressures might have hurt their margins.

Deutsche Bank analyst Matt O’Connor said, “For the first quarter, year over year, we were probably expecting capital markets revenue to be down like 10 to 20 percent [at the start of 2021], as a range across the banks. And now we’re down 30-50 percent. It’s pretty materially weaker.”

Notably, fourth-quarter earnings released in January fell short of expectations, with several banks warning that spending will continue to rise this year, putting pressure on margins.

With the banking sector’s first-quarter earnings just around the corner, investors will be looking at how the banks performed and what lies ahead. The spotlight this week will be on the quarterly results of the so-called “Big 5 Banks” — JPMorgan (JPM), Citigroup (C), Goldman Sachs (GS), Morgan Stanley (MS), and Wells Fargo (WFC).

Year-to-Date Performance

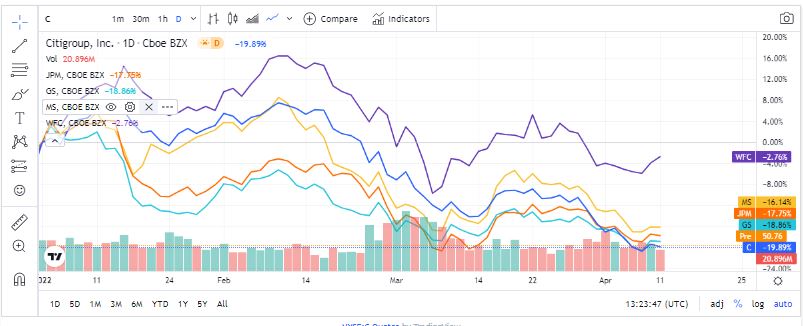

The “Big 5 Banks”, which were expected to benefit from interest rate hikes, have performed poorly so far this year and are all trading in the red year-to-date.

The price-performance of these banking stocks is depicted in the graph below.

JPMorgan

JPMorgan, the largest bank in the United States by assets, has recently been expanding through acquisitions. The company is creating branches in new areas to broaden its reach. The plan will help the bank capture cross-selling opportunities by expanding its footprint in the card and vehicle loan sectors, in addition to gaining market share.

Aside from that, the company continues to expand its investment banking and asset management businesses in China.

For the upcoming Q1 results, analysts expect JPMorgan to announce adjusted earnings of $2.72 per share, a fall of 40% year-over-year.

Overall, JPMorgan stock has a Moderate Buy consensus rating on TipRanks based on nine Buys, six Holds, and one Sell. As for price targets, the average JPM price target of $171.19 implies almost 28.7% upside potential from current levels.

Citigroup

Citigroup has been focusing on core business growth while streamlining its processes globally. The corporation continues to optimize its branch network while also attempting to streamline operations and reduce costs.

The company’s earnings have outperformed analysts’ projections for the last seven quarters. For the upcoming quarter, analysts estimate Citigroup to report adjusted earnings of $1.43 per share, a fall of 60% year-over-year.

For 2022, total revenues are expected to grow in the low single digits, excluding divestitures. Higher interest rates and higher fees are anticipated to drive this growth.

On TipRanks, Citigroup stock sports a Moderate Buy consensus rating based on eight Buys, eight Holds, and one Sell recommendation. As for price targets, the average C price target of $70.88 implies almost 40.2% upside potential from current levels.

Goldman Sachs

Goldman’s bottom line in the upcoming quarter could be impacted by its expanding cost base. Furthermore, in the March-end quarter, headwinds were produced by a reduction in the investment banking business due to depressed capital markets and increased market volatility triggered by the Ukraine conflict.

For the upcoming first quarter, analysts estimate Goldman to report adjusted earnings of $9.07 per share, a fall of 51% year-over-year.

Also, we used TipRanks’ new online tool to track user visits to its website. Surprisingly, the company’s monthly user numbers came out to be quite encouraging. The tool showed that overall projected visits to the Goldman Sachs website increased in Q1. In particular, the total projected worldwide visits to the GS website increased by 38% from the fourth quarter of 2021.

On TipRanks, Goldman Sachs stock sports a Moderate Buy consensus rating based on 10 Buy and five Hold recommendations. As for price targets, the average GS price target of $434.36 implies almost 35.4% upside potential from current levels.

Morgan Stanley

Morgan Stanley has been working on a number of initiatives to restructure its operations in order to increase stable revenue streams. The corporation had a wonderful year in 2021, with record earnings and significant capital returns to its stockholders.

Further, the company’s earnings have outperformed analysts’ projections for the last seven quarters. For the upcoming earnings quarter, analysts estimate Morgan Stanley to report adjusted earnings of $1.73 per share, a fall of 22% year-over-year.

However, the current market volatility has created a panic among investors. According to TipRanks’ Stock Investors tool, investors currently have a Very Negative view of Morgan Stanley, with 1.4% of investors decreasing their exposure to MS stock over the past 30 days.

On TipRanks, Morgan Stanley stock sports a Moderate Buy consensus rating based on five Buy and six Hold recommendations. The average MS stock price target of $105.11 implies almost 25% upside potential from current levels.

Wells Fargo

The company’s deposit base continues to grow. The deposit balance is projected to improve more as the economy improves, notably in the consumer business and commercial banking divisions. The bank’s liquidity should be bolstered as a result of this.

For the upcoming first quarter, analysts estimate Wells Fargo to report adjusted earnings of $0.81 per share, a fall of 23% year-over-year.

We used TipRanks’ new online tool to track user visits to its website. The company’s monthly user numbers remained disappointing. The tool showed that overall projected visits to the Wells Fargo website decreased in Q1. In particular, the total projected worldwide visits to wellsfargo.com decreased by 13% sequentially from the fourth quarter.

On TipRanks, Wells Fargo stock sports a Moderate Buy consensus rating based on 11 Buy and four Hold recommendations. The average WFC stock price target of $60.37 implies almost 22% upside potential from the current levels.

Bottom Line

As banks strive to contain expenses in an inflationary environment, the approaching earnings season for banks could be a mixed bag for investors. The dangers have definitely increased as a result of the Russia/Ukraine war and a larger likelihood of recession as the Federal Reserve hikes rates to combat inflation. Nonetheless, the banks have several potential tailwinds, including increased interest rates and a faster-growing loan environment.

Discover new investment ideas with data you can trust

Read full Disclaimer & Disclosure