Pharmaceutical giant Pfizer Inc. (PFE) is scheduled to report its first-quarter results on May 3, before the market opens. All eyes are on how the multinational will kick start the year, especially when dealing with the fading effects of the COVID-19 pandemic.

Pfizer witnessed a huge surge in demand for Comirnaty (Pfizer-BioNTech SE (BNTX) COVID-19 vaccine) in 2021 owing to the widespread growth of the virus in various forms across the globe. Its fourth-quarter and full-year 2021 results were rather mixed with a quarterly earnings beat and revenue miss.

2022 however, has been a rather dull year thus far in regards to the spread of the virus and challenges are mounting for vaccine makers. However, not all is lost for Pfizer, as it boasts of a strong portfolio of other drugs both in the market and in various stages of development.

The U.S. Food and Drug Administration (FDA) has set the date to June 28, to discuss the strain for the fall booster. If the FDA signals a newer variant of the virus, vaccine makers will have to push to bring an updated version of the shots to the market. Nonetheless, there is an ongoing debate on whether a booster will even be needed, seeing the dissipating severity of the virus.

PFE stock has lost 12.7% year-to-date vis-à-vis gaining nearly 60% in 2021 when COVID-19 cases were in full bloom. The company pays a regular quarterly common dividend of $0.40 per share which reflects a current dividend yield of 3.12%.

Wall Street’s Expectations

Pfizer and partner Biohaven Pharmaceutical (BHVN) recently received a much-awaited green light from the European Commission for the marketing authorization for Vydura (Rimegepant) for both treatment and prevention of migraine headaches.

Responding to this, Mizuho Securities analyst Vamil Divan noted that the approval opens up an under appreciated opportunity for Rimegepant.

Divan has a Hold rating on the PFE stock with a price target of $55, implying a 12.1% upside potential to current levels.

For Q1, the Street expects Pfizer to report sales from Comirnaty of $10.60 billion, and Paxlovid (an oral antiviral pill for COVID-19) is expected to generate $2.42 billion in sales. On an overall basis, total sales consensus stands at $24.4 billion, and earnings are pegged at $1.55 per share.

Divan has a higher estimate for Comirnaty ($11.68 billion in sales) and a lower estimate for Paxlovid ($1.73 billion) compared to the consensus estimates.

For the full year Fiscal 2022, Pfizer has forecasted sales from Comirnaty of $32 billion and Paxlovid sales of $22 billion.

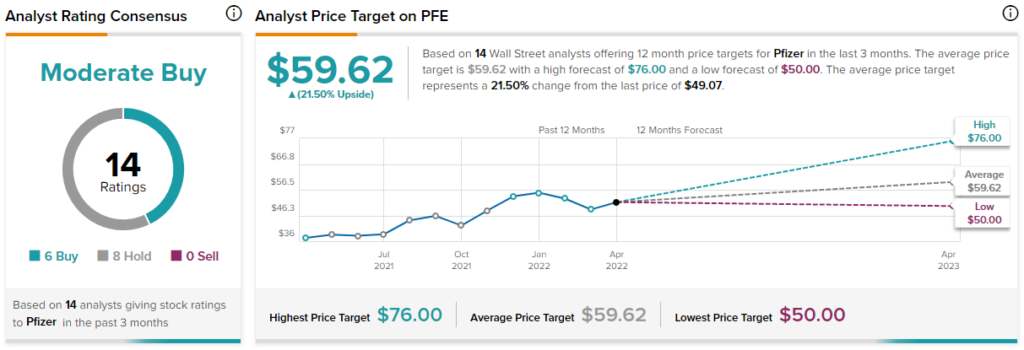

The other analysts on the Street too are cautiously optimistic about the stock with a Moderate Buy consensus rating based on six Buys versus eight Holds. The average Pfizer price forecast of $59.62 implies 21.5% upside potential to current levels.

What Works for Pfizer?

Paxlovid was approved in the U.S. in December 2021 and has received conditional approvals from several other nations since. Paxlovid is one of Pfizer’s most ambitious at-home antiviral drugs to prohibit and fight the mild-to-moderate virus related side effects. However, recent cases of a viral load rebound following the five-day course of Paxlovid has the market abuzz about actually how effective the drug may be.

Pfizer has a strong line-up of other drugs including Eliquis, Biosimilars, Vyndaqel/Vyndamax, Prevnar family, Chantix, Ibrance, and Sutent to name a few. Some of these drugs have been witnessing a declining growth in revenue owing to logistic issues, unfavorable timing of the pandemic, and slowing demand. It remains to see how these drug sales are shaping up in 2022 with the opening of economies.

Notably, Pfizer has undertaken a slew of strategic acquisitions lately, all of which will enable the company to boost its performance irrespective of the COVID-19 related vaccine sales, a major point to consider for the longer-term trajectory of PFE stock.

A point in the case remains that Pfizer has further potential for sales growth in the international markets considering the increased competition from other major pharma companies. In 2022, Comirnaty and Paxlovid vaccine sales to the international markets will continue to lead its growth based on all the pre-signed purchase orders from various countries.

Ending Thoughts

Apart from the cautious outlook of Wall Street analysts, both hedge fund investors and insiders have loaded up on PFE shares in the last quarter. Although, investors have offloaded 4% of the stock in the last seven days.

Interestingly, Pfizer scores a “Perfect 10” on the TipRanks Smart Score system which implies that the stock is highly likely to outperform market expectations. All in all, it would be a good time to wait on the sidelines till the first quarter results clear up the story for 2022.

Discover new investment ideas with data you can trust

Read full Disclaimer & Disclosure