Healthcare giant Pfizer (NYSE:PFE) is scheduled to announce its third-quarter results on Tuesday, November 1. Pfizer stock has been under pressure as investors are concerned about the expected decline in the company’s COVID-related sales in the upcoming quarters as the pandemic fades.

Analysts’ Expectations from Pfizer’s Q3 Results

Pfizer’s COVID-19 vaccine, Comirnaty (developed in collaboration with BioNTech (BNTX), has been a key driver of its strong results in recent times. In the second quarter, Comirnaty brought in $8.9 billion in revenue, while the company’s antiviral COVID-19 drug Paxlovid generated revenue of $8.1 billion. Overall, Q2 revenue grew 47% to $27.7 billion, while adjusted earnings per share (EPS) increased 92% to $2.04. Both these metrics exceeded analysts’ expectations.

Pfizer expects Comirnaty revenue of about $32 billion and Paxlovid to deliver sales of $22 billion in the full year 2022. It’s worth noting that the company expects nearly 25% of its second-half Comirnaty sales in Q3 and 75% in Q4, based on the expected deliveries of Omicron-adapted vaccines in the fourth quarter. In contrast, 60% of Paxlovid’s second-half sales are expected in Q3 and 40% in Q4.

Analysts expect Pfizer’s Q3 EPS to grow 3.7% year-over-year to $1.39. Meanwhile, revenue is expected to decline 12.5% to $21.1 billion.

Is Pfizer a Buy, Sell, or Hold?

Going into Q3 results, SVB Leerink analyst David Risinger lowered his price target for Pfizer stock to $48 from $53 while maintaining a Hold rating. Risinger feels that the company might miss the consensus Q3 EPS estimate due to weaker-than-anticipated COVID-related revenue and currency headwinds.

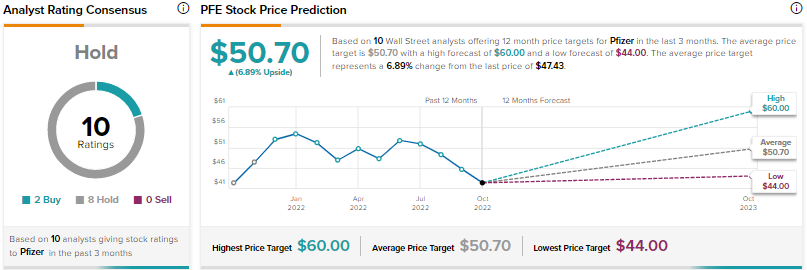

Overall, Wall Street is sidelined on Pfizer stock based on two Buys and eight Holds. The average PFE stock price target of $50.70 implies 6.9% upside potential. Shares have declined 20% year-to-date.

Conclusion

Analysts are concerned that lower-than-anticipated COVID-19 revenues and forex headwinds could weigh on Pfizer’s Q3 performance.

Meanwhile, the company is optimistic about its long-term growth based on its strong product pipeline and strategic deals, including the recent acquisitions of Biohaven Pharmaceuticals, ReViral, and Global Blood Therapeutics.