Electronic Arts (EA) creates and distributes games and content for internet-connected consoles, mobile devices, and personal computers.

Electronic Arts is one of the industry’s more stable players. The regularly scheduled releases, such as annual sports games, have provided consistent cash flow to the company. It also pays a $0.17 per share quarterly dividend, having a current dividend yield of 0.56%.

Coming to its earnings numbers, the company’s financial performance during the third fiscal quarter was disappointing. Net bookings of $2.58 billion fell short of the $2.68 billion consensus projection. In addition, earnings per share of $0.23 fell 68.1% from the year-ago quarter and missed the consensus estimate of $3.23.

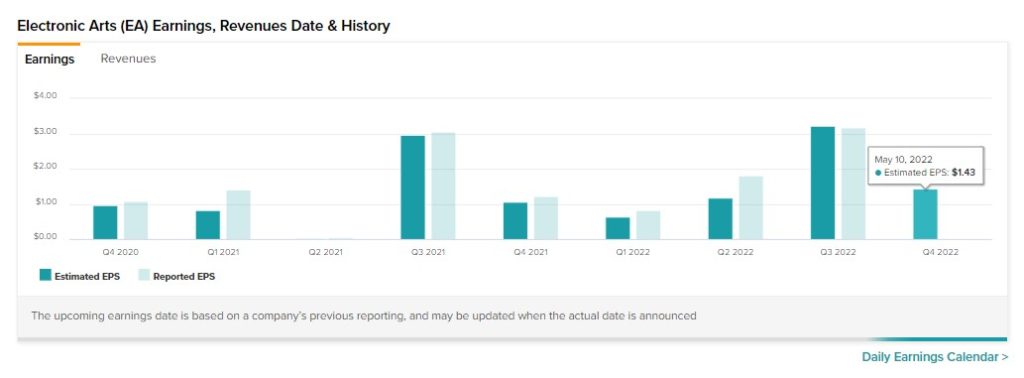

On May 10, Electronic Arts will reveal its fourth-quarter 2022 earnings. Let’s see how the business is expected to perform in the upcoming quarter.

What Do EA’s Website Visit Stats Indicate?

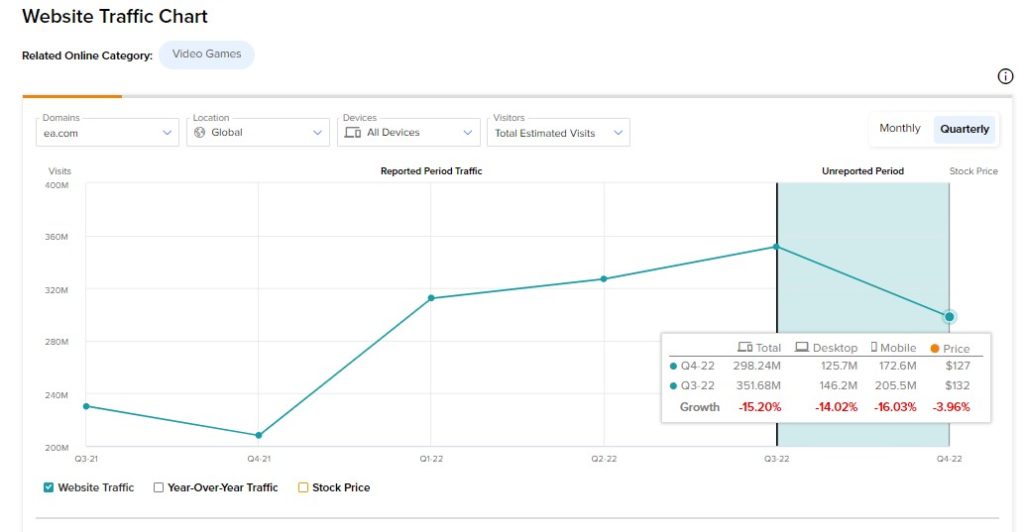

We looked at the company’s website user statistics using TipRanks’ Website Traffic Tool, which allows us to see online visit counts by quarter, month, or area.

Using the tool, we discovered that there was a 15.2% decline in total global visits to the ea.com website from the preceding quarter (Q3).

However, on a year-over-year basis, monthly visits to Electronic Arts website spiked 43.3% in the fiscal fourth quarter.

Experts Forecast Year-Over-Year Profit in Q4

Electronic Arts is expected to report adjusted earnings of $1.43 per share in the fiscal fourth quarter, according to analysts. The Q4 EPS forecast shows a 16.3% increase in earnings from the year-ago quarter.

Electronic Arts CFO Blake Jorgensen remained upbeat about the company’s prospects in 2022 on the Q3 conference call. He stated, “Our portfolio approach will enable us to deliver organic growth in the double digits this year, continue to deliver strong cash flow, and provides a strong foundation for growth as we look to the future.”

Wall Street’s Take

Goldman Sachs analyst Eric Sheridan downgraded the stock to a Hold from a Buy and maintained a price target of $145 per share.

Sheridan writes, “We see EA as a fast growing company with long term margin potential and well positioned to take market share going forward. We see growth mostly driven by their core portfolio, mobile strategy, international expansion, M&A opportunities and organic projects, and long term EBITDA margin expansion to be realized in the out years.”

However, the analyst prefers to stay on the sidelines until he has a better understanding of the long-term growth and margin trajectory.

On TipRanks, Electronic Arts stock commands a Strong Buy consensus rating based on six Buys and one Hold. As for price targets, the average EA price target of $161.88 implies 35% upside potential from current levels.

Bottom Line

The stock has lost approximately 11% year-to-date due to high market volatility in technology stocks. It will be fascinating to observe if the impending Q4 numbers can boost the stock price and satisfy shareholders.

Learn more about the Website Traffic tool in this video by YouTube sensation Tom Nash.

Discover new investment ideas with data you can trust

Read full Disclaimer & Disclosure