Semiconductor giant Nvidia (NASDAQ:NVDA) is scheduled to announce its earnings for the fourth quarter of Fiscal 2023 (ended January 29, 2023) after the market closes on Wednesday, February 22. Analysts expect revenue and earnings to decline year-over-year, reflecting weak demand in the gaming and crypto end markets.

However, investors might focus on the outlook and the growth potential in the artificial intelligence (AI) space.

NVIDIA’s Q4 Earnings Expected to Decline

Nvidia’s Q3 FY23 revenue declined 17% year-over-year to $5.93 billion, while adjusted earnings per share (EPS) plunged 50% to $0.58. The company exceeded analysts’ revenue estimates but lagged earnings expectations. Macro pressures and China’s lockdowns caused a huge slump in the revenue from the PC gaming market, offsetting the 31% rise in the Data Center segment revenue.

Nvidia guided for Q4 FY23 revenue to be “$6 billion, plus or minus 2%.” The company projected “modest” sequential growth in Q4 revenue to be driven by automotive, data center, and gaming.

Meanwhile, analysts expect Nvidia’s Q4 FY23 revenue to decline 21.3% year-over-year to $6.02 billion. They project adjusted EPS to fall nearly 39% to $0.81.

Is NVDA Stock a Buy?

Ahead of the Q4 results, Oppenheimer analyst Rick Schafer reiterated a Buy rating on Nvidia and raised the price target to $250 from $225. Schafer expects Nvidia’s Q4 results to be in-line or exceed the Street’s estimates. Furthermore, he expects fiscal first-quarter guidance to be roughly in line with Wall Street’s expectations.

“NVDA’s AI-led structural growth thesis intact. DC [data center], high-performance gaming, and auto present triple play for sustained growth,” said Schafer.

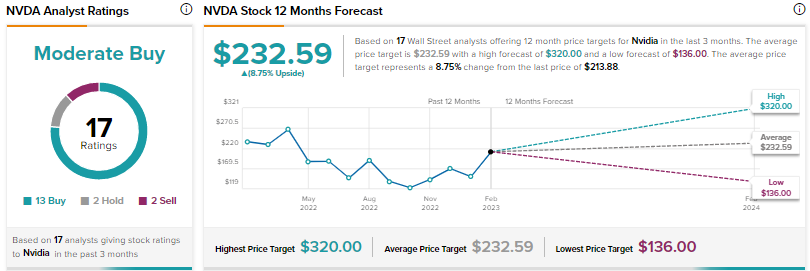

Wall Street is cautiously optimistic about Nvidia, with a Moderate Buy consensus rating based on 13 Buys, two Holds, and two Sells. The average NVDA stock price target of $232.59 implies nearly 9% upside potential. Shares have rallied over 46% since the start of this year.

Conclusion

Continued weakness in certain end markets, like gaming, is expected to adversely impact Nvidia’s performance on a year-over-year basis in Q4 FY23. Nonetheless, an upbeat guidance by the company and the demand in AI space could drive the stock higher.