Zillow (Z) is a digital real estate platform that provides user-friendly buying, renting, financing, and other features.

I am bearish on the stock.

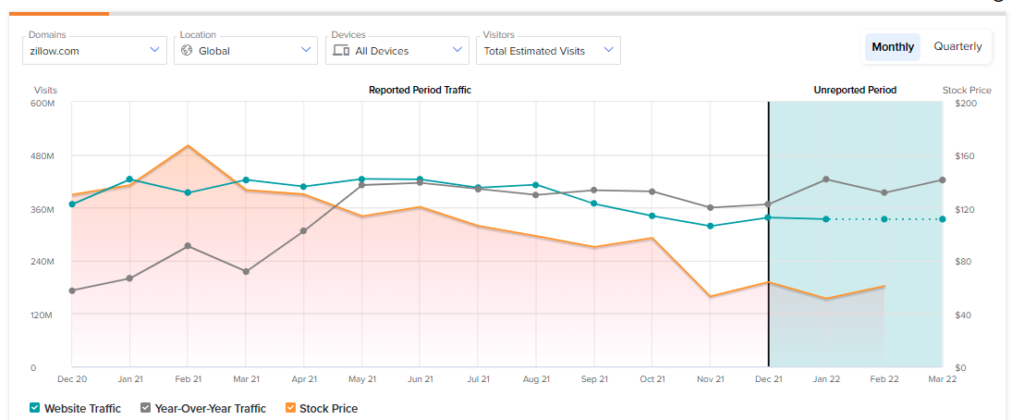

Website Traffic and Market Outlook

According to TipRanks’ website tracker, Zillow’s website clicks are holding steady after a rapid decrease in its third quarter. This coincided with the company’s earnings as Zillow beat its fourth-quarter earnings per share estimate by $0.10.

Market Outlook

January’s property sales data conveyed that homes remain in short supply, and sales jumped more than anticipated.

According to Lawrence Yun of the National Association of Realtors: “Buyers were likely anticipating further rate increases and locking-in at the low rates, and investors added to overall demand with all-cash offers.”

I expect home sales to stall moving forward with the U.S. personal saving rate having dipped below pre-pandemic levels at 7.9% and seven interest rate hikes anticipated, which would decrease loan demand.

Rate hikes will likely resolve the inflation problems as the five-year annual implied inflation growth rate has flatlined to 1.99%, but we need to consider the nature of the inflation slowdown.

The nature of current inflation is still due to a mixture of push and pull factors, but rising interest rates aggressively will diminish purchasing power in the short run before it stabilizes in the longer term. This will, in turn, influence Zillow’s deal flow and transactional volumes dearly, possibly causing a stock price downturn.

Technical Levels

Zillow was one of the big losers for the bulk of 2021 but has managed to claw back just over 13% of its losses during the past month. However, the stock’s RSI has shot up to near an overbought level at 59.9, suggesting that it was a temporary recovery in the firm’s stock price.

Wall Street’s Take

Turning to Wall Street, Zillow has a Moderate Buy consensus rating, based on two Buys and two Holds assigned in the past year.

The average Zillow price target of $78 implies 29.7% upside potential.

Concluding Thoughts

Zillow faces serious market headwinds amid a challenging property market and a possible consumer slowdown.

The stock has recouped some of its previous losses after a successful fourth-quarter earnings report but is already near an oversold level, suggesting that it may have been temporary.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure