Wells Fargo (NYSE: WFC) is an American financial services firm with a stronghold in the consumer banking sector. It serves approximately one in three American households and nearly 10% of U.S. mid-market corporations.

In addition, the bank also possesses a solid asset management division with more than $1.9 trillion assets under management. I am bullish on the stock.

Why Wells Fargo Could Outperform Again in 2022

The market loved banking stocks towards the tail end of 2021 as they crushed earnings amid a consumer banking recovery. Wells Fargo’s stock increased by 58% during the year, beating the S&P 500 twofold.

The tail of the tape in 2021 saw investors pile in on consumer banking stocks as the Federal Reserve indicated that it would raise interest rates in 2022; this narrative has persisted into early 2022, and the magnitude of bullish investor sentiment could well increase as we inch closer to the execution of contractionary monetary policy.

Wells Fargo possesses a substantial interest-based revenue segment, comprising approximately 44.87% of the firm’s total revenue mix. As interest rates rise, so do the spreads on loans that are/have been originated, which in turn amplifies a bank’s operating income.

The performance of banking stocks are heavily reliant on their operating performance, meaning that Wells Fargo investors are placing heavy emphasis on the expectation of short-term earnings improvements.

The big bank’s non-interest-based revenue also looks to remain solid in 2022. In its latest earnings report, Wells Fargo’s investment banking sales had increased 41% year-over-year, signaling strength in the equity market.

The bank’s investment banking division could sustain its strong run after the broader market experienced 64% growth in IPOs and 63% growth in M&As during 2021; there’s still plenty of slack in the underwriting and advisory market, which could see transactional volume ascertained during 2022, with Wells Fargo benefiting.

Valuation

Wells Fargo is a cyclical stock, which means that its price multiples will be mean reverting in most cases, and according to the stock’s current ratios, investors are looking at a good deal here.

The stock’s P/E ratio is undervalued by 37.88% relative to its five-year average, which is magnified by a PEG ratio (0.01) trading below the generally accepted benchmark of 1.00.

Furthermore, Wells Fargo stock is trading at a P/B ratio of 1.29, which is 2.33x below the generally accepted valuation benchmark. I find this interesting as banking stocks typically correlate closely with their book values, and although Wells Fargo’s stock is moving in tandem with its increasing book value, it’s yet to be fully priced in by the market.

Wall Street’s Take

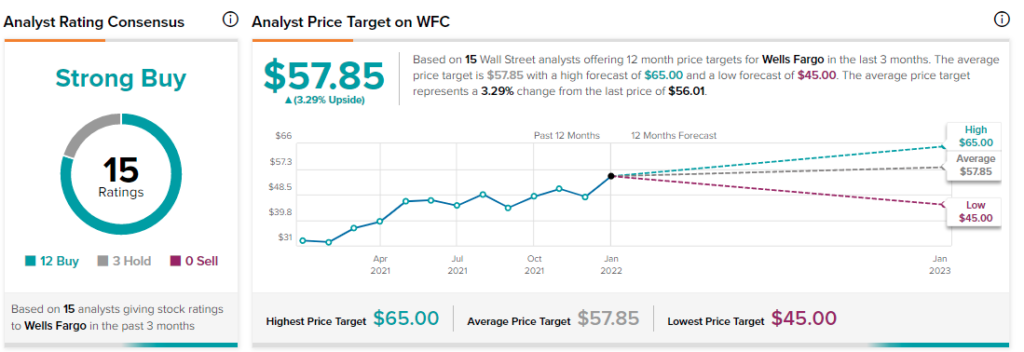

Turning to Wall Street, Wells Fargo has a Strong Buy consensus rating, based on 12 Buys and three Holds assigned. The average Wells Fargo price target of $57.85 implies 3.3% upside potential.

Concluding Thoughts

Wells Fargo could benefit from a healthy investment banking space and a recovering debt market in 2022, which could see the stock outperform the broader stock market once again.

Download the TipRanks mobile app now

Read full Disclaimer & Disclosure