In an environment where many retailers are under pressure to perform, Walmart (WMT) once again showed off its incredible ability to survive. Walmart’s earnings report proved a welcome boost to the company’s share price. TipRanks’ consensus looked for Walmart to post $1.62 per share in earnings. WMT handily beat that estimate by coming in at $1.77 in adjusted earnings. However, that figure was just a hair under last year’s earnings per share figure at this time, which came in at $1.78.

Revenue fared every bit as well. A Refinitiv consensus looked for $150.81 billion in revenue; Walmart posted $152.86 billion. Same-store sales in the U.S. added 6.5%, though that figure doesn’t include fuel. Given that estimates looked for a jump of 5.9%, Walmart did better than expected once again.

Interestingly, a recent TipRanks article that discussed WMT’s website traffic trends predicted the surge that was to come, as Walmart’s website traffic grew 26.4% year-over-year in Q2.

The fact that Walmart still succeeded against estimates despite being down against this time last year is, in a nutshell, why I’m bullish on Walmart. There are few retailers that are set up for surviving market downturns the way Walmart is, and that should make it an investment worth pursuing.

The last 12 months saw WMT shares on the rise for a while. The company was on track for a winning year until May 17. That started a drop that took about a fifth out of the company’s stock value. Since then, Walmart has struggled to recover. It’s made some gains, but it’s still down against what it was this time last year.

Is Walmart Stock a Buy or a Sell?

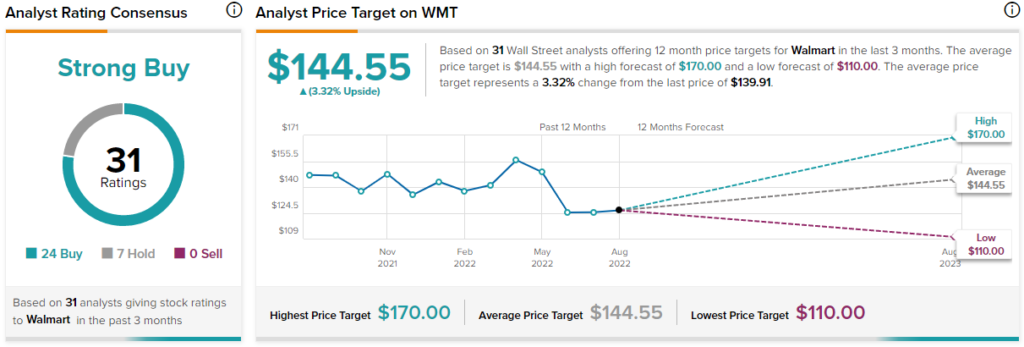

Turning to Wall Street, Walmart has a Strong Buy consensus rating. That’s based on 24 Buys and seven Holds assigned in the past three months. The average Walmart price target of $144.55 implies 3.3% upside potential.

Analyst price targets range from a low of $170 per share to a high of $110 per share.

Investor Sentiment Proving Surprisingly Tepid

Analysts are big on Walmart right now, but what about investors? Some metrics may not be as positive as you might expect. Walmart currently has a 7 out of 10 Smart Score on TipRanks. That’s the highest level of “neutral,” suggesting a slightly better than even chance that Walmart will ultimately outperform the broader market.

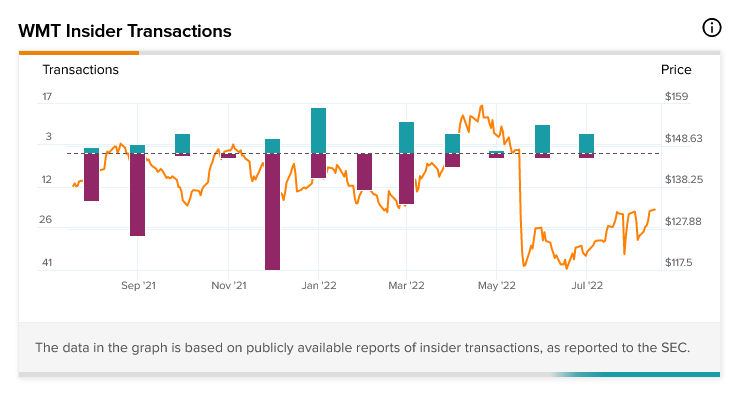

Additionally, Walmart insiders have a clearly mixed view as well. Insider trading at Walmart has been heavily Sell-weighted for the last 12 months but has been increasingly Buy-weighted in the last three. In the previous three months, Buy transactions outpaced Sell transactions by a ratio of 18 to six. Given that all of these were considered “uninformative” transactions, that only tells us so much.

Going back to the full year, meanwhile, shows a much more pessimistic picture. Walmart insiders staged 141 Sells against just 69 Buys.

Taking on a Recession and Mildly Winning

A recession is pretty much baked in at this point. Even just two days ago, BMO Capital Markets’ Kelly Bania downgraded Dollar General (DG) to a Hold. Bania noted that the current share price for Dollar General already reflects the impact of a recession on shoppers’ preferences. As disastrous of news as this is for other retailers, for Walmart, the news is nowhere near so dire.

It’s not that Walmart is looking especially bright. Rather, it’s looking a lot less dim than many of its contemporaries in the retail sector. Just under a month ago, Walmart offered some concerning news about overall profit levels.

A combination of factors was likely to hurt the company, including declining margins as customers put more money into necessities and less into things like apparel and electronics.

Plus, supply-chain issues were hitting the company hard. In some stores, there are signs of a supply glut starting to hit as the various snags in the supply chain start to unravel slowly.

You may remember when there were all those supply ships parked off the California coast? The massive logjam was only starting to break in February 2022. Those goods then started to hit stores right about the same time that recessionary fears started up.

Now, retailers all up and down the spectrum—Walmart included—are facing a pile of new supplies coming in at a time when shoppers want to buy less out of concern for their wallets.

Walmart has already reduced its purchase orders. That’s a good move to help ensure a minimized glut, but a glut remains a glut, and Walmart will have to address that, going forward.

I was personally in a Walmart over the weekend. Row after row of grills greeted me, and this with only a few weeks left in the summer grilling season. Perhaps most unusual was the garden center, with three pallets of clearance-priced toys sitting therein.

Walmart’s future profits are likely to be impacted by that supply glut. Discounts and markdowns will be needed to get those clearance items, from grills to toys, out of the stores.

Worse for Walmart, those discounts are likely going to have to be substantial. A recessionary environment ensures that customers won’t want to pay much for anything that isn’t a necessity.

Despite this, Walmart’s future still looks fairly bright. Walmart has been historically recognized as a “recession-proof stock.” Though that’s not true in the strictest sense, Walmart does tend to do better during a poor economy than in a booming economy.

Why? A practice called a “trade down.” Shoppers will tend to pursue lower-cost alternatives in a bad economy. This better ensures that customers continue to have money they can spend on necessities.

With customers eager to survive a recession, and behaving accordingly, that offers better conditions for Walmart to succeed. Customers flush with cash will buy what they perceive as better quality items. Parents with plenty of money won’t buy their kids clearance-priced Adventure Force toys but rather something with a media tie-in.

When things turn south, though, customers focus harder on necessities and making their dollars go farther. That is most of Walmart’s stock in trade.

Conclusion: Walmart’s Time to Shine is Dawning

Walmart has often done better during a recession than its contemporaries. Its pursuit of low prices and maximum customer value doesn’t always do it a service when times are good. However, when times turn south—and they always do at some point—that’s when Walmart’s practices step up to win.

Yes, Walmart will have hard times ahead like any other. The lower-income shopper may be even lower income in the next few months. Still, with middle-income shoppers becoming lower-income, there will likely be replacements waiting in the wings.

That’s good news for Walmart; just who is in their customer pool doesn’t matter so much as how many customers are in said pool.

That’s why I’m bullish on Walmart. Throw in the fact that Walmart is currently trading just under its average targets, and a reasonable buy-in point emerges. Current macroeconomic conditions pose a great potential win for Walmart. All it needs to do now is capitalize on that for a win.