Teladoc (TDOC) has made great strides on the growing interest in taking medicine online. The rise of COVID-19 made remote doctoring a much more viable — and valuable — prospect than it was. Now Teladoc has emerged as one of the biggest names in telemedicine.

I am bullish, thanks to the combination of a growing market and Teladoc’s increasingly substantial name recognition factor therein.

For the last 12 months, Teladoc has been in a near-steady state of decline. Back in April 2021, the company was challenging the $200 per share mark. Almost a year later, and the company has languished under $100 per share for the last three months.

The latest news gave investors fresh hope for a return to prominence. Guggenheim initiated coverage on Teladoc, calling it a Buy. Guggenheim pointed out that more and more parts of health care are moving to digital interactions.

Better yet, Guggenheim noted, Teladoc is already a leader herein. Thus, it’s built a broader portfolio of available services than much of its competition.

Wall Street’s Take

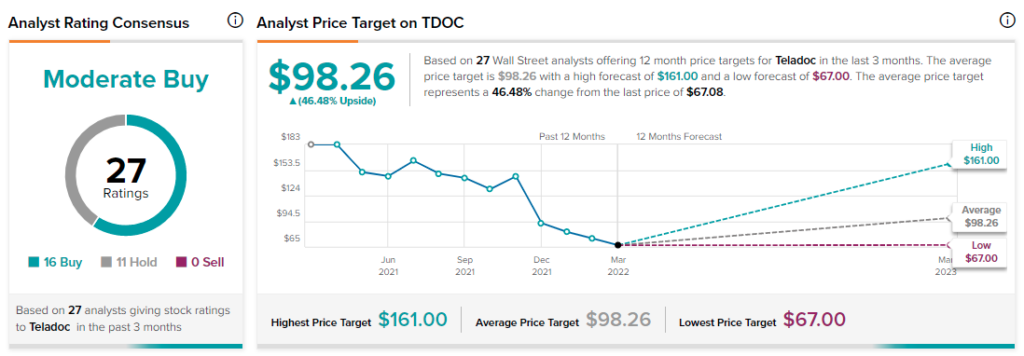

Turning to Wall Street, Teladoc has a Moderate Buy consensus rating. That’s based on 16 Buys and 11 Holds assigned in the past three months. The average Teladoc price target of $98.26 implies 46.5% upside potential.

Analyst price targets range from a low of $67 per share to a high of $161 per share.

Hedge Funds Growing, Insiders Retracting

A compelling picture emerges when considering various sorts of investor traffic, however. The TipRanks 13-F Tracker reveals that hedge funds have not only increased their connection to Teladoc in the last quarter, but they’ve also been increasing that involvement since July 2020.

While there was a decline in interest from April 2020 to July 2020, every quarter after that saw an increase in hedge fund stakes all the way up to January 2022.

However, company insiders proved just a bit less confident. Insiders sold shares worth around $204,200 over the last three months. Given that represents about 3,000 shares at current pricing, though, that sounds more like a slight portfolio rebalancing than anything else.

Meanwhile, Teladoc’s dividend history is nonexistent. The company has yet to issue a dividend, and seems to have no plans to do so.

A COVID-19 Winner with Legs

The COVID-19 pandemic’s early days made Teladoc an utter must-have for physicians of every stripe. With good reason, too; no one wanted to be in the same room as anyone else for any longer than was strictly necessary back then.

Thus, being able to interact with a doctor remotely made sense for everyone involved. That meant more appeal for Teladoc’s product line.

There were, of course, use cases that didn’t involve COVID-19. Most of these focused on bringing specialist doctors to areas where the population density wouldn’t support such specialties.

Psychology and psychiatry found the concept an absolute winner. Practices could be set up anywhere, and operated accordingly. It was no longer vital to establish a practice somewhere that had enough people to serve as patients.

Indeed, Teladoc has recently made some expansion efforts that could help. A partnership with Amazon (AMZN) gives Teladoc access to Echo smart speakers.

The impact here isn’t large, but for those few users who fit in the middle of the Venn diagram of Amazon speaker owners and Teladoc users, it does improve ease of use. Improved ease of use means satisfied customers, after all.

Current Teladoc users also seem happy with Teladoc; reports note that the company retains most of its users from one year to the next. Reports that suggest Amazon may be a competitor with Amazon Care may be a bit overblown. After all, Teladoc will have inertia on its side.

Throw in the constant paperwork nightmare represented by the Health Insurance Portability and Accountability Act (HIPAA), and it helps ensure that Teladoc users won’t make changes lightly.

Concluding Views

Teladoc has plenty going for it. It’s the leader in a comparatively new market. It’s able to fend off potential incursion from large-scale enterprises by market conditions and sheer inertia.

Best of all, it’s trading right around its lowest price targets. That leaves plenty of potential upside and a demonstrated record of sustainability therein.

The insider selling is a little distressing, but this insider selling is of the mildest sort. Throw in increasing interest from the analyst sector, and this suggests a positive outcome to come.

Will Teladoc ever get back to its $200 levels? Maybe. Or maybe not. Teladoc was certainly a pandemic winner. Just because the pandemic is declining on some fronts — and so too is the risk of more forced lockdowns — doesn’t mean Teladoc loses its utility.

Teladoc is a leader in telemedicine. Telemedicine itself is no longer a gee-whiz pipe dream. That combination makes me bullish on the company going forward.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure