Cloud computing giant ServiceNow (NASDAQ: NOW) started the week with a solid performance. It was up 2.5% in pre-market trading today and managed to keep most of those gains so far. The biggest reason for ServiceNow’s gains came from an upgrade at Guggenheim.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Guggenheim analyst John Difucci upgraded ServiceNow from “Neutral” to Buy, thanks to two key factors. One, a set of profit margins that Difucci called “admirable,” and two, a solid customer base that didn’t seem like it would retract much in the face of worsening economic conditions.

There is a solid case for bullishness on ServiceNow – solid enough to get me to agree with it and declare a bullish stance myself. However, there will be some downsides here, so keep an eye out for those as well.

The last 12 months for ServiceNow shares have been on a steady decline. This time last year, shares were up around $688. That proved to be about as good as it would get for ServiceNow, with a 52-week high of $707.60. A decline started in mid-November. Now, the stock is trading at around $368.

Is ServiceNow Stock a Buy?

Turning to Wall Street, ServiceNow has a Strong Buy consensus rating. That’s based on 25 Buys and three Holds assigned in the past three months. The average ServiceNow price target of $531.37 implies 44.2% upside potential. Analyst price targets range from a low of $460 per share to a high of $650 per share.

Investor Sentiment is Not the Greatest

One of the biggest issues facing ServiceNow today is a string of red flags coming out of its investor sentiment metrics. Currently, ServiceNow has a Smart Score of 5 out of 10 on TipRanks.

That’s slightly below the scale’s midpoint, which puts it just a bit under purely neutral. This suggests that the stock is only slightly more likely to lag the broader market than it is to do better.

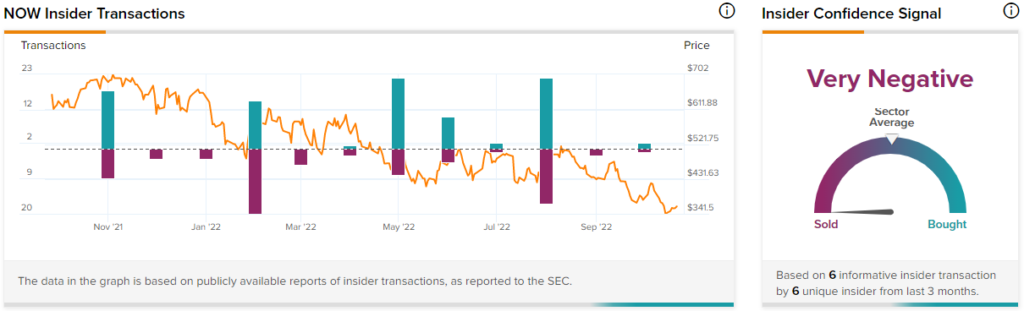

While ServiceNow is enjoying analyst acclaim, its stance with its own insiders is a different matter. Insider trading at ServiceNow is turning somewhat negative. The last “informative” transaction at the company was a Sell two months ago.

CFO Gina Mastantuono sold just over $1.87 million of shares. That’s just one of the Informative Sells that took place in the last three months, leading to a combined total of around $4.8 million.

The aggregate, meanwhile, will lend a little support to the bulls. In the last three months, insiders did sell $4.8 million in shares, but insiders sold stock 20 times while insiders bought shares 24 times. That’s a narrow edge for buying interest.

Meanwhile, over the last 12 months, insiders sold stock on 75 occasions but bought on 92.

Potential Greatness Ahead

The good news for ServiceNow investors is that there’s quite a bit going on that may make ServiceNow a great potential Buy right now. Sure, it’s got plenty of analyst support, but there’s more than that to look to.

First, there’s a great buy-in point right now. The company has lost nearly half its value in the space of the last 12 months. It’s not only below its lowest price target, but it’s also flirting with 52-week lows.

Further, ServiceNow’s current picture, as Difucci expressed, is positive enough. Solid profit margins and a customer base that seems willing to hang in there are good signs, and ServiceNow isn’t resting on its collective laurels, either. It’s improving its value proposition and making itself that much more valuable to its customers.

For instance, ServiceNow recently teamed up with Lucid Software to create a new level of integration. The Lucid Software connection brings

Lucid’s intelligent diagramming tools to the ServiceNow Store. With this, users can take ServiceNow Application Portfolio Management (APM) data and convert it to Lucidchart diagrams.

That, in turn, will make analyzing a current portfolio of applications that much easier. Businesses will be able to find issues in their setups that much faster and work toward making their operations the best they can be.

Just a few weeks ago, ServiceNow also acquired Era Software. That acquisition will give ServiceNow the means to offer a “unified observability solution at scale.”

Such a tool would improve companies’ progress toward digital transformation, a process that’s been a work in progress at many firms for the last decade or so, and those are just two of the several acquisitions that ServiceNow has recently staged.

Some here might be concerned about the overall economic environment and its impact on ServiceNow – not without reason, either. A sufficiently large downturn would hit ServiceNow hard. Many of its client firms would either cancel purchases to conserve cash or shut down altogether.

That would leave ServiceNow in a bad position, scrambling to find new buyers in a market where everyone’s hand is on his or her wallet. However, there are signs that a bad environment might be good news for ServiceNow. All it needs to do is to focus on automation.

Since many of ServiceNow’s tools can be run automatically, that’s a function carried out that requires no employee—and no paycheck—to launch.

ServiceNow can establish itself as a savings generator. All it needs to do is make its marketing collateral reflect that. Better yet, it can generate those savings by bringing in more ServiceNow operations. Companies that buy can carry out a function with a one-time cost instead of an ongoing one.

ServiceNow even has a recent case it can point to. The company has been working with Astellas Pharma (OTC: ALPMF) to improve its automation, freeing up employees to “focus on higher value tasks.”

Conclusion: Bullish, but Watchfully So

There are some potential issues ahead for the company. Its insider trading picture is distressing, though not without bright spots of its own in the aggregate. Analyst support couldn’t be much better. An overall economic downturn, if it’s severe enough, could hit ServiceNow hard. However, ServiceNow may be able to beat that with the proper marketing push.

A company that does well in good times is a solid enough company. A company that can use bad times in its favor is a whole different matter. That’s why I’m bullish on ServiceNow. It’s a company that can make a case for itself even in the worst of times.