The two-year-long, pandemic-driven boom period for the PC industry seems to be fading away. According to a Gartner report, this space has witnessed the steepest decline in nine years, which is triggered by geopolitical, economic, and supply-chain headwinds.

As per Gartner, global PC shipments declined 12.6% year-over-year to 72 million units in the second quarter of this year.

The PC market in the United States did see some growth in desktop and laptop shipments, but it was largely offset by a 50% year-over-year fall in Chromebook shipments. Overall, the U.S. PC market witnessed a 17.5% fall in the second quarter of 2022.

High inflation levels and the Russia-Ukraine conflict impacted the EMEA PC market the most. In this region, PC shipments fell 18% year-over-year to 17.8 million units in the second quarter of 2022.

Further, China’s zero COVID-19 policy weighed on the Asia-Pacific (APAC) PC market (excluding Japan), which declined 5.2% in the June quarter.

As of now, the outlook for the PC industry looks staggering as high inflation levels can continue to mar the demand for desktops and laptops. Going by Gartner’s forecasts, global PC shipments may witness a 9.5% decline in 2022.

According to Ranjit Atwal, a Research Director at Gartner, “A perfect storm of geopolitics upheaval, high inflation, currency fluctuations and supply chain disruptions have lowered business and consumer demand for devices across the world and is set to impact the PC market the hardest in 2022.”

Against this backdrop, let’s talk about two major players of this industry and see how they are placed.

Dell Technologies (NYSE: DELL)

Headquartered in Round Rock, TX, Dell Technologies provides hardware and software services solutions. Infrastructure Solutions Group (ISG) and Client Solutions Group (CSG) are the two operating segments of the company.

ISG enables customers’ digital transformation through multi-cloud and big data solutions, which are built upon modern data center infrastructure. CSG includes branded hardware (such as desktops, workstations, and notebooks), branded peripherals (such as displays and projectors), and third-party software and peripherals.

Although Dell’s PC shipments declined 2.8% year-over-year in the second quarter of 2022, the company grabbed the top spot in the U.S. PC market based on shipments and accounted for 27.2% of the country’s PC market share, according to a Gartner report.

Encouragingly, the company’s PC revenues grew 22% year-over-year to $12 billion in the first quarter of Fiscal 2023.

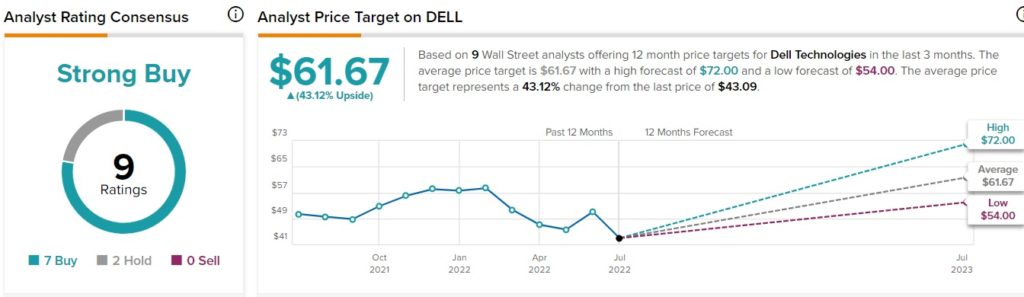

As per TipRanks, the Street is highly confident about this multinational information technology company, which enjoys a Strong Buy consensus rating based on seven Buys and two Holds. Dell’s average price target of $61.67 signals that the stock may surge nearly 43.1% from current levels. Shares of the company have declined 24.9% so far this year.

TipRanks data shows that financial bloggers are 90% Bullish on Dell, compared to the sector average of 65%.

HP Inc. (NYSE: HPQ)

HP is a leading global provider of personal computing and other access devices, imaging and printing products, and related technologies. Headquartered in Palo Alto, CA, the company has three reportable segments — Personal Systems, Printing, and Corporate Investments.

The Gartner report highlighted that HP held a 22.3% market share of the U.S. PC market despite a 43.5% fall in PC shipments in the previous quarter.

In its second-quarter Fiscal 2022 earnings results, the company reported Personal Systems net revenue of $11.5 billion, up 9% year-over-year and 11% in constant currency.

According to TipRanks, the Street has a Moderate Sell consensus rating on HPQ based on four Holds and three Sells. HP’s average price forecast of $35.14 signals that the stock may surge nearly 10.4% from current levels. Shares of the company have declined 16.3% year-to-date.

However, TipRanks data shows that financial bloggers are 93% Bullish on HPQ, compared to the sector average of 65%.

Tough Times Ahead for the PC Industry

The PC industry may continue to see decelerating demand in the second half of 2022, due to macroeconomic blows. Also, consumer demand could further get impacted due to recession fears and restrictive spending.

Read full Disclosure