George Weston (TSE: WN) is a holding company operating via two subsidiaries comprising retail and real estate.

The first is Loblaw (TSE: L), the largest grocer in Canada, in which it has a 52.6% controlling stake. The second is Choice Properties (TSE: CHP.UN), a REIT; George Weston’s ownership stake in Choice Properties is about 61.7%.

While both are separate entities, they operate under a contractual, as well as tacit, framework of strategic business partnerships. This is exemplified by Loblaw being Choice’s largest tenant.

We are neutral on the stock.

Why George Weston is Interesting

When investors first take a glance at George Weston, they might be taken back by the large amount of debt on its balance sheet. Total debt including lease liabilities is a staggering $20.3 billion, almost equal to its $23 billion market cap.

However, it’s important to remember that the company has controlling stakes in Loblaw and Choice Properties, meaning it has to include all the assets of both companies on its balance sheet. The actual breakdown of debt is as follows:

- Loblaw: $12.8 billion (includes $4.9 billion in lease liabilities)

- Choice Properties: $6.9 billion

- George Weston: $600 million

This distinction is important because although George Weston technically controls these two companies and their debt, there is no recourse to the debt. This means that if either Loblaw or Choice Properties gets into debt trouble, George Weston won’t be on the hook to pay it back.

Moreover, the way George Weston makes money is through the dividends and buybacks that both companies payout. In Fiscal Year 2021, the company generated $978 million in free cash flow — 63% higher than its total debt of $600 million. The free cash flow breakdown is as follows:

- Dividends received: $579 million

- Participation in Loblaw’s normal course issuer bid: $563 million

- GWL Corporate, financing, and other costs: -$101 million

- Income taxes paid: -$63 million

As a result, investors have exposure to the cash flows of two stable and essential businesses without exposure to their massive debt loads. This creates an interesting and favorable risk profile for shareholders.

Dividend

George Weston currently has a 1.48% dividend yield, which is below the sector average of 1.51%. When taking a look at its payout ratio of 29.1%, its dividend payment looks safe.

Although not an exciting yield, the company has an objective to gradually increase the dividend each year. Indeed, the dividend has grown at a compound annual growth rate of 4.7% since 2012. Furthermore, the dividend has an 11-year growth streak.

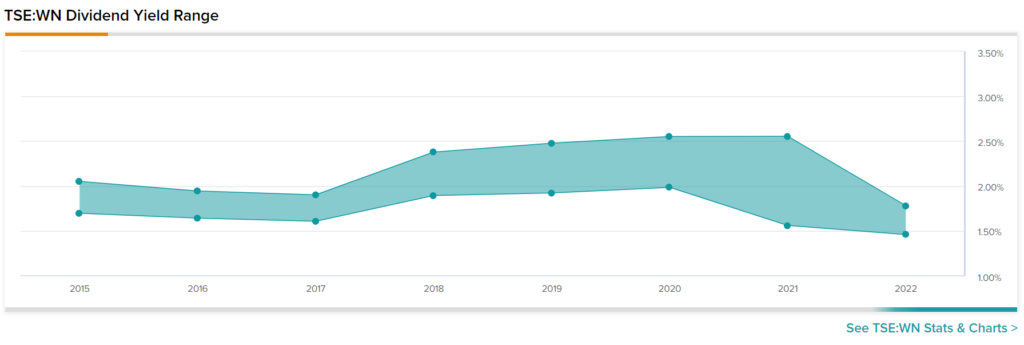

Taking a look at its historical dividend payments, we can see that its yield range has trended downward over the past several years.

At 1.48%, the company’s dividend is near the lower end of its range, implying that the stock price is trading at a premium relative to the yields investors have seen in the past.

Growth Catalysts

The main growth catalyst for George Weston is inflation. Given that both Loblaw and Choice Properties are essential businesses, they can pass on costs to their customers/tenants without much trouble.

In addition, Loblaw also owns discount retailer No Frills. This benefits the company because price-sensitive consumers will naturally head over there as prices continue to rise.

When it comes to Choice Properties, Loblaw is its largest tenant which we already highlighted as being able to pass on costs to consumers. More importantly, though, 71% of Choice Properties’ portfolio is made up of grocery and pharmacy companies. Like Loblaw, these companies will be able to also pass on costs to consumers.

As a result, Choice Properties should be able to increase rents without many problems. Ultimately, both companies should provide George Weston with steadily increasing dividend payments going forward.

Valuation

To value George Weston, we will use a single-stage DCF model because it’s a mature company. For the terminal growth rate, we will use the 30-year Canada Government Bond yield as a proxy for expected long-term GDP growth.

Our calculation is as follows:

Fair Value = Average FCF per share / (Discount Rate – Terminal Growth)

C$151.02 = $6.63 / (0.07 – 0.0261)

As a result, we estimate that the fair value of George Weston is approximately C$151.02 under current market conditions. Currently, it is trading near C$157, implying that it is likely fully priced in by the market.

Wall Street’s Take

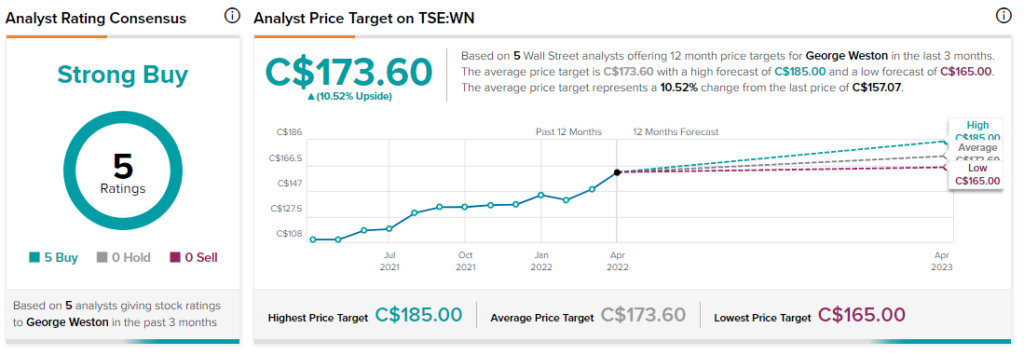

Turning to Wall Street, George Weston has a Strong Buy consensus rating, based on five Buys assigned in the past three months. The average George Weston price target of C$173.60 implies 10.5% upside potential.

Final Thoughts

George Weston is the holding company of two iconic Canadian businesses that have proven to be reliable and profitable in all types of business conditions.

On top of the steady stream of dividend payments the company receives from Loblaw and Choice Properties, it does not have exposure to the large debt load they carry because there is no recourse on the debt.

As a result, the company is an even safer way to play the Canadian consumer staples industry than the two companies it controls.

Nevertheless, our estimates indicate that the company is trading at a slight premium to its fair value, suggesting that there isn’t much room for more upside.

As a result, we are neutral on the stock.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure