Big tech stocks are continuing their solid form, and that includes Facebook (FB) and Alphabet Class A (GOOGL).

I am bullish on both stocks.

Driving Forces

Most know by now that tech stocks have outperformed the broader market since the start of the pandemic lockdowns, but few know why.

Tech stocks outperformed for three fundamental reasons: increasing factor productivity, the prevalence of the Yardeni model, and continued growth versus value outperformance.

Total factor productivity refers to the technology element in the economic growth equation, including capital and labor productivity. Thought of as the most important driving force for developed market growth, total factor productivity has skyrocketed over the past 18 months, eclipsing its previous high of 4.33 in 1985 by 64% in this year’s second quarter.

The Yardeni model is an advancement of the Fed model, and is used to determine the stock market trajectory. The Fed model looks for improvements in the S&P500’s earnings yield, and a U.S. 10-year bond yield decrease to label a bull market. Yardeni argues that earnings growth should be looked at in addition, which brings growth stocks into the picture.

Large-cap growth stocks have beaten large-cap value stocks by approximately 14% since the turn of the century. Growth stocks thrive off of expected earnings, and there are two outstanding big tech growth stocks out there that are set to deliver.

Facebook’s organic growth has been supported by smart hypergrowth acquisitions such as Instagram, WhatsApp, Messenger, and Oculus. The company’s acquisition strategy is what’s helping it add tremendous value, as it exploits horizontal integration to obtain a constantly increasing presence in the tech space.

Facebook has also done well in mimicking other high-growth tech concepts such as Snap’s (SNAP) Snapchat. Facebook has chosen to mimic smaller tech companies’ hot concepts to expand into new markets, and when it hasn’t managed to mimic, it’s simply acquired them for premiums.

Facebook is proliferating, with a PEG ratio of 0.41, justifying its stock price. The company’s EBITDA and free cash flow margins are beating sector medians by 136.9% and 92.4%, respectively.

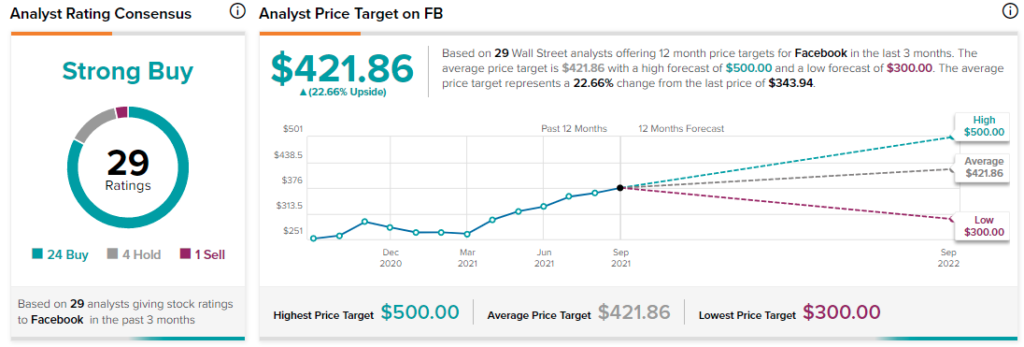

Wall Street remains optimistic about the stock, and thinks it’s a Strong Buy. There have been 24 buy ratings, four hold ratings, and one sell rating assigned to the stock in the past three months. The average FB price target of $421.86 implies 22.7% upside potential.

Alphabet Class A

Alphabet is a revolutionary big tech company that started out as a search engine, via its illustrious Google brand. The company has evolved into a tech giant, with a presence in cloud computing, ad tech, video and streaming, and other innovative solutions.

Alphabet class A allows investors to hold voting rights, unlike Alphabet class C (GOOG), and it has fewer shares outstanding than C, meaning a higher fair stock value is possible.

Alphabet’s robust Cloud division, and its continued development in AI are key driving forces for the company.

Analysts anticipate Alphabet’s EPS to grow by an additional 71.9% by December 2021, as mobile usage of Google’s search function continues to grow exponentially.

The long-term outlook for Google remains positive, as the company has focused on innovative spaces, such as machine learning offerings, and autonomous driving.

Google trades at sound multiples. A PEG ratio of 0.29, indicates that the company’s growth rate exceeds that of the stock. Alphabet’s EBITDA growth outpaced its sector’s over the past year by 1,096.2%, while its cash from operations exceeds the sector’s mean by a staggering 20,322.5%.

Wall Street thinks the stock is a Strong Buy, with 28 Buy ratings, and one Hold rating being placed. The average GOOGL price target of $3198.86 suggests 14.8% upside potential.

Final Word

Facebook and Alphabet are two standout stocks due to their link to the current driving factors behind the tech economy.

Amazon (AMZN) is turning into a conglomerate rather than a pure tech company, Apple (APPL) and Microsoft (MSFT) compete in both the hardware and software space amid a chip shortage, and Netflix (NFLX) is experiencing intense competition as a single product business.

It is these reasons that make Facebook and Google shine above the rest.

Disclosure: At the time of publication, Steve Gray Booyens did have a long position in GOOGL, and AMZN.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates, and should be considered for informational purposes only. TipRanks makes no warranties about the completeness, accuracy or reliability of such information. Nothing in this article should be taken as a recommendation or solicitation to purchase or sell securities. Nothing in the article constitutes legal, professional, investment and/or financial advice and/or takes into account the specific needs and/or requirements of an individual, nor does any information in the article constitute a comprehensive or complete statement of the matters or subject discussed therein. TipRanks and its affiliates disclaim all liability or responsibility with respect to the content of the article, and any action taken upon the information in the article is at your own and sole risk. The link to this article does not constitute an endorsement or recommendation by TipRanks or its affiliates. Past performance is not indicative of future results, prices or performance.