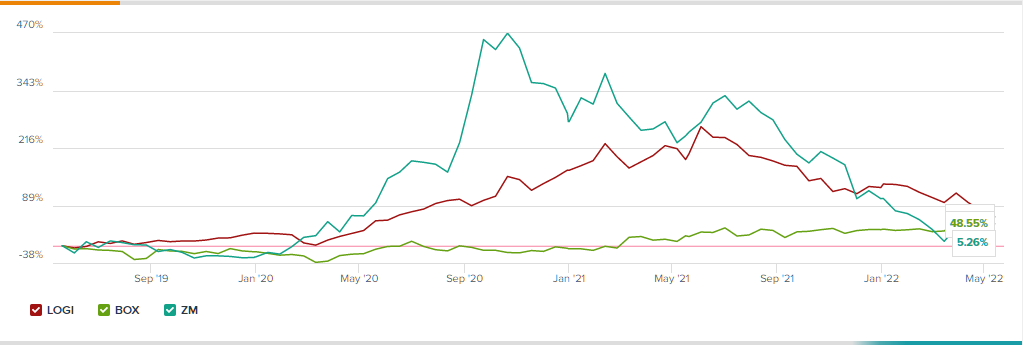

The broader basket of work-from-home (WFH) stocks have been hammered over the past year. Some of the biggest pandemic winners from the WFH group have shed over 80% of their value from peak to trough.

Though the economy has returned to near normal, the WFH trend is unlikely to back down anytime soon. As a result, some of the oversold WFH stocks may be worth a second look, as the worst is likely in the rearview mirror.

We used TipRanks’ Stock Comparison tool to evaluate three WFH stocks that may be most enticing for bottom-fishers who still believe in the trend.

Logitech (LOGI)

Logitech is a peripheral designer and manufacturer that experienced a significant demand surge during the worst of the pandemic-induced lockdowns.

Made famous for its computer mice, keyboards, and other accessories, the company has been in free-fall mode since June 2021. Since then, the stock has lost around 57% of its value.

Indeed, the pandemic pull-forward in demand has hit LOGI stock as hard as any WFH play. Many workforces have likely over-ordered peripherals, causing a post-pandemic demand drought.

In due time, demand for Logitech hardware and software will normalize, and when it does, shares could easily make up for lost time. Though the $132 per share peak is far out of reach, the stock still has meaningful upside from these levels, at least according to Wall Street analysts covering the name.

At writing, the stock has become quite cheap at just 15.5 times trailing earnings. Undoubtedly, the broader peripheral space may have gotten a tad oversold.

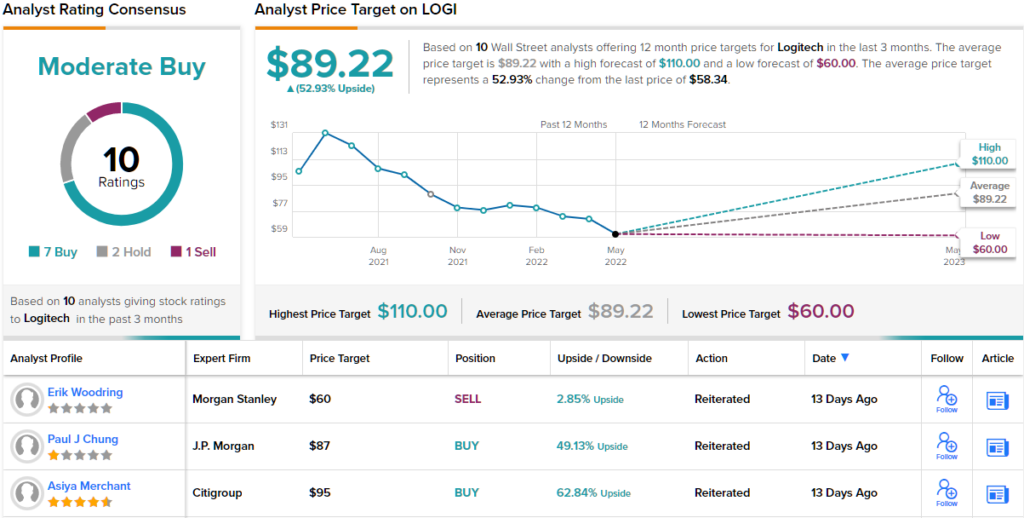

Turning to Wall Street, analysts are incredibly bullish, with the average Logitech price target of $89.22, implying ~53% upside potential. (See LOGI stock forecast on TipRanks)

Zoom Video Communications (ZM)

Zoom Video Communications was made an example of amid the recent sell-off. Shares of ZM have now lost around 85% of their value. The stock is now cheaper than it was during the start of the pandemic, which doesn’t make a lot of sense.

The company reported solid numbers for the fourth quarter, thanks in part to a push towards enterprise clients.

Earlier this year, Zoom launched its omnichannel contact center system aimed at enterprise customers. The intriguing new offering could help reignite excitement in the fallen pandemic one-hit-wonder.

With the recent acquisition of an AI-based support platform named Solvvy for an unknown sum, Zoom just added another intriguing offering to its already impressive suite. Undoubtedly, Zoom’s going after the enterprise, and I think it’ll be successful, as CEO Eric Yuan looks to position the company for growth in the “new normal” environment.

Though many locked-down employees have grown tired of “Zooming,” I don’t think the leading video-conferencing platform provider is going anywhere anytime soon.

Even if the pandemic were to end tomorrow (that’s incredibly unlikely), Zoom looks like a staple as the workplace continues its digital transformation.

At around 7.8 times sales, Zoom looks enticing for a company that can sustain solid double-digit growth.

Wall Street analysts are bullish, with the average Zoom Video price target of $153.59, implying ~73% upside from current levels. (See ZM stock forecast on TipRanks)

Box (BOX)

Box is a cloud content management platform that’s fared best of the WFH stocks on this list. In fact, Box stock was sitting at an all-time high just over a month ago before shares slipped into a 14% correction.

Box CEO Aaron Levie and company have done a fantastic job upselling customers and taking steps toward improving margins. The company has come a long way since its days as just another cloud storage solutions provider.

The workflow collaboration tool market continues to be red hot, and, like Zoom Video, Box has set its sights on the lucrative enterprise market. Looking ahead, Box is looking for revenue to fall in the $233 million to $235 million range for Q1 2023.

With shares trading at just 6.3times sales, the $4-billion company stands out as an intriguing value in the WFH space.

Wall Street analysts are bullish, with the average Box price target of $32.50, implying 15% upside from today’s levels. (See BOX stock forecast on TipRanks)

Conclusion

Just because we’re in the late stages of the pandemic does not mean employees are returning to the office. WFH is here to stay, and the three WFH stocks in this piece look intriguing after their recent plunges.

Currently, Wall Street analysts are most bullish on Zoom Video Communications stock.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure