Recently reported results have proved that rising interest rates are a double-edged sword for banks. Major U.S. banks saw a strong rise in their second-quarter net interest income (NII), fueled by higher interest rates. However, the Federal Reserve’s hawkish stance and a potential economic downturn hurt banks’ other revenue streams. Bearing that in mind, we used the TipRanks Stock Comparison Tool to place JPMorgan Chase, Wells Fargo, and Citigroup against each other to pick the more attractive bank stock.

While NII was up in Q2, several U.S. banks posted a significant dip in their investment banking revenue, as companies seem less confident about mergers and acquisitions, and are instead raising cash through equity and debt offerings.

Also, banks recorded provisions to cover potential loan losses amid growing concerns that continued rate hikes to tame inflation might push the economy into a recession. Let’s review the results of the aforementioned banks and the perspective of Wall Street analysts.

JPMorgan Chase (NYSE: JPM)

JPMorgan, the largest U.S. bank by assets, lagged analysts’ expectations despite a 19% rise in its Q2 NII. The company’s net income fell 28% due to lower investment banking revenue and a $428 million boost in credit reserve to cover potential bad loans. To add to investors’ woes, JPMorgan is temporarily suspending share buybacks in an effort to build capital for meeting regulatory capital requirements.

Despite the dismal results, Berenberg analyst Peter Richardson upgraded JPMorgan stock to a Hold from Sell and kept the price target unchanged at $120. Richardson believes that headwinds like reduced investment banking activity, paused buybacks, and increasing expenses, are temporary. The analyst pointed out that JPM shares are trading at about a 20% discount to their long-run average and that downside risks to the stock are now more limited.

While Richardson expects JPM’s investment banking revenue to decline 18% in the second half of the year, he acknowledges that cyclicality is part of any investment bank’s operations. Richardson highlighted that JPM’s consumer lending credit quality remains strong, with “consumers and businesses have capacity to sustain further loan growth.”

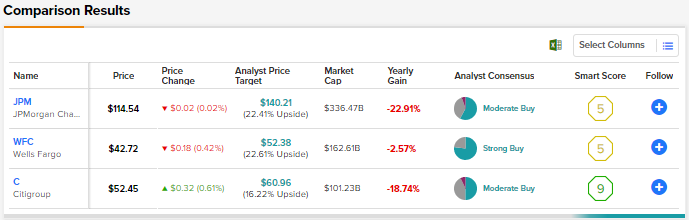

All in all, the Street is cautiously optimistic on JPM stock, with a Moderate Buy consensus rating based on 11 Buys, seven Holds, and one Sell recommendation. At $140.21, the average JPMorgan Chase price target implies 22.41% upside potential from current levels.

Wells Fargo (NYSE: WFC)

Wells Fargo’s Q2 net income plunged 48%. A 16% rise in NII was more than offset by the impact of rising interest rates and weaker financial markets on the bank’s venture capital, mortgage banking, investment banking, and brokerage advisory results. Further, the bottom line included a $580 million provision for credit losses.

On the brighter side, Wells Fargo did not announce any temporary halt in its buyback activity. However, it stated that it would continue to be “prudent” and consider market conditions before making any buybacks in the upcoming quarters. The bank didn’t buy back any shares in the second quarter.

Following the Q2 print, Evercore ISI analyst John Pancari lowered his 2022 and 2023 earnings per share (EPS) estimates for Wells Fargo, mainly to reflect the possibility of higher loan loss provisions in the upcoming quarters. The analyst also cut his estimates to reflect a lower non-interest income run rate.

However, it’s worth noting that Pancari’s EPS estimates reflect a more constructive NII outlook, fueled by better-than-expected loan trends, a higher net interest margin run rate, and a positive forecast.

Overall, despite his revised estimates, Pancari sees upside potential in WFC shares at current valuation levels due to the likelihood of further cost efficiencies, better spread revenue trajectory, and regulatory progress. Pancari maintained a Buy rating on WFC stock with a price target of $48.

On TipRanks, WFC scores a Strong Buy consensus rating based on 10 Buys and three Holds. The average Wells Fargo price target of $52.38 suggests 22.61% upside potential from current levels.

Citigroup (NYSE: C)

Citigroup’s net income declined 27% in Q2, but smashed analysts’ expectations. The bank’s Q2 results gained from a 14% rise in NII due to higher interest rates, and robust trading activity. However, like other banks, Citigroup also reported a steep drop in its investment banking revenue. Also, it set aside $375 million for potential loan losses.

Like JPMorgan, Citigroup will also be temporarily suspending share repurchases to meet higher capital requirements.

In reaction to the results, UBS analyst Erika Najarian raised her price target for Citigroup stock to $52 from $48 and maintained a Buy rating. Najarian stated that the rise in Citigroup stock in reaction to the Q2 performance reflects its “distressed valuation.” The analyst feels that the much-needed 50 basis points improvement in common equity Tier 1 (CET1) in Q2 also reflects that the bank’s new leadership team “could execute.”

Overall, Citigroup scores a Moderate Buy consensus rating based on seven Buys, six Holds, and one Sell rating. The average Citigroup price target of $60.96 implies 16.22% upside potential from current levels.

Conclusion

Though each of these three bank stocks are in the red year-to-date, Wells Fargo stock has fared better than JPMorgan and Citigroup so far. Currently, the upside potential in JPMorgan and Wells Fargo stocks is comparable. That said, Wall Street analysts are more bullish about Well Fargo than the other two banks, as reflected in the consensus rating.