Oil prices have declined from the peak levels seen in June amid fears of an impending recession and demand concerns in China, the world’s largest oil importer. However, tight supplies could keep oil prices high. Meanwhile, as per a Bloomberg report, the Biden administration is contemplating buying crude to refill the Strategic Petroleum Reserve (SPR) when prices drop below $80 a barrel. As per the report, 24% of the reserve has been depleted since March in response to the Russia-Ukraine war. The decision to refill the SPR could prevent a further decline in crude prices. Given this volatile backdrop, we will discuss the prospects of three energy companies – ConocoPhillips (NYSE:COP), Exxon (NYSE:XOM), and Schlumberger (NYSE:SLB). Using TipRanks’ Stock Comparison tool, we will pick the energy stock that could fetch relatively higher returns from current levels.

ConocoPhillips (COP) Stock

ConocoPhillips, one of the leading exploration and production companies, posted stellar Q2 results, driven by high energy prices. Q2 adjusted earnings per share skyrocketed 208% year-over-year to $3.91.

ConocoPhillips boosted its shareholder return plan for the year to $15 billion from $10 billion, backed by robust cash flows. The enhanced planned capital return includes a Q3 ordinary dividend of $0.46 and a Q4 variable cash payment of $1.40. The company also improved its balance sheet by retiring $1.8 billion of debt in Q2, bringing the year-to-date debt reduction to $3 billion.

Meanwhile, as part of its energy transition efforts, ConocoPhillips continues to expand its global LNG portfolio. Recent developments include the company’s participation in QatarEnergy’s North Field East LNG project, and a non-binding agreement with Sempra Infrastructure to develop the Port Arthur LNG project and jointly participate in other large-scale LNG projects.

Is COP a Buy or Sell?

Last month, MKM Partners analyst Leo Mariani increased his price target for COP stock to $118 from $110 and maintained a Buy rating. The analyst noted that international natural gas prices have reached record highs, driven by the Russia-Ukraine conflict and outages and maintenance at some major global LNG facilities. Mariani feels that ConocoPhillips is among the few U.S. exploration and production companies that can offer exposure to the stellar rise in gas prices.

With nine Buys and two Holds, ConocoPhillips earns the Street’s Strong Buy consensus rating. The average COP price target of $128.45 implies 11.2% upside potential from current levels. COP stock has surged 60% year-to-date.

Exxon Mobil (XOM) Stock

Soaring oil and gas prices helped integrated energy giant Exxon deliver solid earnings in the first half of this year. The company’s Q2 EPS surged 276% to $4.14, driven by higher price realizations, strong refining margins, increased production, and cost controls.

Furthermore, strong cash flows helped Exxon boost shareholder returns. The company returned $7.6 billion to shareholders in the second quarter, including $3.7 billion in dividends.

The rise in production of low-cost barrels in Guyana and the Permian as well as continued investments in global LNG (including the Coral LNG and Golden Pass LNG projects) are anticipated to drive Exxon’s future growth. Moreover, tight cost controls are expected to enhance profitability. In the first half of 2022, the company generated cost savings of $6 billion compared to 2019. Furthermore, it is on track to achieve over $9 billion in annual structural cost savings by 2023.

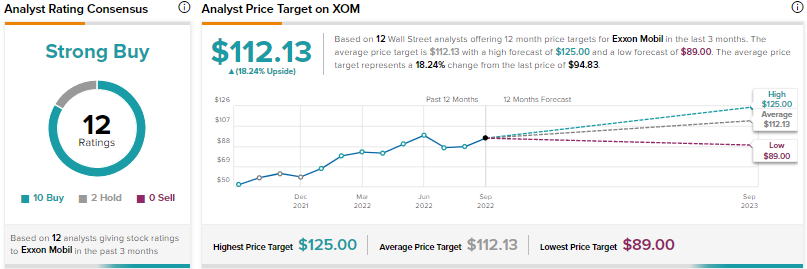

Is Exxon a Buy, Sell, or Hold?

Recently, Piper Sandler analyst Ryan Todd slightly trimmed his price target for Exxon to $108 from $109 and reiterated a Buy rating as he remains positive on integrated oil companies. Todd expects refining estimates to move higher, driven by near-record distillate margins. The analyst expects this trend to continue through the 2022 winter and into an “equally tight” 2023. Despite cost inflation, Todd remains optimistic about his upstream coverage.

Overall, Exxon scores a Strong Buy consensus rating backed by 10 Buys and two Holds. The average Exxon price target of $112.13 implies 18.2% upside potential. Shares have surged 55% so far this year.

Schlumberger (SLB) Stock

The emphasis on energy security due to geopolitical concerns has increased exploration and production activities. This is favorably impacting Schlumberger, a leading oil field services company that provides technology and solutions for reservoir characterization, drilling, production, and processing to the oil and gas industry.

Schlumberger’s Q2 adjusted EPS increased 67% year-over-year to $0.50, driven by a 20% rise in revenue to $6.8 billion and margin expansion. The company updated its full-year revenue outlook to at least $27 billion, reflecting a high-teens growth rate.

As per a Reuters report, at the recently held Barclays CEO Energy-Power Conference, Schlumberger CEO Olivier Le Peuch stated that oil and gas activity in North America is rising at a faster-than-anticipated rate. He noted that oil and gas producers are more bothered about securing equipment and operational performance than an abrupt fall in oil prices or a possible economic downturn. The CEO believes that international oil activity has the potential to expand at a faster rate than the activity in North America in the times ahead.

Le Peuch further stated that the ongoing investment rates and consistency are something that he has “not seen for quite some time.” Le Peuch also highlighted that Schlumberger is seeing its best margins in nearly a decade and that “investors should expect that the margin expansion is here to continue.”

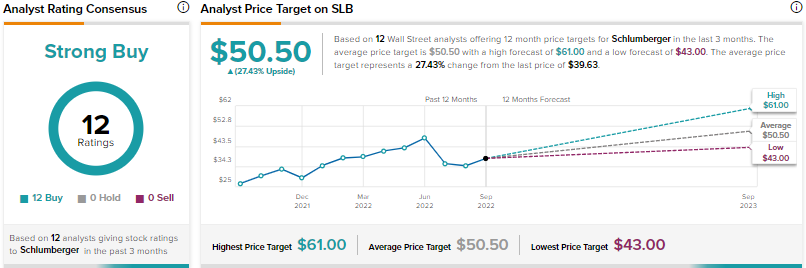

What Is the Target Price for SLB Stock?

In late July, Benchmark analyst Douglas Becker upgraded SLB stock from a Hold to Buy, with a price target of $55. Becker’s upgrade was based on various reasons, including a “positive inflection point in international producer spending and activity.”

Overall, the Street has a Strong Buy consensus rating for SLB stock based on 12 unanimous Buys. The average Schlumberger stock price prediction of $50.50 implies 27.4% upside potential. SLB shares have rallied 32% year-to-date.

Conclusion

Currently, Wall Street analysts are bullish on all three energy stocks discussed above. While ConocoPhillips and Exxon have delivered higher year-to-date returns than Schlumberger, analysts see higher upside potential in Schlumberger stock from current levels.

Schlumberger scores a “Perfect 10” on the TipRanks Smart Score system. What’s more, as per TipRanks’ Hedge Fund Trading Activity tool, SLB stock has a Very Positive confidence signal. Hedge funds have increased their holdings in SLB stock by 2.8 million shares in the past quarter.