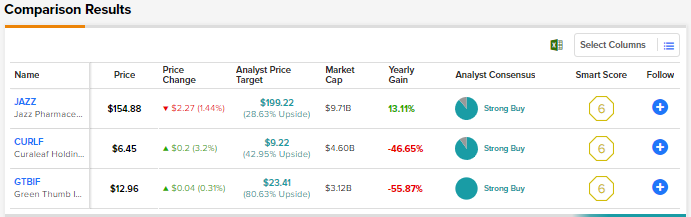

Cannabis stocks continue to be clobbered this year due to the lack of favorable reforms and the persistent delay in the legalization of cannabis at the federal level. Marijuana continues to be a Schedule 1 substance in the U.S. under the Controlled Substances Act, implying that it has no currently accepted medical use and has a high potential for abuse. Meanwhile, more U.S. states continue to legalize cannabis and drive additional growth. Here we will discuss three cannabis stocks – Jazz Pharmaceuticals (JAZZ), Green Thumb (GTBIF), and Curaleaf Holdings (CURLF) (TSE:CURA) that Wall Street analysts are highly bullish about. Using TipRanks’ Stock Comparison Tool, we placed these three cannabis stocks against each other to pick the one that could offer the highest upside potential.

Jazz Pharmaceuticals (JAZZ)

Jazz is a biopharmaceutical company developing medicines focused on neuroscience and oncology. The company’s 2021 acquisition of GW Pharmaceuticals enhanced its portfolio with the addition of Epidiolex, the first marijuana-derived drug to be approved in the U.S.

Jazz continues to expand the prescriber base for Epidiolex and is generating data to further establish the broad applications of Epidiolex across various seizure types. The company is also expanding Epidiolex into European markets, where it is called Epidyolex. Furthermore, Jazz’s pipeline includes early and late-stage cannabinoid product candidates, which could drive long-term growth if approved.

Is Jazz a Good Stock to Buy?

Following Jazz’s upbeat Q2 results, H.C. Wainwright analyst Oren Livnat reiterated a Buy rating and increased the price target for Jazz stock to $204 from $200 on marginally higher EPS estimates. Livnat noted that the company beat analysts’ estimates across neuro and oncology lines.

Wainwright feels that the Street is underestimating Jazz’s cash-flow generation capabilities amid limited Xyrem AG (Authorized Generic) competition. Xyrem is Jazz’s key drug that is used for treating excessive daytime sleepiness and cataplexy in narcolepsy patients. The analyst also noted that strong operating cash flows helped in bringing down net leverage to 3.2x, six months ahead of the company’s target to reduce net leverage to below 3.5x by the end of 2022.

On TipRanks, Jazz scores a Strong Buy consensus rating based on eight Buys and one Hold. The average Jazz stock price prediction of $199.22 implies 28.6% upside potential.

Curaleaf Holdings (CURLF)

Curaleaf is one of the largest multi-state cannabis operators in the U.S. with operations in 22 states. The company also expanded into the European cannabis market by acquiring EMMAC Life Sciences Group last year.

Curaleaf’s second-quarter revenue grew 8% year-over-year to $337.6 million and exceeded analysts’ estimates. The top line gained from higher retail revenue even as wholesale revenue declined. Net loss widened to $0.04 from $0.01 in the prior-year quarter but was in line with the Street’s expectations. Higher operating expenses and growth investments weighed on the bottom line.

Curaleaf attributed its lower wholesale revenue to the ongoing assessment of the wholesale businesses in California and Colorado.

Meanwhile, the retail business gained from solid growth across Curaleaf’s footprint and the addition of 28 new stores over the year. Moreover, the company benefited from additional sales from New Jersey, which kicked off legal sales of recreational cannabis in April.

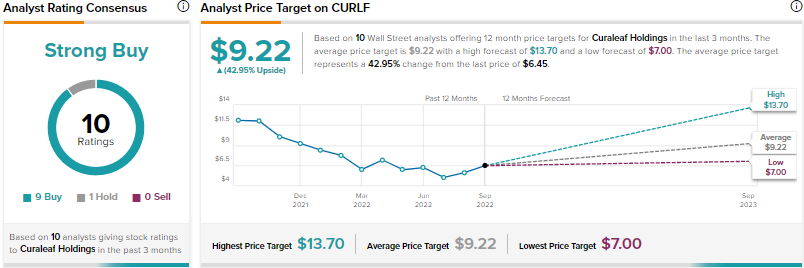

Is CURLF a Buy or Sell?

Recently, Jefferies analyst Owen Bennett lowered his revenue estimates for Curaleaf, Trulieve Cannabis (TCNFF), Cronos Group (CRON), and Canopy Growth (CGC) to reflect the impact of increased gasoline and food prices, as well as oversupply in certain markets, on cannabis sales. The analyst trimmed his 2022 revenue estimate for Curaleaf to $1.41 billion from $1.45 billion.

Bennett noted that both Trulieve and Curaleaf were facing price pressure in their wholesale divisions due to increased rivalry and oversupply. That said, the retail operations of these two U.S. companies have been faring relatively well.

Bennett reaffirmed his Buy rating on Curaleaf, stating, “We were encouraged to see another multi-state operator (MSO) effectively navigate growing industry pressures.”

Overall, consensus among analysts is a Strong Buy backed by nine Buys and one Hold. The average CURLF price target of $9.22 implies nearly 43% upside potential.

Green Thumb Industries (GTBIF)

U.S. multi-state operator Green Thumb delivered market-beating second-quarter results despite challenging market conditions. Green Thumb has 17 manufacturing facilities and 77 retail locations across 15 U.S. markets. The company’s RISE retail cannabis stores are expanding at a rapid rate. It’s worth noting that Green Thumb has delivered positive net income for eight consecutive quarters, in contrast to many of its peers, who continue to be unprofitable.

Green Thumb’s Q2 revenue increased 14.6% year-over-year to $254.3 million, thanks to strong traffic in existing stores, the beginning of adult-use cannabis sales in New Jersey, higher sales from Illinois, and the opening of 19 new retail locations over the past year. EPS was flat at $0.10 on a year-over-year basis.

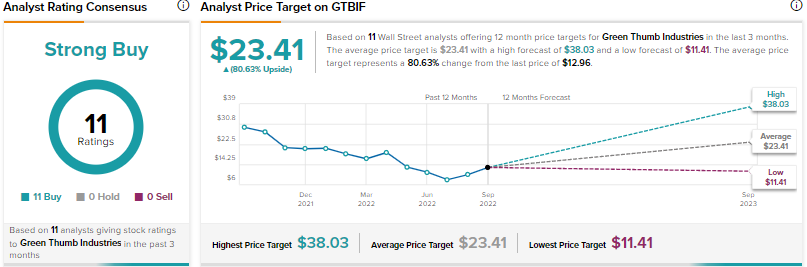

Is Green Thumb Industries a Buy?

Following the Q2 print, Alliance Global Partners analyst Aaron Grey reiterated a Buy rating on Green Thumb. However, he lowered his price target for the company’s shares trading on the Canadian stock exchange to C$25 from C$40.

Grey believes that Green Thumb is “among the best positioned to weather the storm” amid a competitive environment, challenging capital markets, and illegality at the federal level. The analyst is bullish on the company based on its solid balance sheet, focus on premium offerings, and positive operating cash flows.

Other analysts seem to agree with Grey’s bullish stance, as Green Thumb scores a Strong Buy consensus rating based on 11 unanimous Buys. At $23.41, the average GTBIF price target implies 80.6% upside potential.

Conclusion

Despite the uncertainty associated with the legalization of cannabis at the federal level and the ongoing macro headwinds, Wall Street continues to be highly optimistic about these three cannabis stocks. Following a significant year-to-date dip in Green Thumb stock, analysts see strong upside potential in the times ahead. Based on the upside potential, Green Thumb seems to be a better pick than Jazz Pharmaceuticals and Curaleaf.