The onset of the COVID-19 pandemic drastically impacted outdoor activities. Several companies involved in travel, outdoor entertainment, and leisure like cruise lines, airlines, theaters, and theme parks, reported heavy losses when consumer mobility was restricted by COVID-19 restrictions. Many of these companies experienced strong recovery following the reopening of the economy. While cruise stocks could recover, they have yet to make up for their pandemic losses, and analysts remain more confident on theme parks, instead. For the industry, soaring inflation, spike in fuel prices, and geopolitical concerns have impacted the pace of recovery and profitability.

Bearing these dynamics in mind, using the TipRanks Stock Comparison Tool, we placed Carnival, Norwegian Cruise, and Six Flags against each other to pick the better Outdoor Activities stock.

Carnival Corporation (NYSE: CCL)

Carnival is one of the world’s largest cruise companies with a fleet of 92 ships. Carnival shares plunged 14.1% on Wednesday, June 29, as Morgan Stanley analyst Jamie Rollo lowered his price target on Carnival stock to $7 from $13 and reiterated a Sell rating.

Rollo reduced his estimates for Carnival “again” following the company’s “weak” Q2 FY22 (ended May 31, 2022) results and outlook. Rollo expects FY22 EBITDA loss of $0.9 billion due to weaker-than-anticipated occupancies, weakening pricing, elevated unit costs and increased fuel costs. Rollo pointed out that this year would mark Carnival’s third year of losses.

Carnival’s Q2 FY22 revenue grew by 50% to $2.4 billion compared to the first quarter, but missed analysts’ expectations. Further, the company posted a higher-than-expected loss per share of $1.61. Carnival stated that it expects a net loss in Q3 FY22 and for the full-year due to the ongoing effects of the pandemic, inflation, and elevated fuel prices.

Rollo cut his price target by almost half and sees a new $0 bear case. The analyst highlighted that $4 billion of debt is maturing in the next 18 months and $5 billion of the company’s cash is customer cash. So, if the high yield market closes, or if there is “a demand shock that causes trip cancellations or weak bookings” followed by customer deposit outflows, then liquidity could rapidly be impacted.

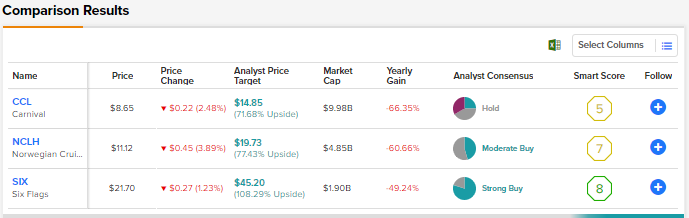

Overall, the Street is sidelined on Carnival stock, with a Hold consensus rating based on five Buys, five Holds, and four Sells. At $14.85, the average Carnival price target implies 71.68% upside potential from current levels. Shares are down nearly 57% year-to-date.

Norwegian Cruise Line (NYSE: NCLH)

Norwegian Cruise operates the Norwegian Cruise Line, Oceania Cruises, and Regent Seven Seas Cruises brands and has a combined fleet of 28 ships.

The company’s revenue jumped to $521.9 million in Q1’22 compared to $3.1 million in Q1’21 due to the resumption of cruise voyages. Also, the adjusted loss per share narrowed to $1.82 from $2.03 in the prior-year quarter. That said, the Q1’22 loss per share was wider than analysts’ expectations and revenue also lagged estimates.

However, Norwegian reassured that consumer demand remains strong with net booking volumes back to pre-Omicron levels and now approaching historical levels despite a temporary headwind due to the Russia-Ukraine war.

Earlier this month, Susquehanna analyst Christopher Stathoulopoulos initiated coverage of Norwegian Cruise with a Buy rating and a price target of $20. The analyst stated the cruise industry, which has been one of the hardest hit travel industry sub-sectors during the pandemic, is on the mend and the liners have a line of sight to profitability into 2023.

The analyst noted that industry fundamentals are improving, but cruise stocks have been “overly beaten down.” Amid the current scenario, Stathoulopoulos prefers cruise liners with attributes that could help mitigate cyclical pressures and growing geopolitical risks.

All in all, the Street is cautiously optimistic on Norwegian stock, with a Moderate Buy consensus rating based on five Buys and six Holds. With shares down 46.4%, the average Norwegian Cruise price target of $19.73 implies 77.43% upside potential from current levels.

Six Flags Entertainment (NYSE: SIX)

Six Flags is a leading regional theme park company with 27 parks across the U.S., Mexico, and Canada.

Six Flags’ Q1 FY22 (ended April 3, 2022) revenue grew 68% to $138 million, reflecting strong recovery following the easing of restrictions. Loss per share narrowed to $0.76 from $1.12 in the prior-year quarter. Overall, the company fared better than analysts’ expectations as the quarter gained from higher attendance and increased guest spending per capita.

Despite near-term pressures, Six Flags continues to make investments to enhance guests’ experiences. The company expects FY22 capital spend to be slightly higher than FY21, with investments directed toward new roller coasters, and implementation of guest facing technology as well as amenities in its parks.

Recently, Stifel analyst Steven Wieczynski slashed his price target for Six Flags stock to $35 from $52, citing a lower target multiple. That said, the analyst maintained a Buy rating on the stock, calling it “one of the most defensible/oversold” across his coverage given the massive pullback over the past three months.

Amid fears around consumers’ health and the possibility of spending cuts, Wieczynski believes that investors are pricing in an almost worst case scenario and believes that the regional theme park industry has unique characteristics that mostly have proven to be “somewhat recession/event-resilient.”

Overall, Six Flags scores a Strong Buy consensus rating based on eight Buys and two Holds. The average Six Flags price target of $45.20 implies 108.29% upside potential from current levels. Shares have plunged nearly 49% so far this year.

Conclusion

Outdoor activities stocks might continue to be under pressure over the near term due to the fear of an impending recession. Amid the current scenario, analysts have a more bullish opinion on Six Flags compared to Carnival and Norwegian Cruise. Also, Wall Street’s average price target indicates a higher upside potential for Six Flags stock than the other two stocks.

Read full Disclosure