Last week marked the second consecutive weekly decline in oil prices, with the West Texas Intermediate (WTI) crude futures, the U.S. oil benchmark, closing 1% weaker at $98.26 a barrel on April 8. Oil prices fell on a weekly basis as the member countries of the International Energy Agency, including the U.S., announced their plans to release more reserves to bring down global prices.

The recovery in energy demand following the reopening of economies and the Ukraine-Russia crisis triggered a sharp rise in oil and gas prices, benefiting stocks in the energy sector. The SPDR S&P Oil & Gas Exploration & Production ETF (XOP), which includes major oil and gas companies, has rallied 46% year-to-date.

We used the TipRanks stock comparison tool for energy stocks to compare Exxon Mobil, Chevron, and ConocoPhillips to see if Wall Street analysts see further upside potential in these stocks following a strong run.

Exxon Mobil (NYSE: XOM)

Exxon Mobil is one of the largest integrated energy companies and is involved in the exploration, production, and distribution of oil and natural gas. It markets fuels, lubricants, and chemicals under four brands –Esso, Exxon, Mobil, and ExxonMobil.

A rebound in oil and gas prices fueled by the recovery in energy demand drove a 57.3% rise in the company’s 2021 revenue to $285.6 billion. Adjusted EPS came in at $5.38 in 2021, compared to a loss per share of $0.33 in 2020.

The company cut its capital spending to $16.6 billion in 2021 from $21.4 billion in 2020.

The energy giant generated operating cash flows of $48 billion in 2021, which according to the company, is the highest level since 2012 and reflects a significant rise compared to $14.7 billion in 2020. Further, Exxon reduced its debt by $20 billion in 2021, bringing debt back to pre-pandemic levels.

Exxon’s initiatives to streamline its business and cut down its costs helped deliver savings of $1.9 billion in 2021. It is now on track to exceed its target of reducing costs by $6 billion by 2023.

Given its improved financial position, Exxon initiated share repurchases in Q122 as part of its $10 billion buyback program over the next 12 to 24 months.

Also, Exxon retained its status as a dividend aristocrat (a term used for companies that have increased dividends for at least 25 consecutive years) by increasing its quarterly dividend to $0.88 from $0.87. This marked the 39th consecutive annual dividend hike. Exxon’s forward dividend yield stands at 4.1%.

Following Exxon’s recent favorable update about Q122, Bank of America Securities analyst Doug Leggate raised his estimate for Q122 EPS from $2.15 to $2.18.

The analyst noted that the upward revision in guidance was “driven mainly by strong upstream earnings more than offsetting slightly lower contributions from Chemicals and Corporate QoQ with downstream relatively in-line.”

Leggate added, “XOM has hit its debt targets, is ready to accelerate buy backs in our view and is the only major to emerge from COVID with line of sight to expand FcF [Free Cash Flow].”

Leggate maintained a Buy rating on Exxon Mobil stock, with a price target of $120.

Meanwhile, the Street is cautiously optimistic about Exxon Mobil based on 10 Buys and 13 Holds. At $89.59, the average Exxon Mobil price target implies a modest 3.17% upside potential from current levels. The stock has rallied about 42% year-to-date.

Chevron Corporation (NYSE: CVX)

Integrated energy company Chevron delivered mixed Q421 results earlier this year, with revenue beating analysts’ estimates and earnings lagging the Street’s expectations. Q421 earnings were impacted by weaker-than-estimated production.

Chevron’s revenue increased 72% to $162.5 billion in 2021, and adjusted EPS surged to $8.13 from $0.09 in 2020, a year severely impacted by a pandemic-induced slump in demand.

Higher crude oil and natural gas prices helped boost Chevron’s operating cash flows to $29.2 billion in 2021 from $10.6 billion in 2020. This helped the company reduce debt by $12.9 billion.

Chevron’s capital and exploratory expenditures came in at $11.7 billion in 2021, compared to $13.5 billion in 2020. Chevron anticipates capital spending in the $15 billion to $17 billion range for the next five years.

The company aims to grow its renewable fuels production capacity to 100,000 barrels per day by 2030 and is acquiring Renewable Energy Group in a $3.15 billion cash deal to accelerate this goal. The transaction is expected to close in the second half of 2022.

Chevron is also a dividend aristocrat and has increased its dividends for 35 consecutive years, including a 6% hike in its quarterly dividend per share this year to $1.42. Chevron’s forward dividend yield is 3.3%.

Recently, UBS analyst Luiz Carvalho raised his price target on Chevron stock to $192 from $150 and reaffirmed a Buy rating, citing the company’s lower exposure to Russia than its peers along with his updated crude oil price deck forecasts.

However, RBC Capital analyst Biraj Borkhataria told investors, “CVX has outperformed the rest of the integrateds by some margin and we believe shares may take a pause in the near term as analysts calibrate company specific issues for 1Q. Notably, our Chevron earnings estimate is the only one where we’re below consensus across the group.”

Borkhataria has a Buy rating on Chevron and a price target of $160.

To summarize, the Street is cautiously optimistic about Chevron, with a Moderate Buy consensus rating based on 15 Buys and eight Holds. Following a 44.8% rally in the stock so far this year, the average Chevron price target of $164.63 implies a downside potential of 3.12% from current levels.

ConocoPhillips (NYSE: COP)

ConocoPhillips is one of the world’s leading exploration and production companies, with operations in 14 countries. It became an upstream pure-play following the spin-off of its downstream business in 2012 to create the independent company Phillips 66 (PSX).

ConocoPhillips is known for its low-cost structure and efficiency. In its 4Q21 conference call, the company indicated that its free cash flow break-even point is around $30 per barrel.

Meanwhile, higher realized prices and volumes helped ConocoPhillips generate revenue of $48.3 billion in 2021, up 151% from 2020. The company posted adjusted EPS of $6.01 in 2021 compared to an adjusted loss per share of $0.97 in 2020.

Improved business conditions helped ConocoPhillips generate operating cash flows of $17 billion in 2021, up from $4.8 billion in 2020.

The company continues to dispose of non-core assets as part of its ongoing efforts to focus on “low cost of supply opportunities.” Last month, ConocoPhillips completed the sale of its Indonesia assets to MedcoEnergi for about $1.36 billion.

ConocoPhillips expects capital spending of $7.2 billion in 2022, up from $5.3 billion in 2021. Capital expenditure this year includes funding for ongoing development drilling programs, major projects, exploration and appraisal activities, and investments in early-stage low-carbon opportunities.

Further, the company expects to return $8 billion to shareholders in 2022, reflecting a 30% increase over 2021. These payments include an ordinary dividend per share of $0.46 and a second-quarter variable return of cash (VROC) payment of $0.30.

On March 31, Mizuho analyst Vincent Lovaglio increased his long-term oil price forecast to $70 per barrel from $61, with his 2022-25 estimates up $16 per barrel on average, driven by an increase in estimated U.S. unconventional oil volume growth and the resulting increase in capital intensity.

Given the increase in the price deck, Lovaglio raised his price targets for exploration and production companies, including ConocoPhillips stock to $150 from $115.

Lovaglio reiterated a Buy rating on ConocoPhillips.

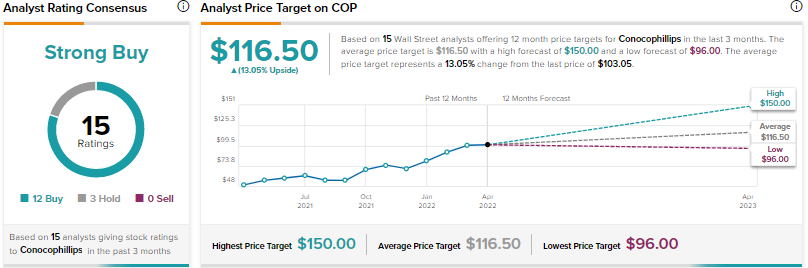

On TipRanks, ConocoPhillips scores a Strong Buy consensus rating based on 12 Buys and three Holds. The average ConocoPhillips price target of $116.50 suggests 13.05% upside potential from current levels. The stock has advanced about 43% year-to-date.

Conclusion

Shares of Exxon Mobil, Chevron, and ConocoPhillips have had an impressive run so far this year and have outperformed the broader market. However, Wall Street analysts are more bullish on ConocoPhillips and see higher upside potential from current levels.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure.