With the easing of COVID-19 restrictions, airlines, hotels, and several other travel-related companies have been benefiting from pent-up demand, especially for leisure travel. However, macro headwinds and a looming recession could impact the strong recovery in the months ahead.

The Baird/STR Hotel Stock Index fell 5.8% in May to 5,584 due to the broader market volatility. Michael Bellisario, senior hotel research analyst and director at Baird stated, “Hotel fundamentals have continued to improve and are showing no signs of slowing; the demand recovery is broadening, the harder-hit urban markets are rebounding, and midweek business travel is coming back at a strong pace.”

However, Bellisario noted that despite the positive momentum, investors remain a bit skeptical and “are focused on the health of the consumer amid a slowing growth backdrop.”

Bearing that in mind, we used the TipRanks Stock Comparison tool to place Xenia, Wyndham, and Marriott International against each other to pick the better hotel stock.

Xenia Hotels & Resorts (NYSE: XHR)

Xenia is a Real Estate Investment Trust (REIT) that has hotels and resorts in the luxury and upper-upscale segments. It owns 34 hotels across 14 states, which are operated and/or licensed by leading names like Marriott, Hyatt, Kimpton, Fairmont, Loews, Hilton, The Kessler Collection, and Davidson.

Xenia’s first-quarter revenue jumped 139% to $210.3 million, reflecting robust travel recovery. Total RevPAR (Revenue per Available Room), a key industry metric, surged 133% to $143.99. Adjusted funds from operations per share improved to $0.25 compared to $(0.18) in the prior-year quarter.

Following the Q1’22 results, B. Riley analyst Bryan Maher upgraded Xenia to a Buy from Hold with an unchanged price target of $22. Riley explained that Xenia posted a “strong” Q1 beat as January’s weakness due to Omicron was “quickly erased” starting in mid-February and continuing into March, thanks to the ramp-up in leisure and business travel.

Maher further added that the favorable trends continued in April, and management is expecting this to continue into the summer. The analyst noted that as group business (historically group travel accounted for one-third of Xenia’s business) ramps this year, the company should see a “robust” EBITDA improvement.

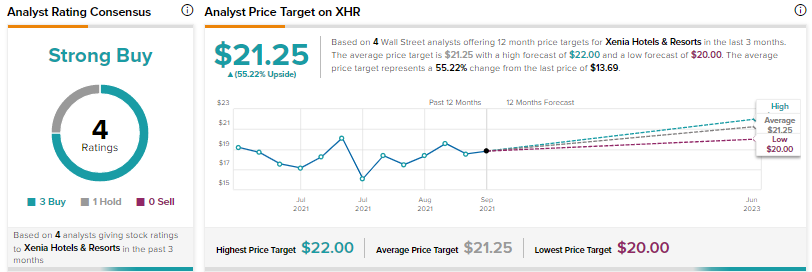

Overall, Xenia scores the Street’s Strong Buy consensus rating based on three Buys and one Hold. The average Xenia price target of $21.25 implies 55.22% upside potential from current levels.

Wyndham Hotels & Resorts (NYSE: WH)

Wyndham is a leading hotel franchisor with over 8,900 hotels across more than 95 countries. It operates its hotels under 22 brands, including Days Inn, Ramada, La Quinta, Microtel, Super 8, and Wyndham. The company is mostly focused on the economy and midscale segments of the lodging industry.

Higher pricing and increased occupancy levels helped Wyndham in delivering Q1’22 revenue of $371 million, up 22.4% year-over-year. RevPAR grew 39% year-over-year to $34.06 (in constant currency). Further, adjusted EPS jumped 164% to $0.95.

Baird analyst Bellisario noted that Wyndham’s Q1 earnings beat was driven by non-fee-related items, like lower selling, general and administrative expenses, marketing, reservation, and loyalty under-spending, as well as a rise in other revenues.

Bellisario pointed to lagging international trends, mainly due to lockdown-related weakness in China. Also, the analyst noted that the recovery in the U.S. market continues “but not quite at the same rate of improvement vs. 2019 levels as prior quarters.”

That said, Bellisario continues to be bullish on Wyndham based on several factors, including his expectation for the midscale and economy chain scale hotels to “continue performing well,” significant cash flow generation potential this year, and increasing shareholder capital returns.

Overall, Bellisario reiterated a Buy rating on Wyndham stock with a price target of $96.

On TipRanks, Wyndham earns a Strong Buy consensus rating backed by four unanimous Buys. At $99.75, the average Wyndham price target implies 53.70% upside potential from current levels.

Marriott International (NASDAQ: MAR)

Marriott is a leading hotel chain that boasts a portfolio of over 8,000 properties under 30 leading brands across 139 countries. Some of the popular brands in the company’s portfolio include St. Regis, Bvlgari, JW Marriott, The Ritz-Carlton, Marriott Hotels, Le Meridien, and Sheraton.

Marriott’s Q1’22 revenue grew 81% to $4.20 billion, with the comparable systemwide RevPAR (constant dollar) up 96.5%. The top line gained from a strong recovery in the U.S., Canada, and international markets, except China. Adjusted EPS jumped to $1.25 from $0.10 in the prior-year quarter.

BMO Capital analyst Ari Klein noted that Marriott delivered “strong results with upside across key metrics” as leisure travel remains resilient, while business and group demand continues to improve. However, Klein highlighted that management didn’t provide any formal guidance given continued low visibility.

Klein stated, “An uncertain macro and its impact is a key question moving forward, but for now there is no evidence of a slowdown. While there are still some recovery question marks, increasing capital return should provide support.”

Klein concluded that while Marriott’s portfolio “positions it well for the recovery’s next phase,” he feels that at the current EV/EBITDA valuation levels, the risk-reward profile seems balanced. Klein reiterated a Hold rating with a price target of $183.

Overall, the Street is cautiously optimistic on Marriott, with a Moderate Buy consensus rating based on four Buys and seven Holds. The average Marriott price target of $188.73 implies 38.30% upside potential from current levels.

Conclusion

Shares of Xenia, Wyndham, and Marriott are down 24.4%, 27.6%, and 17.4%, respectively. Currently, analysts are highly bullish on Xenia and Wyndham, while they are treading cautiously regarding Marriott. Wall Street’s average price target indicates almost comparable upside potential for Xenia and Wyndham.