The S&P 500 (SPX) is down 21.3% year-to-date, and has finally fallen into bear market territory following last week’s higher-than-anticipated inflation report. Markets are now anticipating aggressive interest rate hikes as part of the Fed’s efforts to tame inflation. Amid these uncertain and challenging times, investors are looking for stocks with strong fundamentals that can fare better than the broader market.

Generally, healthcare companies are more resilient amid a recession than companies across several other sectors as they provide many services and products that are essential even in a tough macro market.

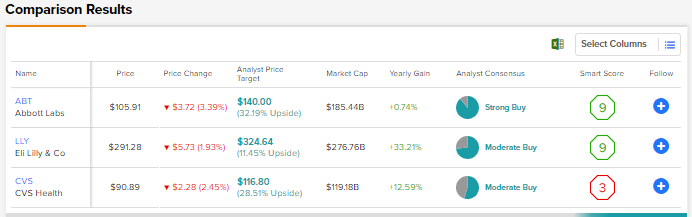

Using the TipRanks Stock Comparison tool for healthcare stocks, we placed Abbott, Eli Lilly, and CVS Health against each other to pick the stock that Wall Street analysts expect to yield better returns.

Abbott Laboratories (NYSE: ABT)

Healthcare giant Abbott has recently been in the news for issues related to its baby formula products. Earlier this year, the company recalled its baby formulas following complaints of illness caused by consumption of its products. Unsanitary conditions at Abbott’s Sturgis, Michigan facility led to the contamination of the baby formulas, and the plant was subsequently shutdown in February amid a probe by the U.S. FDA (Food and Drug Administration).

At a time when supply chain issues were already impacting availability of infant food, the closure of Abbott’s Michigan facility exacerbated the situation and caused a massive shortage nationwide.

Earlier this month, Abbott resumed baby formula production at its Michigan plant after meeting initial requirements as part of the consent decree entered into in May with the FDA.

Coming to positive developments, Abbott recently received FDA approval for its FreeStyle Libre 3 continuous glucose monitoring (CGM) system. Rival Dexcom is awaiting FDA approval for its G7 CGM system.

BTIG analyst Marie Thibault views FDA’s clearance of Libre 3 CGM as a “significant win” for the company.

Thibault continues to be bullish about Abbott based on its “strong Medical Device product portfolio and pipeline, expanded Diagnostics presence, underlying growth in the base business, efforts to sustain strong EPS growth, and robust cash generation.”

Thibault also highlighted Abbott’s focus on high-growth areas, like diabetes, structural heart and diagnostics, and its robust pipeline of new products. The analyst reiterated a Buy rating on Abbott with a price target of $140.

Overall, Abbott scores a Strong Buy consensus rating backed by eight Buys and one Hold. The average Abbott price target of $140 implies 32.19% upside potential from current levels. Shares are down 25% so far this year.

Eli Lilly & Co. (NYSE: LLY)

Eli Lilly is one of the leading healthcare companies in the diabetes space, with drugs like Trulicity, Humalog, Jardiance, Basaglar, and Humulin. It also boasts a strong portfolio of oncology and immunology drugs. Eli Lilly recently announced favorable developments about several key treatments in its pipeline.

Recently, J.P. Morgan analyst Chris Schott increased his price target for Eli Lilly stock to $355 from $340 and reiterated a Buy rating. Schott upped his estimates following the U.S. FDA’s approval of Mounjaro (brand name for Tirzepatide) for Type 2 diabetes and after positive results from the Phase 3 SURMOUNT-1 clinical trial evaluating Tirzepatide for the treatment of obesity. These results were published in The New England Journal of Medicine, and presented at a symposium sponsored by the American Diabetes Association.

Schott estimates Mounjaro to generate peak sales of $12 billion to $13 billion in the diabetes segment, while he sees the product expanding use of the GLP-1 (glucagon-like peptide-1) class to earlier stage patients. Further, the analyst sees over a $10 billion opportunity in the product for the obesity segment. This is up from the previous estimate of $6 billion to $8 billion.

Overall, Schott estimates total Mounjaro peak sales of $25 billion, and expects Eli Lilly’s EPS to increase to over $28 by 2030 from $8.80 in 2022. These numbers would occur before considering any contribution from donanemab, the company’s Alzheimers drug candidate.

Overall, the Street is cautiously optimistic on the stock, with a Moderate Buy consensus rating based on 11 Buys and four Holds. The average Eli Lilly price target of $324.64 implies 11.45% upside potential from current levels. The stock has outperformed the broader market and has advanced 5.5% year-to-date.

CVS Health (NYSE: CVS)

CVS operates over 9,000 retail pharmacy locations and more than 1,100 walk-in medical clinics, and a health insurance business since its acquisition of Aetna in 2018.

CVS recently reaffirmed its full-year guidance, which it had raised last month following better-than-anticipated first-quarter results. The first-quarter results gained from strength in the company’s insurance unit and retail business despite a slowdown in revenues from COVID-19 testing and vaccinations administered at its stores.

CVS is closing 300 stores this year as part of its plan to shut down 900 locations by the end of 2024. It is focusing on a digital-first approach to address customers’ need to buy online. As at the end of the first quarter, CVS had served nearly 44 million digital customers.

Recently, Bernstein analyst Lance Wilkes downgraded CVS to a Hold from a Buy, and lowered the price target to $112 from $122. Wilkes is positive on the U.S. healthcare services group in general, and feels that it is well positioned in an inflationary environment. Coming to CVS, Wilkes still likes its long-term strategy of shifting to a government MCO (Managed Care Organization) and risk-bearing care delivery company with a retail presence.

However, in the current environment, Wilkes sees CVS stock’s multiple expanding once the VBC (Value-Based Care) delivery segment is created and starts to reflect traction in revenues and earnings.

All in all, consensus among analysts is a Moderate Buy rating based on six Buys and five Holds. The average CVS price target of $116.80 implies 28.51% upside potential in the 12-months ahead. Shares have declined nearly 12% year-to-date.

Conclusion

Analysts currently seem to be more bullish on Abbott than Eli Lilly and CVS Health, and estimate a higher upside potential in Abbott stock from current levels.

Despite recent pressures and the expected decline in COVID-19 testing revenues, Wall Street continues to be optimistic about Abbott based on its diversified portfolio and a strong pipeline.

Read full Disclosure