Cybersecurity stocks have been impacted by the broader sell-off in the tech sector this year even though demand for cybersecurity products and solutions continues to be strong. Continued shift of enterprises to the cloud, growing e-commerce transactions, and the rise in advanced and complex cyber threats have fueled robust demand for cybersecurity companies.

Though a looming recession might impact businesses, cybersecurity companies could show resilience due to the heightened risk of cyber attacks.

According to Grand View Research, the global cyber security market size stood at $184.93 billion in 2021 and is expected to grow at a compound annual growth rate of 12% in the 2022 to 2030 period.

With that in mind, using the TipRanks Stock Comparison tool, we’ll place Palo Alto, CrowdStrike, and CyberArk against each other and pick the cybersecurity stock which could offer higher returns.

Palo Alto Networks (NASDAQ: PANW)

Palo Alto offers cybersecurity solutions to clients across cloud, networks, and mobile devices. Thanks to several strategic acquisitions, the company has rapidly expanded beyond its on-site firewall offerings to cloud-based cybersecurity solutions.

Last month, Palo Alto impressed investors with a beat-and-raise quarter. The company’s Q3 FY22 (ended April 30, 2022) revenue increased 29% to $1.39 billion, while adjusted EPS grew nearly 30% to $1.79. Despite higher costs stemming from supply chain woes, profitability improved due to the company’s efficiency measures.

Mizuho Securities analyst Gregg Moskowitz noted Palo Alto’s “impressive” billings and Product revenue growth in Q3 FY22. The company’s billings grew 40% to $1.8 billion in Q3, while Product revenue rose 22% to nearly $352 million.

The analyst remains “very constructive” on Palo Alto’s improving mix shift toward higher-growth recurring revenue.

Moskowitz concluded that Palo Alto remains one of his top picks and that the company “easily possesses the strongest array of cloud assets among traditional network security vendors.”

Moskowitz reiterated a Buy rating on Palo Alto stock with a price target of $600.

With 24 Buys against just one Hold, Palo Alto scores the Street’s Strong Buy consensus rating. The average Palo Alto price target of $639.58 implies 21.36% upside potential from current levels.

CrowdStrike Holdings (NASDAQ: CRWD)

CrowdStrike has emerged as one of the leading cybersecurity players with the wide-acceptance of its cloud-native Falcon platform.

The company recently reported upbeat Q1 FY23 (ended April 30, 2022) results, with revenue increasing 61% to $487.8 million and adjusted EPS rising significantly to $0.31 from $0.10 in the prior-year quarter. Further, CrowdStrike ended the quarter with ARR (Annual Recurring Revenue) of $1.92 billion, up 61% year-over-year.

CrowdStrike raised its full-year outlook fueled by continued momentum in the adoption of the company’s core products, growing customer base, and strong customer retention.

Following the print, Stephens analyst Brian Colley stated that he would take advantage of any weakness in CrowdStrike stock as he believes that the company “remains one of the best-positioned vendors in cybersecurity to deliver sustainable (and best-in-class) profitable growth given its wide competitive moat, attractive unit economics, rapid platform expansion into additional large/high-priority security markets, secular tailwinds, and a massive TAM [Total Addressable Market] expected to reach $126B in 2025.”

Colley reiterated a Buy rating on CrowdStrike stock with a price target of $232.

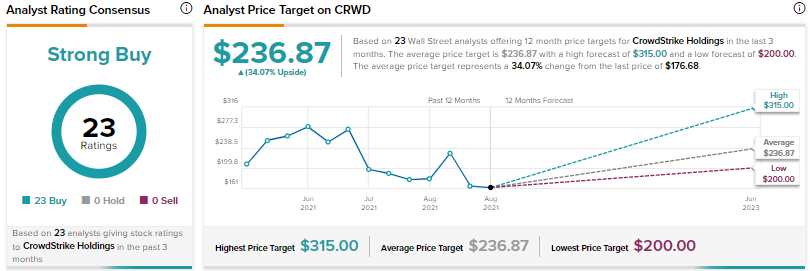

Overall, CrowdStrike scores a Strong Buy consensus rating based on an impressive 23 unanimous Buys. At $236.87, the average CrowdStrike price target implies upside potential of 34.07% from current levels.

CyberArk Software (NASDAQ: CYBR)

CyberArk is one of the leading providers of identity security solutions. The company recently completed its transition from a perpetual licences model to a subscription model.

CyberArk delivered mixed results for Q1’22. Revenue grew 13% to $127.6, but lagged analysts’ expectation of $130.5 million. It slipped to an adjusted loss per share of $0.30 from an adjusted EPS of $0.10 in the prior-year quarter, but fared slightly better than analysts’ adjusted loss per share estimate of $0.31.

CyberArk raised its full-year ARR (Annual Recurring Revenue) outlook and now expects ARR growth of 36% to 38%, following an impressive 48% growth in Q1 ARR to $427 million.

Colley recently initiated coverage on CyberArk with a Buy rating and a price target of $170. The analyst believes that the company is “uniquely positioned to serve as a broader identity security platform” due to its leadership in Privileged Access Management (PAM).

Colley feels that CyberArk’s top-line growth and profitability are set to accelerate in 2023 given the completion of its subscription transition. The analyst believes that product innovations in lucrative emerging categories like CIAM (Customer Identity and Access Management), CIEM (Cloud Infrastructure Entitlements Management), and DevSecOps should drive future growth.

Colley also highlighted CyberArk’s exposure to several secular and company-specific growth drivers.

Most of the analysts are also optimistic on CyberArk, with a Strong Buy consensus rating based on 12 Buys and one Hold. The average CyberArk price target of $171.54 implies 18.39% upside potential from current levels.

Conclusion

Shares of Palo Alto, CrowdStrike, and CyberArk are down 5.4%, 13.7%, and 16.4%, respectively, year-to-date, amid persistent macro headwinds. That said, these companies continue to benefit from solid cybersecurity demand due to increased threat of cyber attacks amid geopolitical tensions and growing digitization.

While Wall Street is bullish about all three stocks, currently they see higher upside potential in CrowdStrike. Further, on TipRanks’ Smart Score system, CrowdStrike earns a nine of out 10 score, indicating that the stock is likely to outperform the market.

Read full Disclosure