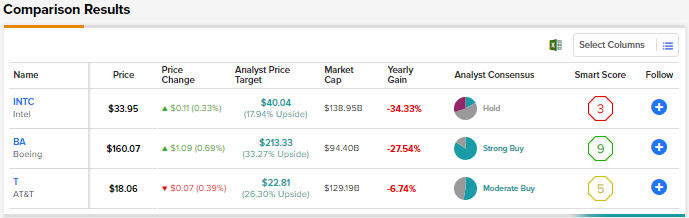

Persistent market volatility is keeping investors worried. The U.S. Federal Reserve’s hawkish stance indicates continued interest rate hikes to tame inflation. Many fear that rising interest rates might push the economy into a recession. Amid these uncertain times, many investors seek opportunities to pick up some blue-chip stocks trading at attractive levels. Blue chips are large, well-established companies, and often rank among the dominant players in their respective sectors. Using the TipRanks Stock Comparison tool, we placed Intel, Boeing, and AT&T against each other to pick the blue-chip stock that earns a “Strong Buy” consensus rating from Wall Street analysts.

Intel (NASDAQ:INTC)

The chip giant has been struggling over the past few years and has been losing ground to rivals, like Advanced Micro Devices (AMD), due to product delays and a lack of innovation. The ongoing macro challenges have made matters worse, with Intel recently reporting a massive second-quarter earnings miss. Aside from the economic downturn, the company also blamed internal execution issues and supply chain bottlenecks for its poor performance.

Intel’s Q2 adjusted earnings per share declined 79% to $0.29 and revenue fell 22% to $15.3 billion. The company’s top line was impacted by lower demand for personal computer chips and weaker-than-anticipated data center chip sales.

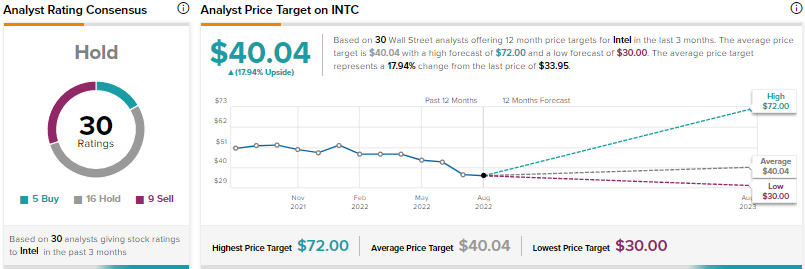

Following the print, Rosenblatt Securities analyst Hans Mosesmann cut his price target for Intel stock to $30 from $40. Mosesmann reiterated a Sell rating, calling the quarter an “unmitigated disaster.” The analyst questioned as to why such a big earnings miss was not pre-announced by the management.

Mosesmann also pointed out the delay in the company’s next-gen Sapphire Rapids data center processors into 2023. The analyst feels that Intel’s business model will be under pressure due to numerous years of share losses in the data center market, regardless of a recovery in the PC chip market.

Overall, with five Buys, 16 Holds, and nine Sells, the Street has a Hold consensus rating on Intel stock. The average INTC price target of $40.04 suggests 17.94% upside potential.

Boeing (NYSE:BA)

Aviation giant Boeing has been under tremendous pressure over the past few years due to the grounding of its 737 MAX planes following fatal crashes, production halt related to the 787 Dreamliner, impact of the pandemic on the airlines sector, supply chain bottlenecks, and internal operational lapses.

Coming to recent performance, Boeing’s second-quarter results missed analysts’ expectations. However, the company is optimistic about delivering positive free cash flow this year.

Furthermore, Boeing investors recently got a reason to rejoice as the Federal Aviation Administration (FAA) gave clearance to the company to commence deliveries of the 787 Dreamliner. Deliveries of the 787 Dreamliner aircraft have been suspended for more than a year due to production flaws.

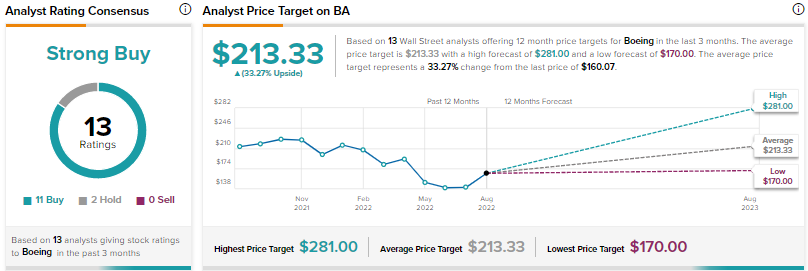

Morgan Stanley analyst Kristine Liwag believes that the FAA’s preliminary regulatory clearance for 787 Dreamliner deliveries is “a major milestone for the business and unlocks another lever of free cash flow generation.”

Liwag noted that Boeing’s inventory comprises 120 787 aircraft, which according to her estimates could generate revenues of $17 billion. That said, the analyst cautioned that the company still needs to make the required fixes and FAA inspectors will have to give clearance to each aircraft before delivery. Overall, Liwag has a Buy rating on Boeing stock with a price target of $215.

On TipRanks, Boeing has a Strong Buy consensus rating based on 11 Buys and two Holds. The average Boeing stock price prediction of $213.33 implies 33.27% upside potential.

AT&T (NYSE:T)

Earlier this year, telecom giant AT&T completed the spinoff of the WarnerMedia business to focus more on its core telecommunications business and invest in the growth areas of 5G and fiber. AT&T’s renewed focus seems to be fetching results, with the company reporting an impressive 813,000 postpaid phone net additions in the second quarter. What’s more, AT&T Fiber net additions came in at 316,000.

Despite better-than-expected Q2 results, investors were spooked by AT&T’s decision to slash the full-year free cash flow outlook by $2 billion to the $14 billion range. Growth investments, an elongated bill payment cycle, and macro challenges weighed on the company’s Q2 free cash flow and led to a downward revision to the full-year guidance.

Following the Q2 print, Barclays analyst Kannan Venkateshwar downgraded AT&T stock to a Hold from Buy, and lowered the price target to $20 from $22. While the analyst acknowledges the impact of macro challenges on Q2 results, he feels that the company’s performance in the quarter could “renew concerns about management credibility.” The analyst noted that AT&T’s management lowered its guidance within four months of issuing it.

Venkateshwar opines that “visibility may worsen” if the economy slips into a recession. The analyst concluded, “AT&T seems to be back in the same place that it started with respect to concerns about its dividend sustainability and management credibility.”

The Street is cautiously optimistic on AT&T stock, with a Moderate Buy consensus rating based on 10 Buys versus nine Holds. At $22.81, the average AT&T target price implies 26.30% upside potential.

Final Thoughts

While Intel is in the midst of a turnaround, persistent execution issues are keeping most of the analysts on the sidelines. Coming to AT&T, analysts seem to be treading carefully due to cash flow concerns. Meanwhile, currently, Wall Street is highly bullish on Boeing and sees higher upside potential in this blue-chip stock compared to Intel and AT&T. While Boeing still has much to do to regain its credibility, the company seems to be on the right track to revive its business.