A massive vaccination drive and pent-up demand for leisure travel helped several airlines recover to some extent last year. However, the spread of the Delta and Omicron variants and the spike in oil prices triggered by the Russia-Ukraine crisis caused turbulence and impacted the pace of the recovery.

Much to investors’ relief, major airlines announced favorable revenue updates in mid-March due to stronger-than-anticipated leisure travel demand. That said, airlines continue to face certain near-term headwinds, including staffing challenges, elevated fuel prices, and uncertainty around international and business travel.

With that in mind, we’ll use the TipRanks stock comparison tool for airline stocks to compare Delta Air Lines, United Airlines, and American Airlines and discuss the opinions of Wall Street pros.

Delta Air Lines (NYSE: DAL)

Delta, along with its alliance partners reaches over 800 destinations in more than 130 countries. Before the onset of the COVID-19 pandemic, the carrier offered over 5,000 daily departures and 15,000 affiliated departures.

Earlier this year, Delta claimed that it was the only major U.S. airline to deliver profitability in the second half of 2021. The company generated a net income of $280 million in 2021 compared to a net loss of $12.4 billion in 2020.

Delta provided an update in mid-March and now expects Q122 adjusted revenue at about 78% of 2019 levels, compared to the prior forecast of 72%-76%. Also, it anticipates Q122 capacity at about 83% of 2019 levels. The updated guidance was at the lower end of the 83%-85% capacity outlook initially issued.

The company stated that it expects adjusted fuel price to now come in at $2.80 per gallon, up from the previous guidance range of $2.35-$2.50 per gallon.

Despite higher fuel prices, Delta maintained its Q122 pre-tax loss guidance to be consistent with prior expectations. Back in January, Delta stated that it expects to incur pre-tax losses in the first two months of the year before returning to “solid profitability” in March.

Also, it expects to achieve positive free cash flow in Q122 on robust spring and summer travel demand. Overall, Delta anticipates “meaningful” profitability in 2022 and aims to generate improved earnings beyond pre-pandemic levels by 2024.

Following the update by Delta and its peers, Jefferies analyst Sheila Kahyaoglu noted that despite corporate travel remaining weak, airlines had “considerable confidence” about passing on higher fuel costs to customers.

Kahyaoglu stated, “DAL needs to recapture $15-20 each way on an average ticket value of $200, or just under 10%, which it feels fairly confident about capturing that value in the second quarter given the booking curve remains fairly short.”

Kahyaoglu reiterated a Buy rating on Delta stock with a price target of $38 (3.38% downside potential).

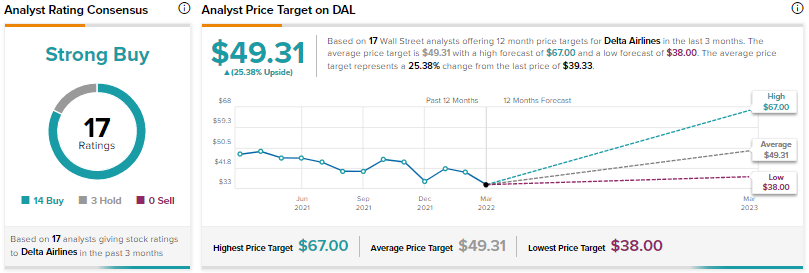

Overall, Delta scores a Strong Buy consensus rating based on 14 Buys versus three Holds. The average Delta Air Lines price target of $49.31 reflects 25.38% upside potential from current levels.

American Airlines (NASDAQ: AAL)

American Airlines, along with its regional partner, American Eagle, offers approximately 6,700 flights daily to 350 destinations in 50 countries.

Improved business conditions helped American Airlines bring down its net loss to about $2.0 billion in 2021, compared to a net loss of $8.9 billion caused by the COVID-19 outbreak in 2020.

In an update provided on March 15, American Airlines stated that it now expects Q122 revenue to decline by about 17% compared to Q119. The company previously predicted a 20%-22% fall in its Q122 top-line results.

However, unlike the improved revenue outlook, the company’s capacity forecast was not encouraging. American Airlines expects its Q122 capacity to be down 10%-12% compared to Q119 levels. The previous forecast indicated an 8%-10% fall in Q122 capacity.

Given the rising crude oil prices, American Airlines predicts fuel costs at an average of $2.73-$2.78 per gallon. The company believes that higher revenue could more than offset the increase in fuel and other expenses. It anticipates ending Q122 with available liquidity of more than $15 billion.

Prior to the outlook update, Seaport Global Securities analyst Daniel McKenzie downgraded American Airlines to a Hold from a Buy.

Explaining the downgrade, McKenzie commented, “Energy market chaos tied to the Russian/Ukraine war and a supply/demand dynamic poorly calibrated for the industry’s new cost structure prompt us to capitulate on weaker balance sheet stories.”

The analyst withdrew his price target on American Airlines’ stock on valuation concerns.

Most of the other analysts on the Street echo McKenzie’s sentiment, with a Hold consensus rating based on one Buy, 10 Holds, and three Sells. The average American Airlines price target of $17.97 indicates that the stock is fairly valued at current levels.

United Airlines Holdings (NASDAQ: UAL)

United Airlines boasts the most comprehensive route network among North American carriers. The easing of travel restrictions helped the carrier bring down its net loss to about $2.0 billion in 2021 from $7.1 billion in 2020.

At the J.P. Morgan Industrials Conference held on March 15, United Airlines provided a favorable update and stated that it was experiencing very strong leisure demand across most of its network, with system bookings for future travel improving almost 40 points since the first week of the year compared to 2019 levels.

Also, business bookings have improved over 30 points since the peak of the Omicron breakout compared to 2019 levels. The company’s cargo business continues to be strong, with cargo yields up over 100% versus 2019 levels.

United Airlines now expects Q122 operating revenue to be near the lower end of its prior outlook of a 20%-25% decline compared to Q119. The company continues to anticipate positive adjusted pre-tax income in Q222 despite higher fuel costs. It anticipates a fuel price per gallon of about $2.99 in Q1 and $3.50 in Q2.

However, United Airlines now expects Q122 capacity to be down about 19% compared to Q119, which reflects a deterioration from its previous forecast of a 16%-18% decline. The lower-than-anticipated capacity expectations reflect the impact of the Omicron variant earlier in the year and additional flight cancellations amid current geopolitical conditions.

Given the higher fuel prices and other macroeconomic challenges, the company reduced its total capacity for 2022 to be down in the high-single digits compared to 2019.

Following the company’s business update, BNP Paribas analyst James Hollins upgraded United Airlines stock to a Hold from a Sell. While Hollins acknowledges the “exceptional” pent-up demand, he feels that the Russia-Ukraine conflict is driving fuel costs significantly higher and may continue into 2023 and beyond.

Hollins assigned a $38 price target to United Airlines stock and stated that he now sees only limited downside for the stock from current levels.

Overall, the Street has a Hold consensus rating on United Airlines stock based on seven Buys, six Holds, and three Sells. The average United Airlines price target of $51.88 indicates 13.13% upside potential from current levels.

Conclusion

While leisure travel seems very robust, uncertainty regarding the recovery of corporate and international business to pre-pandemic levels continues to haunt airlines. Under the current circumstances, analysts are bullish on Delta Air Lines stock and remain sidelined on American Airlines and United Airlines.

Download the TipRanks mobile app now.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure.