Also known as the “LinkedIn for Doctors,” Doximity, Inc. (NYSE: DOCS) is a popular social networking and telemedicine company. This cloud-based platform provides its members with tools to effectively collaborate with colleagues, securely coordinate patient care, conduct virtual patient visits, and stay updated with recent medical developments and news.

Founded in 2010, the company boasts of two million medical professional members, as of March 31, 2022. A well-diversified mix of members, encompassing 80% of physicians that cover all 50 states in the U.S., over 50% of U.S. nurse practitioners and physician assistants, and over 90% of graduating U.S. medical students, use this platform.

Now, let’s explore more about this recently listed company, which created a lot of buzz during the peak pandemic days.

IPO Details

Headquartered in San Francisco, CA, Doximity got listed on the New York Stock Exchange in June 2021. The company sold 22,505,750 shares of its Class A common stock at $26 per share, including 3,495,000 shares issued upon the exercise of the underwriters’ option to buy additional shares.

Through its initial public offering (IPO), Doximity raised $548.5 million in net proceeds.

Doximity made its debut on the exchange on June 25, 2021. Shares of the company opened at $50, up 92.3% from the IPO price, and closed the day at $55.98, up 115.3%. Unfortunately, DOCS stock has declined 18% (as of July 8, 2022) since its listing, according to TipRanks.

The company’s stock witnessed an all-time high of $107.79 (up a stupendous 314.6% from the IPO price and 92.6% from the closing price on June 24) in September 2021. In May 2022, DOCS stock hit its all-time low of $27.06.

Presently, Doximity commands a market capitalization of $7.43 billion.

Recent Developments

Doximity’s earnings results for the fourth quarter of Fiscal 2022 were impressive. Revenues for the quarter came in at $93.65 million, up 40.4% from the year-ago period.

During its last earnings call, Doximity informed its stakeholders that its board of directors authorized a new stock repurchase program to acquire up to $70 million of the company’s Class A common stock, beginning in the first quarter of Fiscal 2023.

In April, the company also successfully concluded the acquisition of a physician scheduling platform, Amion.

Future Prospects & Risks

The second edition of Doximity’s State of Telemedicine Report highlights that about 73% of patients plan to continue using telemedicine platforms, even after the pandemic subsides.

Also, the U.S. digital health market is expected to see a compound annual growth rate (CAGR) of 26.9% between 2022 and 2030, according to a Grand View Research report.

Unfortunately, Doximity’s dismal revenue projections of $88.6 million to $89.6 million for first quarter of Fiscal 2023 have left its investors frowning.

Performance on TipRanks

Recently, Vikram Kesavabhotla of Robert W. Baird reiterated a Buy rating on the stock with a price target of $45 (6.43% upside potential).

Overall, the Street is cautiously optimistic about the stock and has a Moderate Buy consensus rating based on 9 Buys, 2 Hold and 1 Sell. Doximity’s average price target of $47.50 signals that the stock may surge nearly 12.35% from current levels.

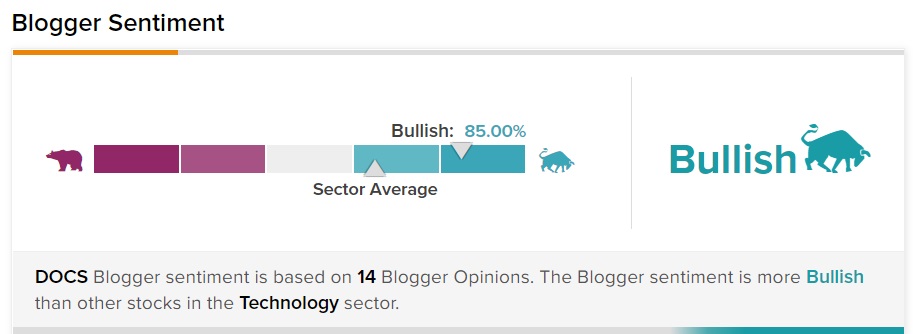

TipRanks data shows that financial bloggers are 85% Bullish on Doximity, compared to the sector average of 65%.

Concluding Thoughts

Doximity seems to be well-positioned to benefit from the burgeoning digital health care market. Further, DOCS stock can be considered by investors who are seeking to buy the dip in the company’s shares.

Read full Disclosure