FuboTV (FUBO) is one of the streaming plays I’ve thought could have some rather bullish upside. Indeed, in this hyper-growth market, FUBO stock has been a great performer. Over the past two yeas, FUBO stock has been roughly a 10-bagger for patient investors.

Indeed, much of this has to do with a range of secular catalysts that have benefited fuboTV. Consumers of entertainment are increasingly choosing streaming options over traditional cable. However, the gap that’s left for live sports is one of the key reasons many traditional viewers have stuck with cable over the years.

Fubo TV has done a great job of calming concerns in this regard. With various professional sports leagues starting up once again and Conmebol set to hit the screens starting September, viewers have looked to fuboTV as a means of officially cutting the cord.

This streaming company offers viewers an immersive experience. The company’s platform is able to digest live stats and play free-to-play games. Additionally, viewers can use FanView, allowing for the integration of stats and predictive games into their viewing experiences.

FuboTV offers a wholesome viewing experience, and one that has caught on among a growing fan base. This is one of the leading players in the live streaming market, and one many investors are considering as sports seasons start up.

Let’s dive deeper to look at what makes fuboTV unique. I’m currently slightly bullish on FUBO stock. (See FUBO stock charts on TipRanks)

It’s a Goal for FUBO Stock!

Sports fans typically enjoy stats and are competitive in nature. Hence, the FanView stats and predictive games intrigue many investors as well. These features are just one of the reasons investors have piled into FUBO stock of late.

Earlier in June, fuboTV rolled out a beta version of these features. It let the subscribers enjoy the new features during the Conmebol games. The derived results were impressive, with up to 37% watch minute increase in fuboTV.

Naturally, live-streaming services consider subscriber premium to calculate their revenue. However, fuboTV and its rivals, namely Disney (DIS) and Alphabet (GOOG), are also big players in this space. These subscriptions give users access to roughly the same number of channels as traditional cable, though at a significant cost.

Fubo’s ability to be a lower-cost option for consumers is enticing. The company’s existing customer base remains small by most metrics. For example, FUBO had only 681,721 accounts by the end of June. However, the average revenue of FUBO soared 30% during the past year. This amounted to $71.43 a month per user.

That’s not bad.

A leading factor driving such results is the time spent on Fubo TV. The more time a user decides to spend on fuboTV, the more ads it generates. Thus, since marketers crave the demographics of sports fans, FUBO receives increased revenue.

Needless to say, FUBO has hit a massive goal. It saw meaningful growth in its subscriber base this past year. Additionally, its revenue rose 196% during the last quarter on a year-over-year basis. Given that ad revenue is a huge driver of these gains, there remains a lot of latitude for Fubo to increase its margins over time.

Interestingly, the company’s advertising revenue jumped 281% during the past year.

An Added Tint of Uniqueness

It is fair for investors to rank Fubo at par or below the competition. Indeed, fuboTV has some work to do to catch up to the subscription numbers of its peers.

However, fuboTV’s unique niche provides an intriguing growth angle for investors bullish on the streaming trend. The company’s three dozen sports channels, as well as its own unique platform which is in development, could ensure major growth.

The company is working on rolling out its own sports book to enter the Gambling arena. Given how well other gambling-related stocks have done lately with regulatory conditions improving in this space, it’s likely FUBO stock could see a pop in the medium-term.

For now, there are a number of drivers investors considering FUBO stock can look to as reasons to buy. This company isn’t without risks. However, it’s a stock that’s worth putting on the watch list right now.

Analysts’ Take on FUBO Stock

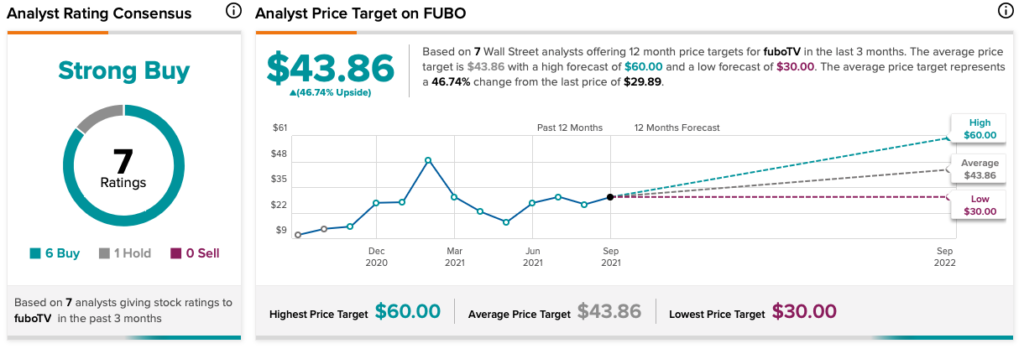

According to the TipRanks’ analyst consensus, FUBO stock is a Strong Buy. Out of 7 ratings, there are 6 Buy recommendations and 1 Hold recommendation.

The average price target for FUBO is $43.86. This price target lies between a low of $30 per share and a high of $60 per share.

Bottom Line

Viewers in the sports streaming space are growing rapidly. Fubo TV is at the center of this trend.

Fubo TV has successfully demonstrated its capability to increase its subscriber base. In the context of this increased growth, this stock has the capacity to reward investors.

That said, this stock does carry its own set of risks. Accordingly, investors should view FUBO stock as a high-risk, high-reward play right now.

Disclosure: At the time of publication, Chris MacDonald did not have a position in any of the securities mentioned in this article

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates, and should be considered for informational purposes only. TipRanks makes no warranties about the completeness, accuracy or reliability of such information. Nothing in this article should be taken as a recommendation or solicitation to purchase or sell securities. Nothing in the article constitutes legal, professional, investment and/or financial advice and/or takes into account the specific needs and/or requirements of an individual, nor does any information in the article constitute a comprehensive or complete statement of the matters or subject discussed therein. TipRanks and its affiliates disclaim all liability or responsibility with respect to the content of the article, and any action taken upon the information in the article is at your own and sole risk. The link to this article does not constitute an endorsement or recommendation by TipRanks or its affiliates. Past performance is not indicative of future results, prices or performance.